“This Is Not A Taper Tantrum” – Nomura Warns Of “Lurking Delta One” Collapse As Gamma ‘Unclenches’

In the new normal world of ‘Correlation 1’ risk-on, risk-off trading, the only thing that matters is the rise and fall of the Equity vol flows.

This is why, as Nomura’s Charlie McElligott explains, with all the pre-warning warnings and expectations management, the current sudden slide in stocks is “not a taper tantrum”, adding that “yesterday’s minutes were a non-event, where the market has already price Q4 official announcement anyhow.“

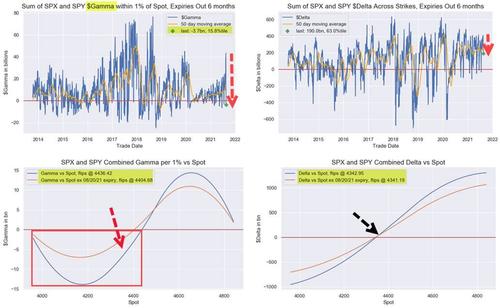

Instead, the Nomura MD notes that US Equities Realized Vol is finally trueing-up to the incessant CRASH -signals from Implied Vol / Skew / Term-Structure / “Vol of Vol” signal extremes we’ve been hammering-on the past few weeks… and it’s causing a risk management / “crash” slide / stress issue around the Street now which is being traded around, ahead of the ever-critical monhtly options expiration cycle as an “accelerant” risk.

And offers some more ominous warnings for the unprepared:

Finally, I would expect that second-order “delta-one” issues are lurking somewhere behind in coming-days, even if any last remaining semblance of “long Gamma” tries to hold the line into tomorrow’s a.m. Op-Ex before “unclenching” thereafter.

This is what the cross-asset-class strategist believes is happening now:

-

My thoughts are that as a few on the sellside vol universe began more clearly speaking to the explicitly “CRASH” vol market signals of the past few months which has gone into absolute *red flag* overdrive mode this past week (and thus, the risk that it could then knock-into second-order “accelerant flows” like options dealer desk gamma hedging and systematic “vol sensitive” strategy de-allocation / deleveraging in standard lagging-fashion thereafter)—that some on the buyside began cutting their risk ahead of the expiration events this wk as this story was increasingly socialized, especially coming-off all-time SPX highs made just Monday

-

The thought was that the extraordinary “pinning” of the market from recently extreme “long Gamma” accumulation in recent weeks, largely via the “strangle seller” and various overwrite programs, could hold us tight and steady into the monthly Op-Ex turns this week (VIXpiration yday, Index / ETF / Singles tomorrow)…and that it was after expiration where you get the gamma “unclench” for tomorrow’s a.m. expiration where we could then finally see the fireworks (recall July expiration, Spooz trading down 1.2% from the highs made into Friday a.m. expiration through the close)

-

But here is the “feedback loop” issue: the Street has been “long Gamma” against their “short Vega” and “short Skew” positions—but the “short Vega” position began to squeeze as Dealers began to try and adjust their “crash” slides yesterday…but as Vol moved higher, that meant losing your Gamma (especially as spot blew through the largest “long Gamma” strikes yday)

-

And part of this is that aforementioned “buyside cutting risk ahead of the Op-Ex turn” catalyst, where the prior extreme “long Gamma” then “coming off” after Op-Ex could allow prices to finally unclench from this tight corridor we’ve been trading-in (again largely thanks to the strangle-selling “Gamma Hammer” flows of the past few months)—which means that now you don’t really have no choice, you cannot “wait around” to see if we stabilize “down here”

-

If you’re a buysider with high grosses and nets (markets at all-time highs) and you cannot cut your underlying “long Equities” exposure fast enough, as Dealers are straining and liquidity worsens (underlying liquidity is ALWAYS the error in the stress backtest, because it simply doesn’t remain constant)…and all ahead of *imminent* delta-one flows about to release from vol-control types….you have to go hit-out ES / buy UX or “crash” options

-

And if shorting S&P futures is the dynamic hedging option, this too is then coming with options Delta now getting PURGED now here too as we blow through the big S&P strikes at 4450 and 4400 on the way down (hell, we traded through 4350 earlier!)—which has put the Street in a worse position, bc their “long Gamma” was obviously so spot sensitive due to the strangle strikes which were pinning us, methinks

-

Well, that prior “long Gamma” is CRATERING now; with volatility jacking + spot blowing-through strikes, that explicitly means “less Gamma” which has kept us stuck in that extremely narrow trading band which has come in conjunction with the “Gamma Hammer à sell strangles” strikes

