AMC Foolishness Comes At A Dear Cost

Authored by Michael Lebowitz via RealInvestmentAdvice.com,

“For one thing, in a world of free money, there’s almost no penalty for being a numbskull. And no reward for prudence. You run your business at a loss? No problem. Just borrow whatever you need.”

– Bill Bonner

In Undermining Capitalism with Unreal Values and Crass Distortion we discuss how recent extreme monetary policy measure undermine capitalism. The article highlights how yield hungry speculators are piling into junk-rated debt despite the fact they all but guaranteed to lose purchasing power.

Our gripe goes well beyond the mispricing of financial markets. Its more insidious. Warped market values reduce the productive output of the economy, and therefore impair wealth and income equality. Misallocated capital is inflating the value of meme stocks, such as the near-bankrupt AMC movie chain, and draining resources from productive sectors of the economy.

Bad News Is Not Good News

The Wall Street Journal recently published- Explaining ‘Bad News for the Economy Is Good News for the Stock Market’.

We can sum it up in one sentence: bad economic news is good news for share prices because it ensures the Fed will provide stimulus for longer.

In a robust economy, with the promotion of productivity as its centerpiece, investors should greatly favor good economic news. Conversely, in a market fueled by excessive speculation, bad news and the accompanying liquidity from the Fed trump economic reality.

The juxtaposition of their preferences define the type of market the Fed is fostering.

March Of The Zombies

In properly functioning markets investors aim to buy assets with promising growth potential. Further, they should generally shun investments with limited or no growth potential. Such a capitalistic process allows new companies with productive ideas to raise capital. At the same time, it limits capital flows to companies with unproductive assets and little potential.

This dynamic ensures productivity growth. We can think of the self-serving process as capitalistic Darwinism, or as well call it, the Virtuous Cycle.

When a central bank recklessly manipulates interest rates, the process fails. In such circumstances capital tends to gravitate toward speculative investments. The fittest, or those offering the economy the most productive benefits, do not receive the lions share of capital. Quite often, so-called zombie companies take capital from them.

Zombies are companies which were bailed out and/or cannot meet their debt payments without issuing more debt. Such companies not only stay alive but often thrive when rates are too low and speculation runs rampant.

Most zombie companies do not offer promising growth or innovation. Instead, they prey on investors with the allure of higher stock prices.

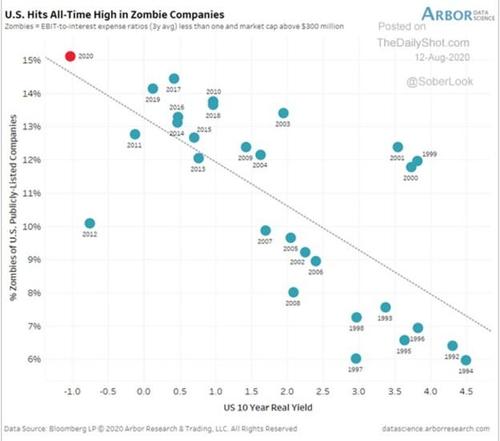

The graph below shows the strong correlation between the number of zombie companies and the level of real yields.

The next graph shows zombie company stocks returned nearly 3x the S&P 500 since January 2020. Not bad, considering the severe recession severely hampered many of their earnings.

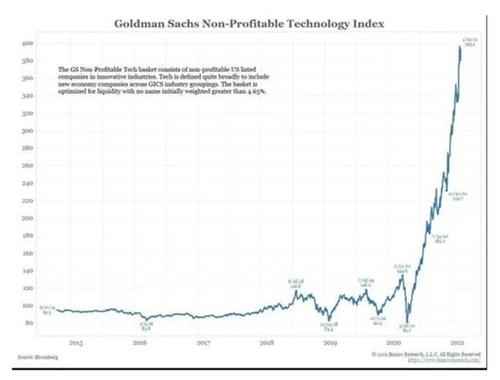

Along the same lines, the Goldman Sachs non-profitable Technology Index, which is not 100% zombie companies, but includes many, has killed it, for lack of a better word.

AMC- The Walking Dead

To better understand zombie corporations, lets dissect a living and thriving zombie.

AMC Entertainment Holdings, AMC, is America’s largest movie theater chain. They have been around for 101 years.

Let’s compare the quantitative definition of a zombie and see how AMC stacks up.

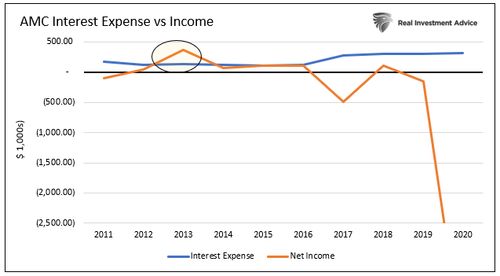

- Income is not sufficient to meet debt payments. As shown below, AMC’s income exceeded its interest expense only once in the last 10 years.

