Goldman Hikes S&P Price Target To 4,700 Due To Lower Rates, Says S&P Could Hit 5,000 If Yield Slide Further

Back in June, when the S&P was still trading in the mid 4200’s, Goldman’s chief equity strategist David Kostin published a cautionary note asking “what if we are wrong” in his assumptions, which was meant to provide cover in case stocks tumbled and/or rates spiked but which also had a prudent outlier loophole in case the meltup in markets accelerated and took out the bank’s year-end price target 4300. Specifically, falling back on the old faithful Fed model, Kostin – who was expecting yields to rise to 1.9% by year end, said that if – all else equal – interest rates remain roughly flat at around 1.3% (or lower) through the end of this year, “Goldman’s S&P 500 dividend discount model (DDM) would suggest a fair value of 4700, or 9% above the bank’s current baseline price target of 4300.“

To be sure, predicting stock upside in case of economic slowdown would leave a bad taste in investors’ mouths, and Kostin conceded that “if rates fail to rise because of weakening growth, then lower earnings or a higher ERP would suggest a lower S&P 500 price despite lower interest rates.” However, “holding baseline ERP constant, a 10-year US Treasury yield of 1.6% (the 3-month average) would lift Goldman’s DDM-implied fair value estimate to around 4700.” In other words, yes – even if the drop in rates is due to weaker economic conditions, that still would be sufficient for higher stocks. A good reminder that we still live in world where both good news and bad news is good for stocks.

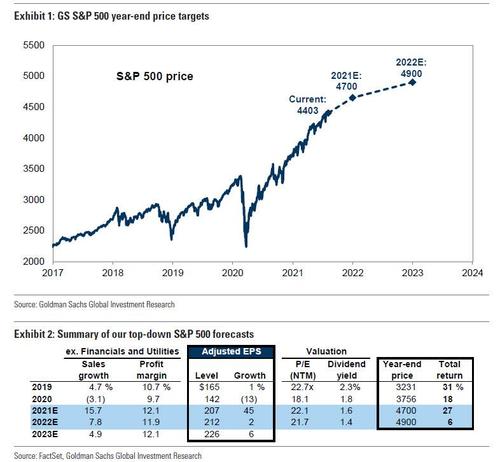

Well, two months later, with the S&P well above the bank’s heretofore price target, overnight Goldman finally capitulated, and David Kostin raised the bank’s S&P 500 estimates and year-end price target from 4,300 to 4,700 – making it the highest such forecast on Wall Street – writing that the bank is “raising our S&P 500 earnings and index targets; high-margin growth stocks will remain winners.”

Key drivers behind Kostin’s price hike: corporate profit resiliency (particularly among Tech stocks) and persistently low rates: the new targets imply a 7% S&P 500 price return for the remainder of 2021 and full year price returns of 25% in 2021 and 4% in 2022, respectively (27% and 6% including dividends. EPS estimates were also updated, jumping to $207 (from $193) in 2021 and $212 (from $202) in 2022.

To justify the revision, Kostin writes that he now expects earnings growth will be the primary driver of US equity returns in 2H 2021 and 2022, as it has been so far this year. Year-to-date, EPS growth has accounted for all of the S&P 500’s 17% price return. Looking forward, he forecasts that modest equity risk premium (“ERP”) compression will offset rising interest rates, resulting in an S&P 500 valuation multiple that remains roughly flat. Earnings-driven equity market appreciation is consistent with the typical pattern at the current point in the business cycle.

The Goldman strategist lists 4 core assumptions behind his new forecast:

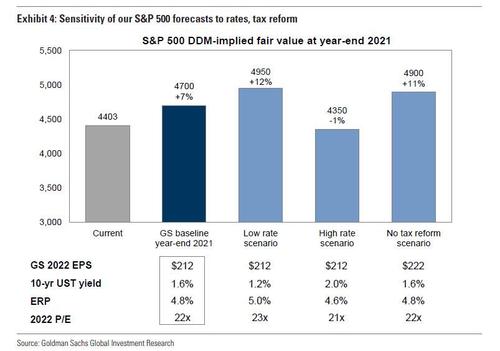

- Baseline: The baseline equity forecast assumes tax reform passes and 10-year Treasury yields climb modestly to 1.6% at year-end, down notably from the bank’s previous forecast of 1.9%. This implies a year-end 2021S&P 500 fair value of 4700 (+7% from today) and a corresponding forward P/E multiple of 22x.

- Low rates: If interest rates were to remain near current levels (1.2% for the 10-year US Treasury yield) without a major downgrade to growth expectations or risk sentiment, the implied S&P 500 fair value at year-end would equal 4950 (+12% vs.the current S&P 500 level) and the P/E multiple would equal 23x.

- High rates: If interest rates rise by more than expected due to a combination of improving economic growth expectations, persistent inflation, and a tighter Fed, the implied S&P 500 fair value would equal 4350 (-1%) corresponding with a P/E of 21x.

- No tax reform: Our baseline forecast includes an expectation that tax reform passes in late 2021, but in a scenario without tax hikes our EPS estimate for 2022would be roughly 5% greater ($222) and our year-end 2021 price target would be around 4900 implying a P/E of 22x.

A chart summarizing the various assumption sensitivities is shown below:

Of particular note is Goldman’s cut to its interest rate forecast: with 10Y yields now expected to end the year at 1.6% vs 1.9%, lower interest rates should support a stable forward P/E multiple of 22x according to Goldman. And if rates are even lower than that, Goldman says that we could see the S&P reaching near 5000 by year-end (conversely, a tightening by the Fed could keep the S&P 500 down near current levels).

