Goldman Downgrades China Stocks After Clients Ask If They Are Even “Uninvestable” Any More

After a rollercoaster move in Chinese stocks following a regulatory crackdown that has prompted many to wonder if China is doing away with capitalism in capital markets entirely (having declared the entire tech-edu space non-profit overnight), Goldman’s clients have had enough and are justifiably asking the bank if the stock market has become too dangerous.

In a note from Goldman’s Kinger Lau, the China strategist writes that the word “uninvestable” has featured in many of his recent conversations with clients regarding investing in Chinese stocks. Here Lau counters tentatively that he “would be hard-pressed to extrapolate the rather extreme regulations such as non-profit orientation and capital raising restrictions to the whole equity universe.”

He then lists several reasons why that’s not the case just yet, including:

-

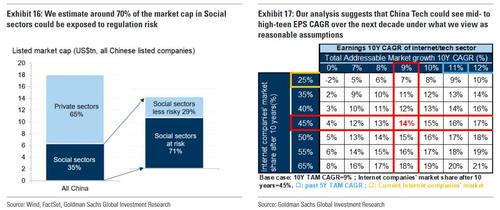

The Social sectors in the POE universe amount to 35% of total listed market cap, and those that are at (regulation) risk (i.e. seeing relatively high price inflation over the past 5 years) represent only 25% of the full-universe market cap;

-

Some POEs in the Social sectors are already generating sub-SOE or sub-market-aggregate profitability, suggesting limited room for abnormal economic rent extraction without creating dead-weight loss to the system;

-

Given the emphasis and actual policy support from the government on developing foundational technologies and nurturing innovation to support high-quality growth, wauthorities would be pragmatic when striking a balance between social/ideological goals and capital markets in non-social sensitive industries over time;

-

The underlying demand in the digital economy is unlikely to be structurallydamaged by regulations if they are confined to select areas, although the share of the TAM could be more evenly distributed among industry players;

-

Current investor sentiment is comparable to the 2015 market selloff episode where China A experienced a peak-to-trough drawdown of 43% and 31%of market cap was suspended trading at one point. However, when concerns dissipated and confidence gradually recovered, foreign portfolio inflows resumed and surpassed previous highs roughly one year after the incidence;

-

From a long-term macro perspective, the new regulations could potentially lead to a more balanced economy in terms of growth drivers and resource allocation, lower Gini Coefficient which is conducive to aggregate consumption growth, foster fairer competition which is crucial for innovation and creativity, and lower systemic risk in the highly levered sectors.

-

The overwhelming regulation concerns have overshadowed policy support in select areas that are aligned with national development objectives, notably green energy, electric vehicle, enterprise/B2B software, semiconductor, and “New Infrastructure”. See next section for details.

Laundry list of sheepishly positive considerations aside, Lau then admits that

“the regulation headwinds will continue to dominate investors’ valuation framework for Chinese stocks until a new equilibrium (price and positioning) is reached, which could be realized by: a) market clearing events (e.g.strong and clear signals from the authorities to remove regulation concerns); b)improved policy clarity in terms of how regulations will be implemented and their impact on fundamentals; c) significant positioning and risk reduction; and/or, d) meaningful adaptive response by the corporate sector (i.e. business restructuring).”

As a result, Goldman says that “it seems premature to call for an inflection point in the price/sentiment cycle” considering that:

-

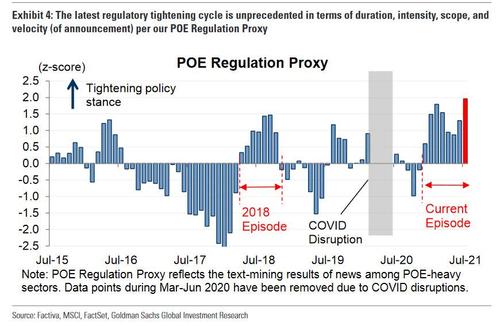

the regulation intensity and velocity has remained strong;

-

risk appetite is depressed and positioning reduction across mandates is underway but the potential for US and Southbound investors to further offload exposures remains; and,

-

the flow picture in the public market could be complicated by the potential collateral damages in the private market, where US$700bnof capital has been deployed over the past 3 years and hedging demand seems high at present.

And in case the message was unclear, the chart below shows that the “latest regulatory tightening cycle is unprecedented in terms of duration, intensity, scope, and velocity (of announcement) per our POE Regulation Proxy“

Lau also goes off on a tangent about socialism which all progressives in the US should read carefully since China is taking precisely those steps that far-left Democrats in the US believe should happen in domestic capital markets:

