JPMorgan Finds That Fed Has Broken The Most Fundamental Market Correlation

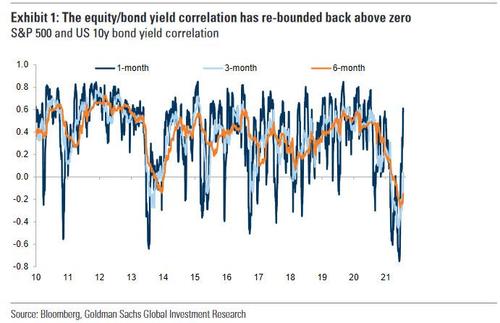

A few months ago investors – especially those working for risk 60/40 balanced and parity funds – freaked out when the traditional correlation between stocks and yields (or inverse correlation between stocks and Treasury prices) flipped, sliding to the lowest on record, as any hope for diversification of equity risk by hiding into government bonds disappeared. And while the correlation has since recovered some of its normal historical pattern as the following chart from Goldman shows…

… a new and just as ominous decoupling has now emerged: that between stocks and investment grade and junk bonds.

In other words, while the low – or inverse – correlation between stocks and bonds has been one of the core anchors of modern finance, allowing cross-asset traders to diversify excess equity risk into bonds, this “basic premise” of modern portfolio consutrction theory no longer works. The culprit? Who else: the Federal Reserve.

As JPMorgan credit strategist Eric Beinstein writes in his latest Credit Market Outlook note, “in recent months, there have been two interesting trends in total return correlations: HG credit has become more correlated with stocks and thereby also more correlated with the HY bond market.”

What’s behind this rising correlation? According to the JPM strategist, there are several drivers:

- First, the unusual dynamic that stocks are doing very well at the same time that UST yields have declined. This, in JPM’s view, “is the result of so much QE-driven liquidity in the market that investors are buying everything: stocks and bonds.”

- The second, less likely, driver of persistently elevated correlations according to Beinstein, is exceptionally strong corporate earnings which have driven further total return gains this year alongside higher equities.

To JPM, this stands in contrast to what has traditionally been a key investment consideration for HG credit – its diversifying characteristic versus Equities, in the context of a balanced asset allocation portfolio (similar to the inverse correlation between stocks and treasurys). As Beinstein explains for those who have not taken finance 101, “when equities have risen, yields have often as well, leading to losses on the HG side and vice versa.” But not anymore, and here’s why:

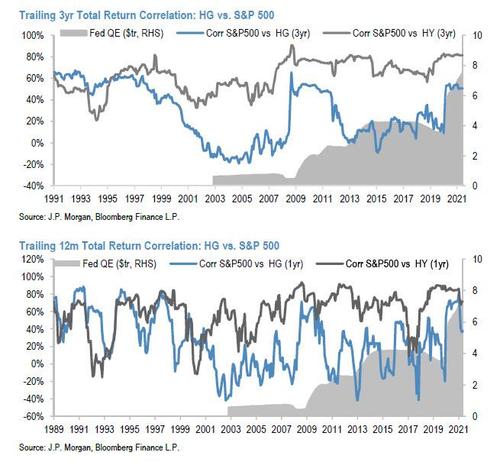

The latest ongoing round of Fed QE appears to have broken this basic premise, with total return correlations between HG and Equities reaching their highest since 2008 on a 3yr trailing basis and since 1997 on a 12m trailing basis (of monthly returns in both cases).

The charts below shows these correlation time series over a very long period of time. They show that over time there have been various correlation regimes. Low to negative correlation has prevailed for most of the past two decades, but there have been several long periods of positive correlation in the past, with the most recent from 2009 to 2011, also following a market crisis.

Both charts above show that while there has been a wide range of return correlation regimes over the past 20 years “the increase in the Fed’s balance sheet (shaded area on the charts below) potentially argues for an extended period of higher correlations.”

Some more observations on how this heightened correlation has played out in the past: HG returned -7.1% in March ’20, before the Fed Covid programs fully took effect, while equity markets weakened sharply as well. To JPM, with UST yields so low “there is a risk that this lack of correlation repeats, with spreads widening more than UST yields may be able to fall.” Another takeaway is that the strong correlation between HG and HY returns argues for owning HY for the greater carry; HG and HY have been 75% correlated over the past 12 months, the highest since 2017. To be sure, it is always dangerous to extrapolate trends in correlation too far.

As Beinstein (somewhat sarcastically)concludes, “the potential implications of these developments are interesting” and explains: “traditionally portfolio theory says that bonds are a diversifier for equity market investments. This has not been the case recently, with the risk that it also remains not the case if/when there is an equity market selloff.“

Translation: in the next crash, everything will go down at the same time and there will be nowhere left to hide… Which is also why the Fed can never again allow a market crash.

Tyler Durden

Fri, 07/30/2021 – 12:30

via ZeroHedge News https://ift.tt/3fbFoSI Tyler Durden