China Shorts Crushed As Retail Investors, Plunge Protection Team Triumph

Having always reflected jealously on the liquidity and transparency (cough, cough) of US capital markets, China decided this week to once again take a page from America’s political playbook and unleash its own Plunge Protection Team.

The so-called ‘National Team’ stepped in after Beijing’s crackdown on various sectors sparked carnage across China tech stocks, education stocks, and then the entire market (along with bonds and FX).

Chinese authorities told foreign brokerages not to “over-interpret” its latest regulatory crackdowns.

“This is more to calm the market to isolate the education industry and not to overinterpret it,” said one of the people, who has knowledge of the meeting held by China Securities Regulatory Commission (CSRC) vice chairman Fang Xinghai.

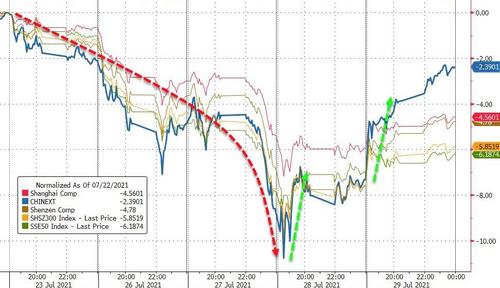

Investors responded to all this actual and psyop support by panic-buying Chinese stocks, most notably the tech start-up heavy ChiNext index, which has now almost erased last week’s losses entirely!

Source: Bloomberg

Reuters reports that during the meeting, Fang told the bankers that official policies would be rolled out more steadily to avoid sharp volatility in the markets, said another person, adding Fang also indicated the crackdown was not aimed at decoupling Sino-U.S. financial markets.

Chinese state media was also cajoled into supporting the rebound, spreading ‘news’ saying yuan-denominated assets in China remained attractive and that short-term market panic did not represent long-term value.

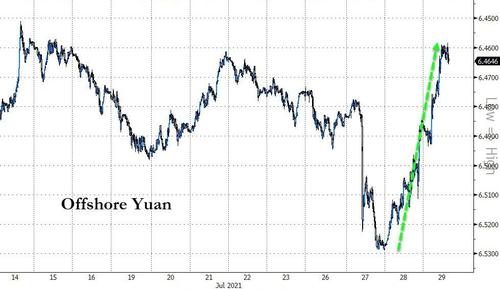

Offshore Yuan has exploded higher on all this ‘support’ ripping from 6.53/USD to 6.46/USD in the last two days…

Source: Bloomberg

But it may be one too many times to unleash the state to rescue capital markets:

“Recent events definitely have a negative impact on the global investor sentiment about China. So the risk is whether the long-term money will also pull out of China,” said Wang Qi, CEO at fund manager MegaTrust Investment (HK).

But Wang did offer some feint praise to Beijing

“In terms of the foreign capital flows, whatever happened lately was mostly driven by hedge fund type hot money… we welcome any Chinese government moves to increase transparency and rebuild investor confidence.”

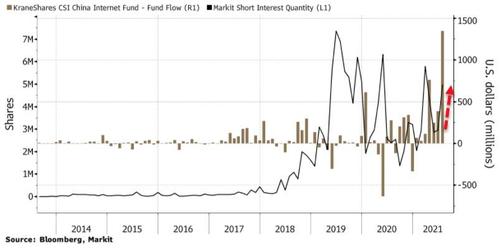

However, amid all this exuberance, someone had to suffer and, as Bloomberg reports, the rip higher is extremely painful news for investors who rushed to a $4.6 billion exchange-traded fund to bet against the beleaguered sector.

Source: Bloomberg

Of the record surge in inflows, a good chunk of the inflows appears to have funded new ETF shares that were immediately lent out to short sellers, a veiled process known as “create-to-lend.”

As few as 1.9 million shares in the KraneShares CSI China Internet Fund (KWEB) were out on loan early in July, a figure that surged to 6.1 million this week, according to IHS Markit Ltd. data.

“It’s pretty likely there are more regulatory assaults to come and markets will be looking out for red warning flags,” said Nigel Green, chief executive and founder of deVere Group.

“This means continuing volatility as investors repeatedly move in to buy the dips then sell-off.”

But of course, responding to a question on whether foreign investors would be wary of investing in Chinese firms as a result of the regulatory crackdown, foreign ministry spokesman Zhao Lijian told a regular briefing on Thursday:

“We have been providing a fair, open and non-discriminatory environment for companies. What you mentioned is just not true.”

So the Chinese have learned gaslighting too, as well as Plunge Protection?

Tyler Durden

Thu, 07/29/2021 – 09:35

via ZeroHedge News https://ift.tt/3la4FAw Tyler Durden