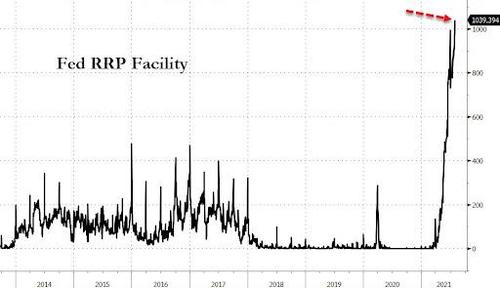

We Have The First Trillion Dollar Reverse Repo

It’s official: at exactly 1:15pm today, the NY Fed reported that for the first time ever, 86 counterparties parked over $1 trillion in reserves at the Fed’s Reverse Repo Facility for overnight ‘safekeeping’ and collecting a nice, fat yield of 0.05% – representing hundreds of millions in absolutely free money as these are reserves that the Fed has previously handed out to banks – for free – who then turned around and handed it right back to the Fed where it collected a small but nominal interest.

Of course, it is month-end (if not quarter-end) so we do get some window-dressing but even without it, it’s only matter of time before we got consistent $1 trillion prints… which then become $2 trillion and so on.

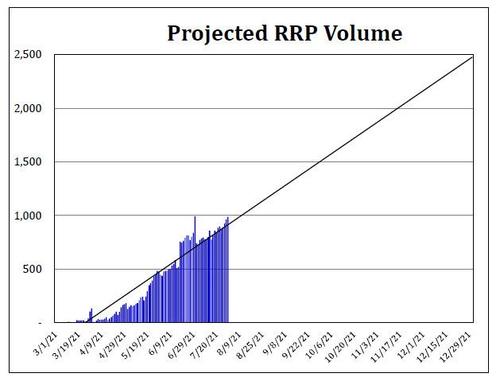

In fact, the question of how big the Fed’s reverse repo facility – which as explained previously is just how the Fed recycles all its massive reserves which it keeps injecting into the financial system (if not economy) at a pace of $120 billion per month – is one we discussed yesterday, and highlighted a calculation by Curvature’s repo guru Scott Skyrm who made the following observations:

During the month of April, RRP volume increased by $49 billion. $296 billion during the month of May, $362 billion in June, and $124 billion in July. If RRP volume continues around the same pace, say $200 billion a month, RRP volume will reach $2 trillion by the end of the year.

Looking at the trendline, it puts RRP volume at $2.5 trillion by the end of the year. However, the RRP volume at the end of the year will be a far larger number due to year-end window dressing, meaning it will likely approach if not surpass $3 trillion on Dec 31, 2021.

A few rhetorical questions from Skyrm to conclude: what will be the impact of $2 trillion going into the RRP each day? How will this affect the markets? Will the Fed need to adjust the RRP rate again?

Tyler Durden

Fri, 07/30/2021 – 13:30

via ZeroHedge News https://ift.tt/3zQYdmf Tyler Durden