-

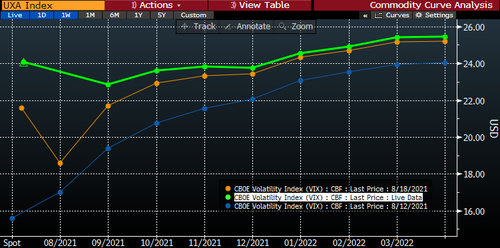

This is kicking-off stress VaR—the Street has too much notional to insure, but not enough balance-sheet available to insure it (as per my consistent messaging about regulatory risk mgmt realities and a supply / demand mismatch which cannot be accomodated)—so they have to “daisy-chain” the vol complex further, with dealers and market makers rolling-out their VIX futures weekly upside into more “term” stuff…or just buying UXA…or selling-out Delta in Spooz

-

Now, the VIX futs curve is reflecting the stress, with front inversion / proper “roll-up”—which means the market is gonna have to keep pricing-in a worst-case scenario, bc you’re going to have to move prices to cover your “short Vega” in the front-stuff /3m-and-in (assuming Dealers have at least some “long Vega” in that 6m-12m area to cover some of their risk-slides—let us pray)

-

And guess what: discretionary investors with “good-enough” years as I said are having to make some calls here as to what makes the most sense: either 1) reduce risk here and sell underlying; 2) short futures if you cant sell underlying singles (which is a risk); or 3) painfully hold their noses and pay Theta / buy Crash (which has been a brutal trade all year for obvious reasons that many have been avoiding, bc crash Theta is so jacked-up expensive and un-economical)—which then means if Theta likely gets only more expensive from here…so it might just make more sense to simply begin cutting your underlying book size / de-gross

So now, here we are in “phase two,” adding fresh “acceleration flows” to the mix:

Dealers are suddenly now in deep “SHORT Gamma vs spot” territory in SPX (below 4435, ref 4355 last yikes) and Delta would flip “short” below 4343 – while mind you, the ES 50dma aligns at 4340 too, which should matter for short-term “momentum / trend” reversal

What happens next?

Simple: price-insensitive de-allocation flow from systematic Vol Control / Target Vol community:

Vol Control was only small yday (sold just -$3.2B on the -1.1% move) which we have anticipated, because there is an inherent “lag” in the both the “averaging up” of the trailing realized vol windows following this lastest spike…but also too bc of intentionally-designed “execution lag” (as well as volume constraints) utilized by funds to best try and avoid mechanical exposure reduction feeding into the aforementioned negative feedback loop.

That said, there will almost inevitably be very significant supply coming from Vol Control next week, where if we hold constant current triggers (3m rVol is currently our deciding input), there is almost “no” likelihood we can “add”…and instead, coming off recent 1.5 year $exposure highs, de-allocating is effectively assured unless we somehow “kick save”.

Also keep in mind that this option for buyside: either

1) cut your exposure,

2) dynamically short Spooz into the downtrade, or

3) pay crash Theta

It all becomes more complicated next week, where there is an actual “event-risk” into Jackson Hole which is already forcing decisions on book sizing risk.

In conclusion, McElligott warns that it is unlikely that this dynamic can simply “clear” in a day or two… we have a structural imbalance which has to get washed-out, yet again.

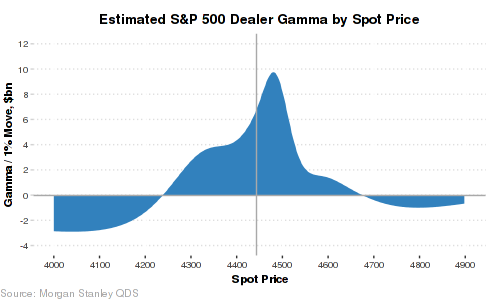

All this long gamma is a) fickle (i.e. the sellers of gamma step away on big drawdowns) and b) flips to short below 4250. That is where Morgan Stanley fears we could hit an air pocket…

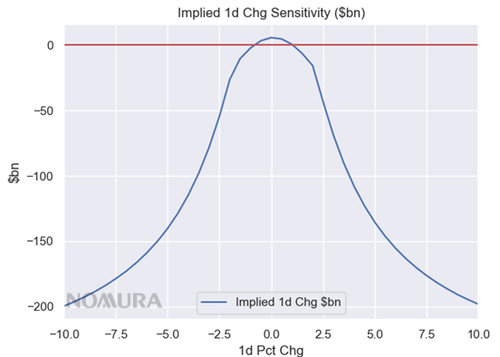

To put come numbers on this imminent chaos, Morgan Stanley warns that market makers likely need to buy over $150mm of vega (in one-year equivalent terms) in a down 5% move in SPX, which is ~20% of the average daily vega traded in S&P 500 options market.

This is not a typo. It is huge. History shows VIX has been more reactive to the S&P 500 in the ensuing months when dealers have more vol to buy in down markets, and a 2x change in VIX for every 1% move in SPX suggests VIX would go to 40 or more in a 10% selloff.

Tyler Durden

Thu, 08/19/2021 – 09:05

via ZeroHedge News https://ift.tt/3sIyIkV Tyler Durden