Inflation Tipping Point

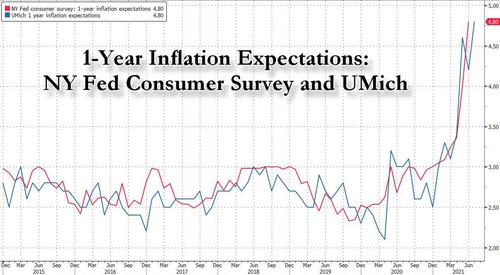

While short-term inflation expectations are soaring according to virtually every survey including the Fed’s own…

… the big question is where do long-term inflation expectations go from here.

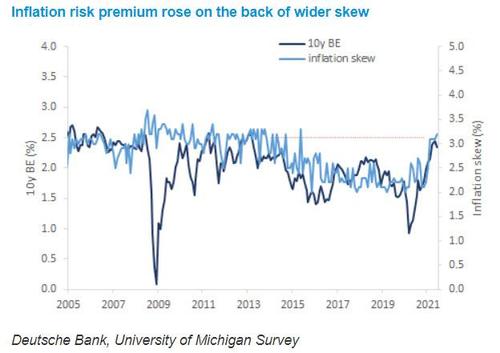

According to an analysis by Deutsche Bank’s Jiefu Luo, long-term inflation expectations are starting to show signs of a break from the post-2013 low inflation regime.

As the DB chart below shows, breakevens pricing is currently consistent with the Michigan survey inflation skew, a proxy for inflation risk premium. Historically, the degree of divergence in inflation outlook drives market pricing of tail risks and therefore inflation risk premium. The skew, which is defined as the difference between 75th percentile and 25th percentile response in expected price change during the next 5-10y question, captures this effect quite well.

DB valuation models converged on current level of long-term breakevens being fair. The risk, however, lies with any disappointment to CPI readings, as the Fed believes it is well positioned to rein in runaway inflation. This suggests that a below consensus CPI print on Wednesday may easily reverse the course of regime switch while it could take more than a few inflation beats to convince the market of a return to higher inflation regime.

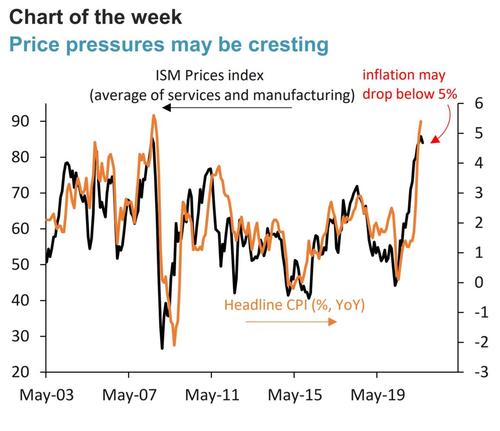

Indeed, as the following chart from Piper Sandlers which tracker the correlation between the ISM price index (avg between mfg and services) and CPI suggests, we may have already peaked on the inflation front, a tipping point reflect by consensus expectations of a 0.5% increase in core CPI in July, down from 0.9% in June.

Tyler Durden

Mon, 08/09/2021 – 12:01

via ZeroHedge News https://ift.tt/3ivyHx6 Tyler Durden