Key Cryptocurrency Developments And Updates From JPMorgan

All those who have followed the writings of JPMorgan’s Nick Panagirtzoglou and Josh Younger, for whom no bitcoin bashing opportunity was too small or too insigificant (we too are patiently waiting for Panagirtzoglou to observe which way bitcoin’s momentum has been moving in recent weeks following the cryptocurrency’s longest winning streak since 2015, a fact he has oddly failed to discuss), may be surprised to learn recently the bank quietly launched a report for its clients looking at all the top crypto developments.

So for those tired of listening to JPM’s conflicted musing as it tries to create a lower entry point for its prop traders, here is nothing but facts from the Crypto Weekly report at the world’s largest bank:

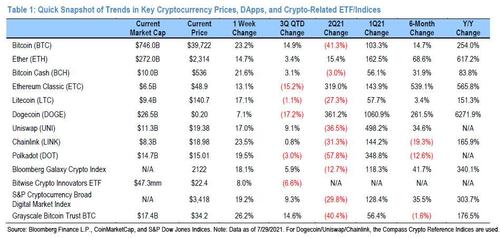

- Bitcoin, Ether, Dogecoin, and other major cryptocurrencies rose sharply during the week after the market took cues from a recent job posting by Amazon seeking to hire a “Digital Currency and Blockchain Product Lead.” It sparked questions among the market participants if the move could lead to Amazon accepting cryptocurrencies as a method of payment soon. Further, the upward movement of the market was fueled by short covering as more than $950mm of crypto shorts were liquidated on Monday, the most since May 2019, as per data from bybt.com. Post the market’s sharp rally, Amazon clarified that the speculation around its specific plans for cryptocurrencies was not true and it remains focused on exploring this space. Despite Amazon’s clarification, the market remained buoyed as Bitcoin ended the week at $39.7K, up 23.2% from the prior week. Meanwhile, Ether rose 14.7% w/w to $2,314 and Dogecoin rose 7.1% in the week.

- Coin Spotlight: Theta serves as the native token for the blockchain-driven video sharing platform of the same name. By enabling faster and cheaper transmission of high-definition streaming, the Theta network shows promise of becoming a central part of the entertainment ecosystem. Tesla revealed that it’s holding Bitcoin worth $1.31B. Moreover, it booked $23mm of impairments related to its Bitcoin holding in 2Q21 and did not buy or sell Bitcoins during the quarter.

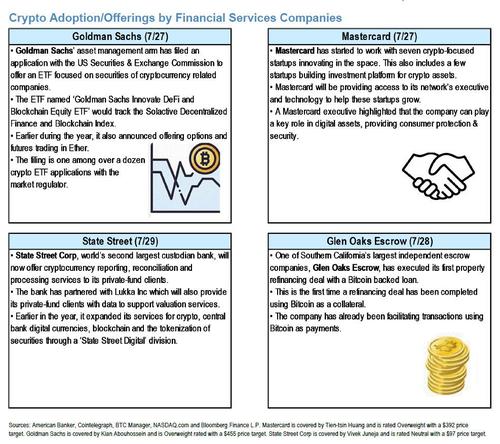

- Goldman Sachs filed an application to offer an ETF focused on securities of cryptocurrency-related companies with the US Securities and Exchange Commission. The proposed ETF would track the Solactive Decentralized Finance and Blockchain Index.

- Twitter’s CEO announced that Bitcoin will be a “big part” of the company’s future. He also remarked that the company would continue to look at the space and invest aggressively in it.

