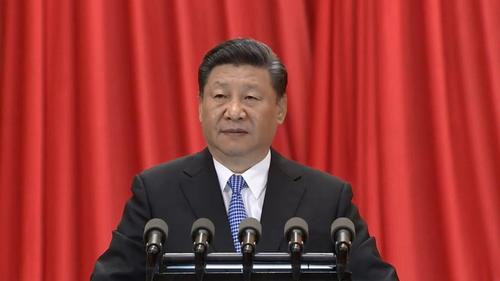

Investors Parse President Xi’s Speeches For Clues About China’s Next Target

Investors have been distracted Wednesday by the wild ride in Robinhood shares, but that doesn’t mean thousands of investors are trying to anticipate any potential targets for China’s next crackdown. Yesterday, it was video games, but other targets have included education, Big Tech, crypto, payments, ride-sharing etc. Just yesterday, Tencent, the worst-hit US-traded ADR, shed another 10% in early trade as an economic publication slammed video games as “spiritual opium” – before the article was withdrawn and edited to be much less aggressive.

Alibaba and Tencent, two of China’s biggest companies and among the most visible to international investors, have taken major hits. China has become one of the most controversial topics of the summer, yet it still has plenty of defenders: billionaire Bridgewater Founder Ray Dalio praised the opportunities to be seized by investing in China.

Despite Beijing’s egregious rug-pull of the Didi IPO, it likely won’t be the last Chinese IPO. But US investors now realize they need to be much more careful of the risks surrounding China. In the absence of other strategies, Bloomberg reports that many analysts have resorted to reading old speeches by President Xi and parsing them for clues about other companies and businesses that might be targeted.

Investors can afford databases of the leader’s speeches. According to Bloomberg, President Xi has denounced “obscene” online content, education inequality and housing-price speculation in popular school districts.

Dan Wang, an analyst at Gavekal Dragonomics, one of the most respected China-focused research shops, said investors previously ignored what he called “Party Speak” because it’s too “dense”. But now, many realize that they must redouble their efforts to parse the contemporary political climate in China, especially since President Xi is expected to seek a third term.

“Investors and analysts have tended to dismiss party-speak, usually because it’s so impenetrable,” said Dan Wang, a technology analyst at Gavekal Dragonomics in Shanghai, who regularly reads the Qiushi Journal, a bi-monthly Communist Party publication. “But much of it is perfectly readable, and we should know at this point that Xi usually follows through on what he says.”

Another issue with reading Xi’s speeches is that many of them are “classified” and available only to CCP members.

Still, anybody seeking to understand the complexities and contradictions of “Xi Jinping Thought” will find plenty of resources.

“With power mostly centralized in his hands, Xi now can change status quo policy quickly and even without much warning,” said Victor Shih, associate professor at UC San Diego and author of “Factions and Finance in China: Elite Conflict and Inflation.”

“On top of quick policy changes, officials below him will want to zealously implement any new policy or ‘spirit,’ the party’s term for policy direction,” Shih added. “This zealous implementation will often take place regardless of the longer-term consequences because officials are afraid of being accused of lackluster implementation.”

Another important element to watch is which agency makes the decision.

One element to watch is which agency makes the announcement, and over the past decade there’s been an increasing amount of joint statements that span different arms of the government and the party. China’s ban on profits for its tutoring industry was jointly issued by the general offices of top government and party bodies — the State Council and the party’s Central Committee — giving the decision more authority than any single department.

Looking ahead, the CCP will likely focus on reforming areas that would have the biggest societal impact. The price of real estate, availability and affordability of health care and retirement living are all important issues that the CCP must tackle to stave off public anxieties.

Jason Hsu, founder and chief investment officer of Rayliant Global Advisors, said” RRight now, it feels like throwing the baby out of the bathwater and every industry is at risk…If you are more aware of what the Chinese has been communicating all along, you know what they will do. Real estate, health care, retirement living — these are identified by policy makers as undermining societal harmony, and the quality of life.”

Tyler Durden

Wed, 08/04/2021 – 20:00

via ZeroHedge News https://ift.tt/3ioZKKh Tyler Durden