“No One Believes In Fiat Currencies Any More”, Barrick Gold CEO Fears EM Economies “In Dire Straits”

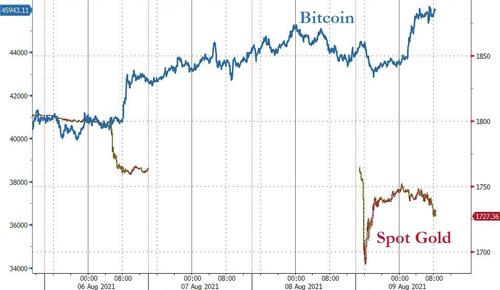

Following the overnight chaos in the precious metals markets, Barrick Gold CEO Mark Bristow appeared on CNBC to remind investors that “this is a long-term business,” adding that “gold prices go down and they go up and sometimes not in that order.”

“Fundamentally,” Bristow remarked,

“this world is battling with how to position investments on the back of the unforeseen and unrealized damage of how the pandemic crisis was managed… and the impact it had on the global economy which really hasn’t materialized yet.”

Asked on crypto adoption and whether it is stealing mind share from the barbarous relic, Bristow says “there’s no comparison with gold,” pointing out that unlike crypto, “gold acts as a stabilizer against volatility in a portfolio while the deltas in crypto are enormous.”

“The critical thing,” the Barrick CEO notes, “is that you can’t just create value… and what you are really buying [with crypto] is energy.”

But what the rise in crypto and gold is telling us, Bristow warns is that:

“no one believes in the fiat currencies any more and everyone’s desperate” to find alternatives.

“There’s a lot of money washing around in the hands of people that did not lose their jobs.”

“The whole issue here is that everyone wants instant gratification, everyone’s already concerned about how you store your [wealth] that you’ve seen grow in the developed worlds.”

“The emerging and developing world’s economies are in dire straits.”

Circling back, Bristow notes that the current weakness in gold is an opportunity:

“Without a doubt, this is a buying opportunity and you still need a 5% or so part of your investments in gold.”

Watch the full interview below:

Tyler Durden

Mon, 08/09/2021 – 15:04

via ZeroHedge News https://ift.tt/3xA3EEo Tyler Durden