The “Real” Real Yield Is -4.15%… And We Are Stuck With It Forever

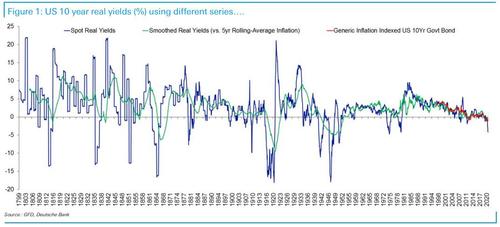

As we pointed out earlier this week, 10 year real yields spent the past few days trading around all-time lows. However, due to data limitations, we can only measure this using TIPS from 1997 onwards. So what do other measures that go back further show?

That is the question posed by Deutsche Bank credit strategist Jim Reid who plotted three real yield series;

-

using TIPS back to 1997,

-

subtracting spot inflation from spot 10yr yields through time,

-

subtracting a rolling 5yr average of inflation from spot 10 year yields.

So using spot yields and inflation, Reid calculates that real yields are a “very low”, to put it mildly, -4.15% currently and the lowest since 1980 and not far off 70 year lows: “Clearly the market doesn’t believe 5.4% inflation is sustainable but it is what it is for now.”

On the other hand, using spot yields and 5yr average inflation, real yields were lower last summer when 10yr nominal yields were c.0.50% and 5-yr average inflation was c.1.7%. At this point they were at 70 year lows. They are 40 bps off this level currently. Nevertheless, according to Reid, this measure does do a good job of broadly tracking real yields as officially quoted using TIPS.

What does this mean? Well, it’s important because with real yields at what is basically all time lows, any attempts to push them higher will lead to a collapse in the financial system, as both Citi’s Matt King wrote in a recent must-read report, and as Jim Reid notes:

“I’ve been on record over the last few years for saying that with debt so high real yields are likely to stay negative for the rest of my career as the authorities have to control funding this rising leverage. I’m even more convinced of this post pandemic. I hope if I’m wrong I can apologize and still have a career though.”

It gets scarier because as Reid concludes, “positive US real yields for any length of time would likely set off debt crises around the world so we are probably stuck with the regime.”

That said, one can still have negative real yields and higher nominal yields. In fact, most of the big debt reductions seen through history have seen such a wide gap via higher inflation. In some ways we are seeing that now.

Looking ahead, Reid strongest conviction is that “real yields will stay notably negative, followed by a view that inflation will be higher going forward than it was over the last decade.”

And sure, that could happen in theory… as long as the Fed never ends QE. Which can also happen as long as the world keeps finding a major “crisis” every year or so to justify ever greater monetary stimulus and liquidity injections. Because one thing is certain: if the Fed turns off the hose, it’s game over.

Tyler Durden

Thu, 07/29/2021 – 15:45

via ZeroHedge News https://ift.tt/3icFPhH Tyler Durden