What is remarkable about this is that if one takes the Goldman forecast at face value, yields will decline because bond traders are anticipating a weaker economy, something which record low real rates already hint. And yet said slowdown is now viewed as favorable to stocks, although Kostin did caveat by saying that this drop in yields has to come “without a major downgrade to growth expectations or risk sentiment.” Translation: as long as yields keep falling and stocks keep rising without anyone asking too many questions what’s behind this move, well… the move should continue and yields can keep falling and stocks keep rising.

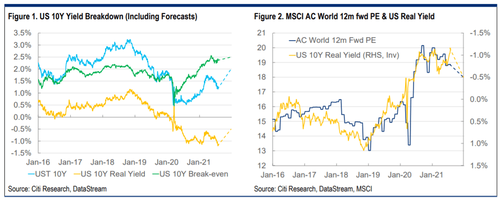

What is even more remarkable is how adept Wall Street has become at goalseeking catalyst to justify a narrative: to wit, just yesterday Citigroup downgraded stocks warning that higher yields will put pressure on growth:

According to Citi chief global equity strategist Robert Buckland, a big rally in nominal and real Treasury yields will leave U.S. equities in an unfavorable position compared with other regions. Unlike Goldman which trimmed its year-end TSY forecast, Buckland calls the recent rally in government bonds “largely technical,” and is forecasting the 10-year Treasury yield to rise to 2% through 2022, with real yields rising 70 basis points.

“What is the bond market trying to tell us?” Buckland wrote . “Is it worried that the Delta Covid variant may hold back global economic recovery? Is it now convinced that the current inflationary upturn is transitory? Or does curve flattening (short yields up, long yields down) suggest potentially over-zealous monetary tightening, that a ‘policy mistake’ is now imminent? Maybe the bond markets are worried about a China slowdown?”

“Citi US rates strategists are not especially convinced by these tempting narratives,” he says. “Instead, they attribute much of the move to technical factors. Most notably, US treasury issuance has dropped over the summer, but will rise again later in the year. They think that this, along with ongoing economic recovery and likely QE tapering, will push 10-year bond yields back towards 2.0%.”

“We factor this bearish bond view into our global equity strategy,” he adds. “Amongst regions, we downgrade the Tech-heavy US to Neutral. We upgrade Japan to Overweight, where valuations and cyclical exposure should be supportive, along with a weaker yen. We remain Overweight UK equities, our favourite value trade.”

“Amongst global sectors, we downgrade real yield-sensitive IT to Neutral and raise Health Care to Overweight. We remain Overweight Financials and Materials, which should outperform as bond yields rise.”

Meanwhile, Citi strategist Tobias Levkovich, who has been among the most downbeat strategists in recent months, has a year-end S&P target of 4,000, saying that central banks have been keeping rates repressed since 2008, which indicates that they do not have confidence in sustainable growth and keeps risk premiums high.

To summarize, whereas Citi still believes that the reflationary narrative will take hold again and push yields higher while hammering stocks, Goldman has capitulated on the “newer normal” theme, and has reverted to the old “new normal” of secular stagnation where economic weakness translates into more Fed intervention, lower yields, and higher prices.

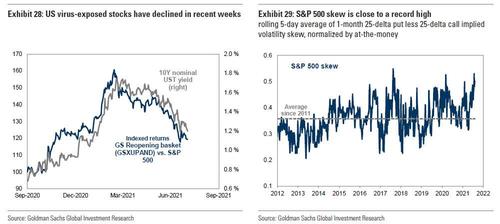

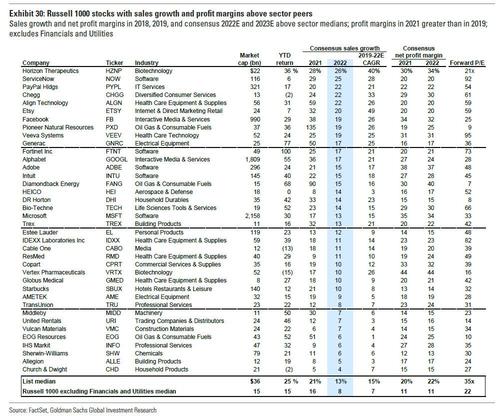

It remains to be seen which of the two strategists is correct, but for those who side with Goldman and see more upside to risk, Goldman recommends investors a balance between long term secular growth positions (focus on the 38 stocks with sales growth and margins consistently above sector peers shown below) and virus-exposed industries where concerns around the Delta variant have created tactical opportunities.

Drilling down on this, in the short term, Goldman believes the market’s pessimism regarding the Delta variant has created an opportunity in some virus-exposed cyclicals. For example, a basket of Reopening stocks has declined in absolute terms by 15% and lagged the S&P 500 by 20 pp since May as investors have downgraded economic growth expectations. In addition, given the upside to our S&P 500 price targets, the bank maintains the view of our index options strategist that investors should take advantage of extremely elevated skew by buying levered risk reversals.

Finally, here are the 38 stocks with sales growth and margins consistently above sector peers which Goldman believes are safe bets for the long-run.

Tyler Durden

Thu, 08/05/2021 – 12:05

via ZeroHedge News https://ift.tt/3AjOlln Tyler Durden