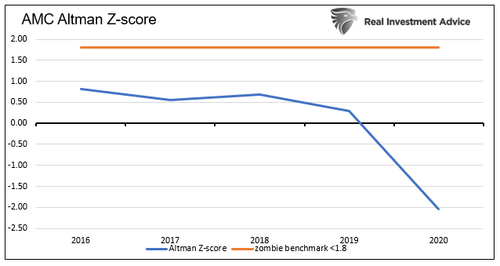

- An Altman score of less than 1.8 suggests a company might be heading toward bankruptcy. This score uses five common business ratios to help predict bankruptcy odds. As shown, AMC’s Altman Z-score has not been close to 1.8 in the last five years.

AMC easily qualifies as a zombie.

Pandemic Effects

As shown above AMC was a walking zombie before the pandemic. Not surprisingly, AMC struggled through the pandemic. Its revenues have shrunk to less than 10% of their pre-pandemic levels.

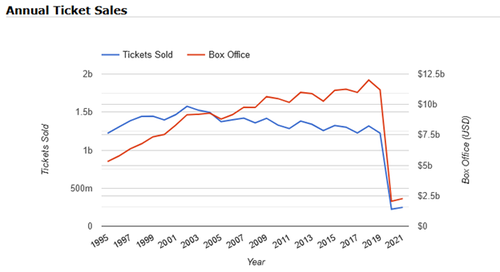

More concerning, despite vaccinations, movie goers are not returning to the movies as they were. While there remains apprehension about going to theaters, AMC is also a victim of streaming. During the pandemic, services like Netflix, HBO, Hulu and others became a more viable movie watching option. To add insult to injury most movies are now simultaneously introduced at the theater and via home streaming services.

Based on data from The Numbers, the situation is dire for movie theaters. For example, the current hit Black Widow’s has brought in about $167 million in box office revenue. In 2019, for comparison, Avengers: Endgame hit $357 million in its best weekend.

The graph below shows how movie ticket sales are only slowly rebounding.

AMC Is Not Dead

While we paint a grim picture of AMC, it is not dead. The movie producers need the theaters and will keep them alive. This is evident in their support for AMC and other theaters. For example, AMC now receives some of the streaming profits from movie studios.

Per CNBC- “What we learned during the pandemic is that it is not easy to replace all that lost theatrical window revenue,” said Eric Handler, media and entertainment analyst at MKM Partners. “That feeds a lot of downstream revenue opportunities. There will be changes to the model, but I still think theatrical is something that will remain.”

From a macroeconomic perspective, we are irrelevant whether AMC survives or goes bankrupt. What we are concerned about is how much capital is being misallocated to AMC.

Gross Misallocation

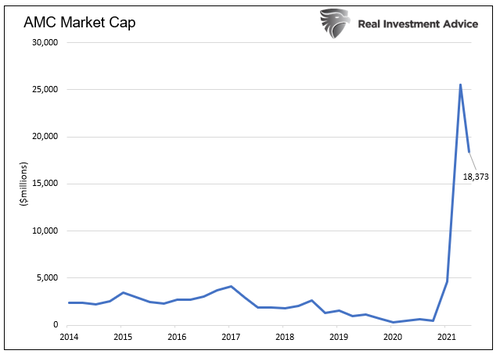

The graph below shows that AMC’s market cap or valuation has recently fallen from $25 billion to $18 billion. Currently, at $18 billion its market cap is about six times its pre-pandemic level.

Given the pandemic related losses and new habits of movie viewers, should the market cap be higher than it was in prior years? NO! It doesn’t matter what we think. AMC has become a popular meme stock and investors seem willing to use their precious capital to chase it well above prior valuations.

Speculators do not consider AMC’s balance sheet, income statement, or prospects. Instead, they solely focus on whether it will go up or not.

What if the $18 billion of capital was instead allocated toward something productive? Imagine if AMC investors focused on cancer research, space exploration, nano technologies, or other productive ventures. Now consider it’s not just AMC. Zombies are all over the place and sucking up capital that could be used to more productive means.

China Gets The Joke

Rampant speculation has negative economic and sociological impacts. Maybe of equal importance our chief economic antagonist appears to be taking a different stance by encouraging productive investment at the expense of non-productive ventures.

Noah Smith, blogger and Bloomberg Opinion author, recently wrote Why is China Smashing its Tech Industry. He believes the recent punishment of “tech” companies such as Alibaba, Ant Financial, Tencent, and Didi are not based on the same monopolistic concerns brewing in the United States. Noah thinks there is much more to the story.

Per his article: “And so when China’s leaders look at what kind of technologies they want the country’s engineers and entrepreneurs to be spending their effort on, they probably don’t want them spending that effort on stuff that’s just for fun and convenience. They probably took a look at their consumer internet sector and decided that the link between that sector and geopolitical power had simply become too tenuous to keep throwing capital and high-skilled labor at it. And so, in classic CCP fashion, it was time to smash.”

Noah argues China is promoting productivity growth, not profit growth. If true, China is playing the long game which will benefit their nation. While banning or even punishing ‘internet” companies is much less likely here, we should take notice.

Summary

The Fed does not directly promote AMC, yet its actions create an environment that allows AMC shares to sop up precious capital despite uncompelling valuations. This capital is therefore not available for more productive investments.

It may be fun watching and/or trading zombie companies, but the cost of such entertainment is more costly than most people grasp.

Tyler Durden

Wed, 08/04/2021 – 10:45

via ZeroHedge News https://ift.tt/3yBmVqk Tyler Durden