Fed’s Favorite Inflation Signal Surges At Fastest Pace In 30 Years As Spending, Income Rise

Following May’s weaker than expected data on Americans’ income and spending, analysts expected more weakness in income and a small bounce in spending in June, however both saw improvement with Personal Incomes rising 0.1% MoM (-0.3% exp) and Personal Spending up 1.0% MoM (+0.7% exp).

May’s income was revised down from -2.0% to -2.2% MoM and spending revised lower from -0.4% to -0.6% MoM.

Source: Bloomberg

Incomes are up 2.3% YoY while spending remains up 13.6% YoY, thanks largely to base case effect still…

Source: Bloomberg

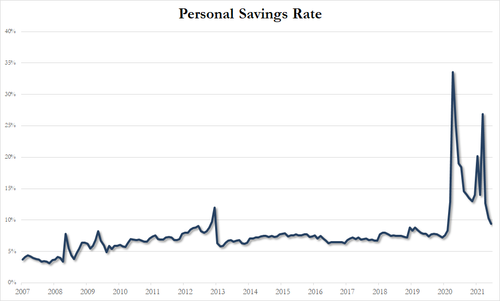

All of which means the savings rate tumbled (to 9.4%, the lowest since Feb 20202, pre-COVID)

Remember when the world’s prognosticators crowed of the pent-up demand coming any minute from the $2.5 trillion in excess savings… well that number is now down to just $1.7 trillion (almost back to $1.3 trillion ‘norms).

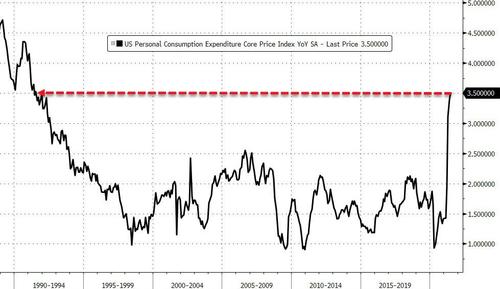

Finally, and perhaps most importantly, The Fed’s favorite inflation indicator – PCE Core Deflator – rose to +3.5% YoY (vs 3.4% in May), the highest since July 1991…

Source: Bloomberg

This was slightly lower than expected (if that is any silver lining) but still doesn’t look very transitory.

Tyler Durden

Fri, 07/30/2021 – 08:37

via ZeroHedge News https://ift.tt/3C0iQy2 Tyler Durden