Key Developments in the Week

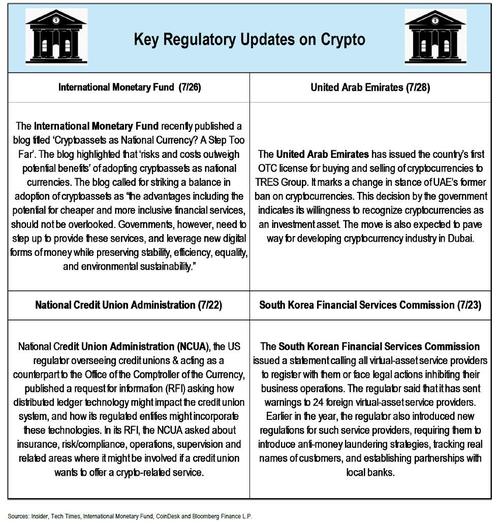

Key Regulatory Updates on Crypto

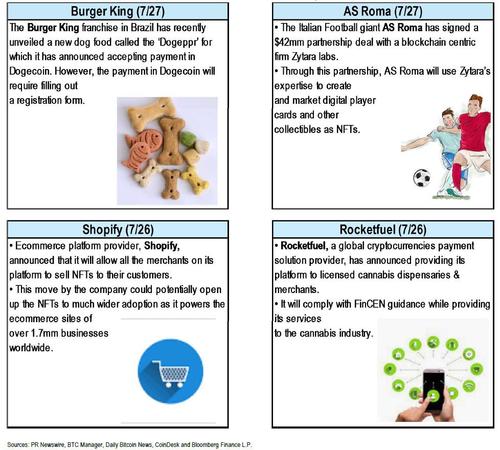

Crypto Adoption by Non-Financial Services Companies

VC Corner: Key Blockchain/Crypto VC Investments

- Fireblocks (7/27): The blockchain infrastructure firm Fireblocks recently raised $310mm in a Series D round that valued the company at $2B. Fireblocks’ technology can implement direct custody without having to rely on third parties. Its platform has been used by over 500 institutions with more than $1T in digital assets. Its list of clients include Revolut, BlockFi, Celsius, Crypto.com, and eToro. The latest funding round was led by Sequoia Capital, Stripes, Spark Capital, Coatue, DRW Venture Capital, and SCB 10X, the venture arm of Thailand’s Siam Commercial Bank. (link)

- Figure (7/28): Figure, a blockchain-based solution provider to the financial services industry, closed $200mm Series D round backed by Apollo Global Management, Inc., Blockchain.com, Rockaway Blockchain, HOF Capital, Endeavour Capital, National Bank Holdings, Goldentree Asset Management, and L1 Digital. This round valued the firm at $3.2B. Figure provides blockchainbased solutions for loan origination, equity management, private fund services, and payments. (link)

- Eco (7/27): Eco, a cryoto wallet company, raised $60mm financing in a latest round led by Activant Capital, L Catterton, a16z Crypto, Lightspeed Venture Partners, LionTree Partners, and Valor Equity Partners. Eco offers an all-in-one digital wallet with rewards and no fees and has average deposits of around $6,000. Eco’s top priorities are accelerating product roadmap and scaling user base. It is looking to significantly grow its team, build up marketing, and pursue regulatory approvals while expanding its services. (link)

- Dibbs (7/27): Fractional sports card marketplace Dibbs announced $13mm Series A funding from Foundry Group, Tusk Venture Partners, Courtside Ventures, and Founder Collective. Dibbs provides a platform for fans to trade fractions of sports cards, in real time. It assigns NFTs to physical assets that are then fractionalized on blockchains. The ownership of these cards is defined using smart contracts. Dibbs will use the incoming funds to increase its team size, add new range of products, and expand globally. (link)

Global Crypto Market Size and Landscape

The size of the global market increased in the past week, with the global crypto sector’s market cap rising 18.2% w/w from $1.31 trillion to $1.55 trillion as of 7/29.

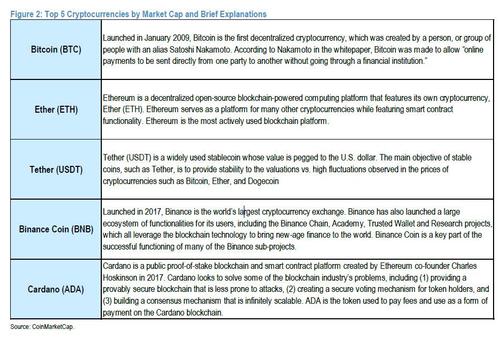

Currently, the top five cryptocurrencies by market cap are (1) Bitcoin, (2) Ether, (3) Tether, (4) Binance Coin, and (5) Cardano. Below we give brief explanations of each of these major cryptocurrencies

d

Tyler Durden

Sun, 08/01/2021 – 18:30

via ZeroHedge News https://ift.tt/3zYv9sX Tyler Durden