$2.5 Trillion In Reverse Repo By Year End

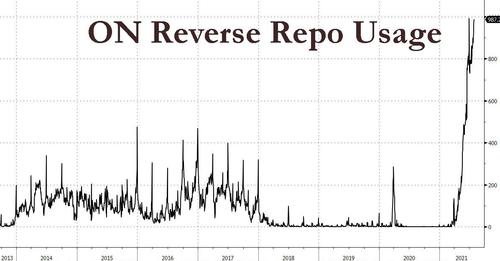

RRP volume is quickly approaching $1 trillion a day, with today’s reverse repo usage hitting the second highest on record at $987.3 billion and just shy of $1 trillion.

And with QE still running at $120 billion a month, the Fed continues to inject liquidity into the markets, which then continues to recycle back to the Fed via the RRP facility.

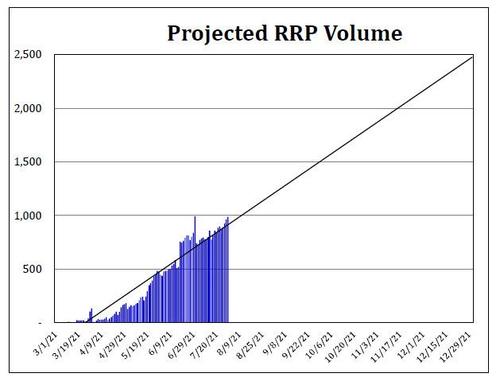

So how big will the Fed’s reverse repo facility get? As Curvature’s Scott Skyrm calculates, assuming QE will not change between now and the end of the year, it is about to get much bigger.

During the month of April, RRP volume increased by $49 billion. $296 billion during the month of May, $362 billion* in June, and $124 billion in July. If RRP volume continues around the same pace, say $200 billion a month, RRP volume will reach $2 trillion by the end of the year.

Looking at the trendline, it puts RRP volume at $2.5 trillion by the end of the year. However, RRP volume at the end of the year will be a large number, meaning it could very well approach $3 trillion by year end.

A few rhetorical questions to conclude: what will be the impact of $2 trillion going into the RRP each day? How will this affect the markets? Will the Fed need to adjust the RRP rate again?

Tyler Durden

Thu, 07/29/2021 – 18:20

via ZeroHedge News https://ift.tt/2UWT2T8 Tyler Durden