SoftBank Disappoints As Masa Refuses To Commit To More Buybacks After Lackluster Earnings

Yesterday, as SoftBank’s quarterly earnings report looming on the horizon, the FT published a deeply reported story in which a handful of SoftBank insiders sounded the alarm about the company playing fast and loose with its investments, and its handling of compliance-related issues. With the firm reeling from the blowup in Chinese stocks (it owns a massive stake in Alibaba, and has invested in Didi and other publicly traded Chinese firms, expectations for Tuesday’s earnings were low to begin with. Yet, the firm still managed to disappoint.

SoftBank reported a 39% decline in Q1 net profit. The decline was due in large part to the absence of the one-off profits from the merger of Spring and T-Mobile, which was a major boon for SoftBank. Despite several notable disasters, both Vision Funds managed to record profits for the quarter.

Regarding China, Vision Fund CFO Navneet Govil said “our broader thesis in China is unchanged: It’s still a large, growing and compelling economic opportunity.”

But China wasn’t the only driver of SoftBank’s investment losses: a 20% drop in the value of South Korean e-commerce giant Coupang resulted in more than $4 billion of losses for Vision Fund II this quarter.

To be sure, the firm’s quarterly profit would have been erased if the results of China’s crackdown on Didi had been factored into the quarterly earnings. The crackdown started just days after the quarter ended. One analyst pointed to this concentration in bets as a major hurdle for SoftBank long term.

“The problem with the Vision Fund SoftBank is that their largest investments so far have been middling to poor – WeWork, Uber, Didi,” Boodry said. “Those three alone are a quarter of the fund. That’s a huge performance hurdle for the rest of the fund to overcome.”

SoftBank chairman Masayoshi Son also appeared to confirm criticisms that SoftBank cut too many compliance and regulatory corners by announcing that he would pour billions of dollars of his own wealth into SoftBank’s Vision Fund II (which is already 100% comprised of SoftBank money), despite concerns about potential conflicts.

Son can invest up to $2.6 billion and will own 17.25% of the equity. He will have a similar arrangement with SoftBank’s Latin America fund.

Asked about the firm’s outlook on China following the government crackdown, Masa said that SoftBank would halt its investments in China while it waits to see how the regulatory situation plays out. Ultimately, Masa expects everything will clear up after a year or two.

“Until the situation is clearer we want to wait and see,” Son said. “In a year or two I believe new rules will create a new situation.”

Given the firm’s reliance on its portfolio of investments, SoftBank’s earnings are often volatile quarter to quarter. During the fiscal year that ended in March, the firm reported the largest annual net profit of any Japanese company.

But the biggest disappointment for SoftBank shareholders (who have watched the value of their SoftBank shares decline by nearly 30% since the start of the year) was the fact that Masa refused to commit to more share buybacks.

Without a constant buyback pump, Softbank is a total disaster

— zerohedge (@zerohedge) August 10, 2021

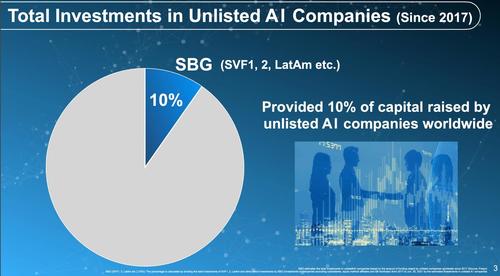

During the post-earnings press briefing, Son declared SoftBank the world’s “top investor in artificial intelligence” accounting for 10% of the capital in unlisted AI startups. The investors in second- or third-place don’t even come close.

Masa has repeatedly warned that the “AI revolution” is coming, and that SoftBank is poised to take advantage of this phenomenon.

“If AI fails, SoftBank would fail, that’s a risk,” Son said.

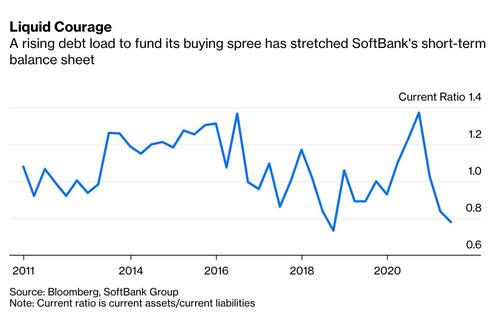

Another alarming detail from the quarterly earnings was SoftBank’s current ratio, a measurement of a firm’s current assets divided by current liabilities. A number less than one means more debts are coming due than there is liquid cash available to pay them. Because of this, the Bloomberg columnist warned that SoftBank needs to “stop buying and start selling.”

Source: Bloomberg

But with Masa now injecting billions of dollars of his own money (his own fortune has been leveraged against the value of his SoftBank shares, creating the potential for a damaging negative feedback loop if the firm’s share price continues to sink) into VFII, signaling that more dealmaking will likely follow.

Tyler Durden

Tue, 08/10/2021 – 10:15

via ZeroHedge News https://ift.tt/3CzwRTR Tyler Durden