Melvin Capital Was Secretly Short Many More Stocks

The infamous collapse of Melvin Capital will forever live in the annals of short squeezes gone terribly wrong. The hedge fund’s publicly disclosed various bearish bets (many of them via puts) including such names as the original meme stock Gamestop was one of the precipitating catalysts for a historic January surge in countless heavily shorted small and mid-cap names. Indeed, Melvin’s short was one of reasons cited in various reports published on WallStreetBets in mid and late 2020 as the clarion call to aggressively start bidding up the names in hopes of sparking a squeeze. That’s exactly what happened and just days later Mevlin suffered irreparable damage, forcing founder Gabe Plotkin to seek a bailout from Citadel and Point 72.

But while all that has been widely publicized, what was unknown until now is that Melvin capital was secretly ramping up its bearish bets in various other names, and had the day trading army been aware of these positions, the outcome for Melvin could have been even more catastrophic.

On Monday of this week, the New York-based firm released previously confidential documents that showed it held put options on several additional stocks at the end of December, including on $324 million worth of shares in Beyond Meat. As Bloomberg, which first noted the amended filings observes, it was the second report Melvin released on a delayed basis that identified stocks it had bet against late last year through puts, positions which had been confidential until now.

According to the latest disclosures filed in an amended 13F statement, Melvin’s combined SEC filings for the fourth quarter listed put options on stocks that it hadn’t previously disclosed betting against, including Beyond Meat, Helen of Troy, First Majestic Silver and CryoPort Inc.

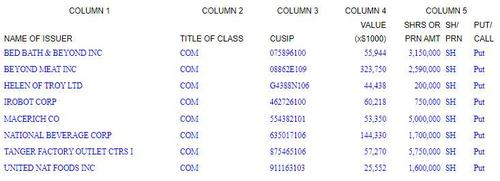

Here are the holdings disclosed in the amended 13F for the Dec 31, reporting period, and which were only made public on Aug 16.

The other amended filing can be found here.

Plotkin obtained permission from the SEC to delay required disclosures starting in February, after Reddit traders used the fund’s earlier filings to target stocks he had likely sold short.

THIS FILING LISTS SECURITIES HOLDINGS REPORTED ON THE FORM 13F FILED ON FEBRUARY 16, 2021 PURSUANT TO A REQUEST FOR CONFIDENTIAL TREATMENT AND FOR WHICH THE MANAGER IS NO LONGER REQUESTING CONFIDENTIAL TREATMENT.

However, by then the proverbial cat was out of the bag as the army of retail daytraders (whether with or without the implicit guidance and backing of one or more hedge funds such as Senvest) started trading in unison in late January in the opposite direction of Melvin’s puts, an unprecedented move by retail investors that saddled one of Wall Street’s most successful traders with a stunning monthly loss of 55%.

Meanwhile, as a result of the rushed liquidation at Melvin, even the shares that the fund was secretly short also started surging around late January during the peak of the retail-trader mania, without any public link to Plotkin’s hedge fund. As Bloomberg notes, “the moves confounded Wall Street and even the companies themselves”, although now we know the reason.

Other short bets, such as ADT, Macerich and United Natural Foods also hadn’t shown up in Melvin’s filings for at least a year. Those shares also moved sharply higher in late January — Macerich, for example, jumped 75% in the three days through Jan. 27 as Melvin was scrambling to unwind its short exposure creating a gamma meltup, only to tumble within a week.

According to Bloomberg calculations, Plotkin added aggressively to his bets that stocks would decline in the final quarter of 2020 around the time the broader market was melting up, the delayed filings show. The face value of shares covered by Melvin’s put options more than doubled during the fourth quarter to almost $1.6 billion, from $703 million at the end of September.

But while Melvin was prudent in hiding some of its shorts, it kept many of its prodigious shorts In the public domain and in January, Reddit traders began using Melvin’s previously reported put options as a proxy for the firm’s short positions. Within weeks, they drove prices of heavily shorted stocks to astronomical levels, most famously GameStop which soared to a peak of $483 on Jan. 28 from less than $20 at the start of the year. That forced Melvin to close out its short positions, both those publicly disclosed as well as the secret ones.

Melvin’s January loss was almost 55%, Bloomberg News reported last month. It was still down about 43% through July.

How did Plotkin manage to keep much of its bearish exposure secret?

As Bloomberg details, in February, Melvin faced a deadline to file the Form 13F that would disclose his holdings at the end of 2020. In that disclosure, the firm took advantage of an SEC loophole that permits fund managers to conceal certain holdings. Melvin released its first confidential amendment to its fourth-quarter report on April 28 and the second one this week. In addition to the first-time positions, they show a jump in the number of put options that Melvin held on earlier targets, including six-fold increases in its bets against ViacomCBS Inc. and Tanger Factory Outlet Centers Inc. By late January, rising stock prices had pushed the face value of Melvin’s year-end put positions to $4.4 billion.

And while Bloomberg’s conclusion is that “it could have been worse if the fund made the same bets entirely through short sales”, we are not so sure: after all this is a market where gamma squeezes – which are the result of rapid option trades where dealers have to take the other side of the trade, creating a self-reinforcing feedback loop – are now the norm as Tesla first showed in 2020. As such, one can make the argument that Melvin’s rapid unwind of its puts may have had an even greater impact on the value of the underlying stock than had the fund been merely short the stock. Considering Melvin’s billions in losses in just a few days from being forced to liquidate a handful of Put positions, we think it would agree.

Tyler Durden

Fri, 08/20/2021 – 19:27

via ZeroHedge News https://ift.tt/3gkNIQP Tyler Durden