July Jolt: Small Caps & Bond Yields Plunge Most Since March 2020 COVID Crash

Small Caps end the month with a loss for the first time since March 2020, and only the 2nd monthly loss since then (Trannies were also down on the month, its 2nd monthly loss in a row). Nasdaq 100 outperformed on the month but was ‘only’ up 2.5%…

Source: Bloomberg

Diving into this week, Amazon saw no bounce at all today after crashing from earnings last night…

Which pushed AMZN below GOOGL in market cap…

Source: Bloomberg

Energy stocks were ugly in July while Healthcare outperformed…

Source: Bloomberg

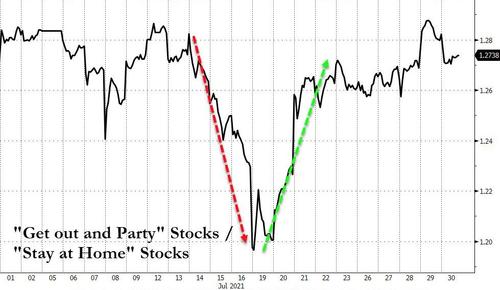

Intramonth, the markets got a scare from Delta and then shrugged it off just as the Biden admin ramped up their fearmongering…

Source: Bloomberg

Still, it was China that was really monkeyhammered in July with the Shanghai Comp suffering its worst month since Oct 2018 (that’s even with The National Team’s rescue this week)…

Source: Bloomberg

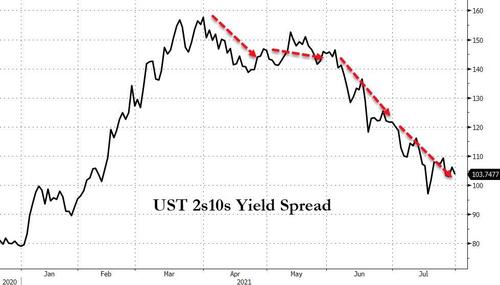

July saw the biggest yields drop in the belly of the curve since March 2020. Bonds were consistently bid in July with the 7Y/10Y outperforming (-24bps)…

Source: Bloomberg

The Yield curve (2s10s) tumbled 18bps (its 4th straight month of flattening)…

Source: Bloomberg

The Dollar ended the month flat – after quite a roller-coaster…

Source: Bloomberg

Cryptos also had a rollercoaster month but Bitcoin and Ethereum ended significantly higher…

Source: Bloomberg

Commodities were mixed on the month with gold up, silver down; and copper up and crude flat…

Source: Bloomberg

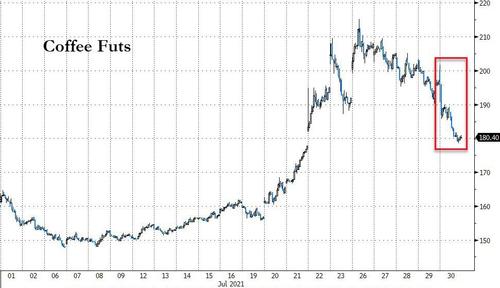

Coffee rollercoastered too amid Brazil Frost concerns (today was biggest drop since 2010 as freeze fears subsided)…

Source: Bloomberg

Finally, real yields collapsed in July to record, negative lows, suggesting gold has room to run here…

Source: Bloomberg

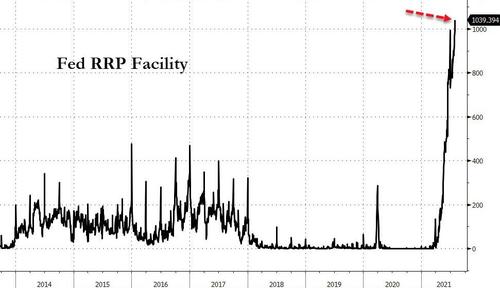

And just in case you think everything is tickittyboo because stocks are near record highs, investors parked more than $1 trillion at The Fed overnight!!! Think we aren’t over-liquidified?

Source: Bloomberg

US Economic Surprise data turned negative this week and is at its weakest since June 2020…while stocks levitate along with The Fed’s balance sheet…

Source: Bloomberg

So, real economic data is slumping, the virus is re-emerging in a more “dangerous” variant, and China’s Capital Markets are collapsing… but US stocks are at record highs…

Phew!

Tyler Durden

Fri, 07/30/2021 – 16:00

via ZeroHedge News https://ift.tt/3rHvxtb Tyler Durden