Inventory At US Car Dealers Falls To New All Time Low

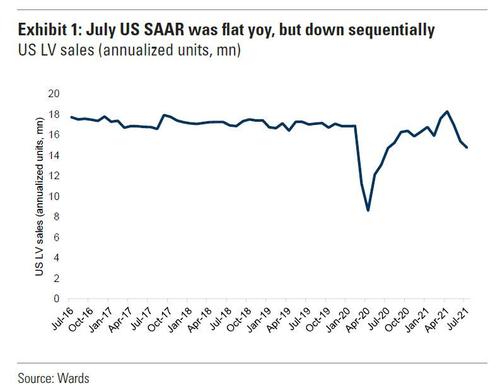

The latest auto sales data revealed that in July, auto sales came in at a 14.75 million SAAR per Wards; while total unit sales in July declined by less than 1% sequentially to 1.288 million (from 1.295 million in June), when factoring in the seasonality adjustment, July US SAAR declined by about 4% sequentially (US SAAR was 15.4 million in June per Wards). The July SAAR came in just below the consensus estimate of 15 million.

Some more details: car sales were up about 4% yoy, SUV sales were up about 9% yoy, and pickup truck sales were down about 3% yoy. Pickups and SUVs as a percent of total units were 18% and 54%, respectively (vs. 20% and 52% in July 2020). Per Motor Intelligence, Ford sales were down about 32% yoy and GM sales were down about 3% yoy in July. Ford’s market share in July decreased yoy to 9% from 14%, and GM’s market share decreased yoy to 15% from 17%. According to media reports, production levels at Ford have been particularly impacted by the semiconductor shortages.

The standout category again was electric vehicles with with July EV sales up about 106% yoy, and hybrid sales up about 65% yoy, per Motor Intelligence. According to Goldman this was due in part to growing consumer demand for EVs and hybrids (as well as more EV/HEV models on the market) in addition to an easier yoy compare (given some areas where EV sales are particularly strong, such as in California, were experiencing COVID-related shutdowns in July 2020). Note that Tesla does not report monthly sales, and with its its dominant EV market share in the US, the EV data has a greater degree of estimation than the other monthly datapoints.

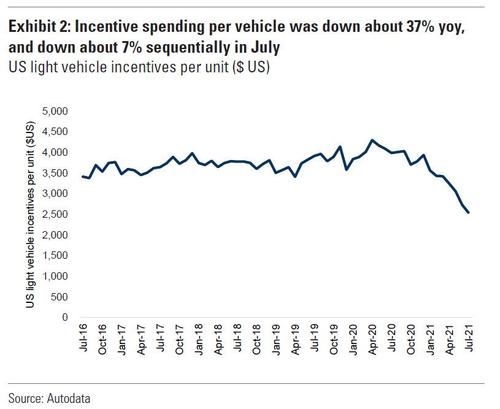

And while incentive spending per vehicles was down a record 37% Y/Y and 7% sequentially to just $2.5 per car, which was to be expected at time when new and used car prices are surging at record levels…

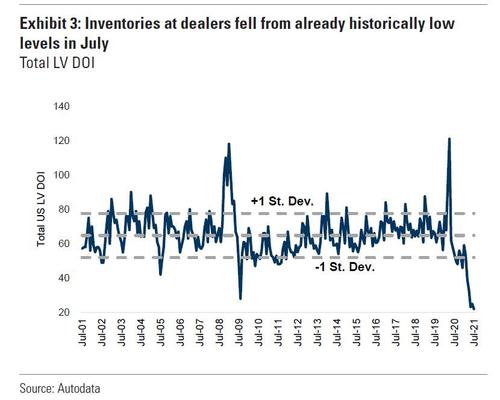

… what we found most interesting in the July data is that inventory at US dealers plunged sequentially to ~1.0 million from 1.3 million in June 2021, and down from 2.5 million in July 2020. This means that industry DOI came in at a record low 22 days compared to 25 days in June 2021 and 53 days in July 2020. Pickup truck DOI was 31 days (vs. 30 in June 2021 and 56 in July 2020), SUV DOI was 20 days (vs. 24 in June 2021 and 52 in July 2020), and car DOI was 19 days (vs. 24 in June 2021 and 55 in July 2020).

As inventories at dealers continue falling from already historically low levels, it will take a long time for inventory at dealers to return to normalized levels given the strong demand for vehicles coupled with ongoing supply chain challenges (particularly with semiconductor chip shortages, but also due to shipping constraints).

Additionally, given that the absolute level of auto sales was down only slightly mom to 1.29 million units, but inventory declined by about 300K, it implies that net supply into the market was lower in July (as inventory declined by about 100K units last month on a similar level of sell through).

Looking ahead, Goldman expects auto production issues “to persist in the near-term due primarily to chip constraints (but also due to shipping challenges, and rising COVID cases in some geographies), which could continue to weigh on industry sales.” The good news: the tide is finally turning and per company comments, automakers expect more chip supply later in 3Q and in 4Q as the semi industry began taking steps to add capacity in late 2020/early 2021 (it takes approximately 9 months to bring semi capacity online, on average, assuming there is clean room space) but supply/demand for chips will remain tight all year.

So as a result of low inventory, and the continued strong pricing environment, Goldman expects industry pricing to remain strong in 3Q.

Tyler Durden

Wed, 08/04/2021 – 20:40

via ZeroHedge News https://ift.tt/37iT3TZ Tyler Durden