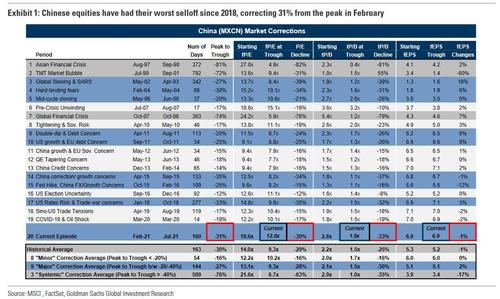

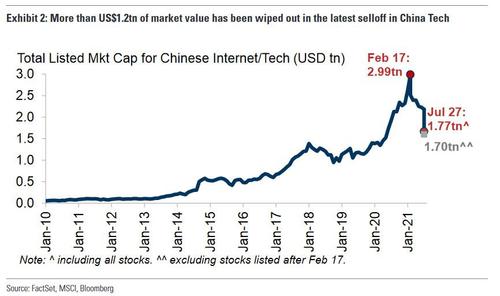

Recent regulations have signaled that the Chinese authorities are prioritizing social fairness/stability over the capital markets in areas that are deemed public goods or important to strategic policy goals. While these moves may help improve social equality over time, they have provoked the worst selloff for China since 2018, with AST companies collapsing 65% since last Friday, and China Tech losing another US$400bn in market cap in the past two weeks (US$1.2tn from mid-Feb).

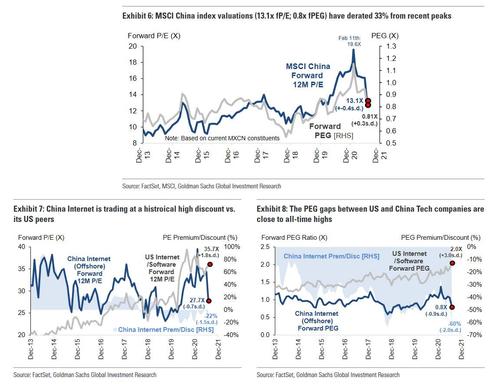

What does all this mean in practical terms? Well, in typical Goldman fashion, with Chinese stocks having already suffered the brunt of the selloff, and many seeing furious bounces from oversold lows, Lau writes that “while index valuations (13.1x fP/E; 0.8x fPEG) have derated 33% from recent peaks the regulation uncertainty will likely translate into a flatter expected earnings slope and higher ERP for POE equities, therefore compressing their fair value until a new equilibrium is reached and positioning is reset.”

And since he does not see this new equilibrium coming any time soon, Goldman “neutralizes” its views on MSCI China by cutting it from Overweight (15% 12m upside) even as the bank still remains Overweight on China A “given its favorable sensitivity to potential (fiscal) policy easing, lower POE/Tech weightings, and robust Northbound flows potential.”

Well thanks for all that Goldman: but in all honesty, it would have been a little more useful if the downgrade had come before Chinese stocks had plunged 31% in the past 6 months…

… wiping out $1.2 trillion in market cap from listed tech stocks.

Translation: buy MSCI China and short China A shares, because as even shoeshine boys know by now, one has to do the opposite of what Goldman recommends to be profitable.

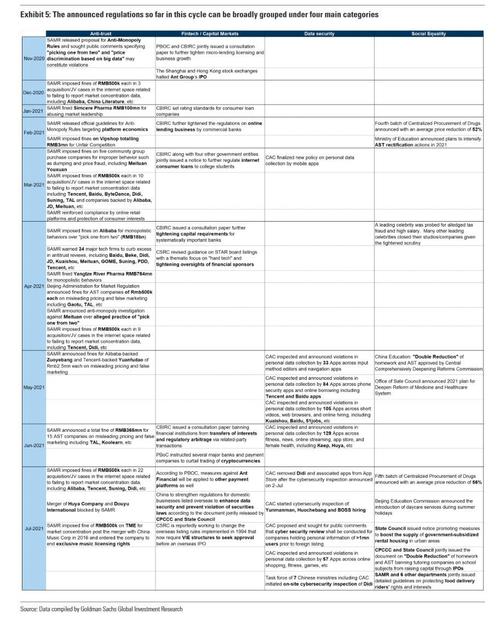

Which is not to say that everything in the report was useless. It had some useful charts including this one summarizing all the announced regulation by Beijing in this cycle…

… a couple of cool valuation charts…

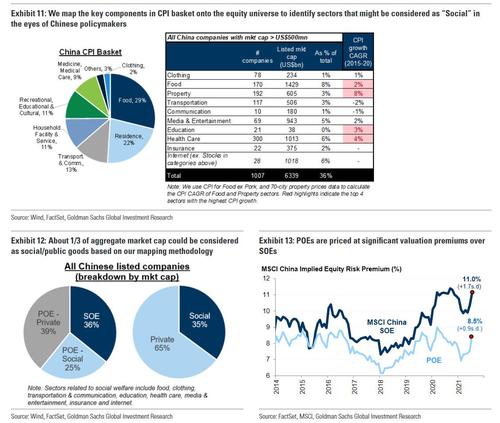

… some speculation on what sectors may be considered as “social” in the eyes of policymakers…

… Goldman’s estimation of how much of market cap in Social sectors is exposed to regulation risk…

… and much more – the full report can be found in the usual place.

Tyler Durden

Thu, 07/29/2021 – 13:05

via ZeroHedge News https://ift.tt/3rIiTtZ Tyler Durden