“The Job Market Recovery Is Dented” – ADP Private Payrolls Miss Huge, Only 374K Jobs Added In August

For the second month in a row, the ADP Private Payroll employment report has been a complete disaster, and one month after the the ADP missed by almost half printing at 330K in June (missing expectations of 683K), moments ago ADP reported that private payrolls in August rose just 374K, which while a modest improvement from July’s downward revised 326K (which was the lowest since February), was again a huge miss to the 638K expected.

“Our data, which represents all workers on a company’s payroll, has highlighted a downshift in the labor market recovery. We have seen a decline in new hires, following significant job growth from the first half of the year,” said Nela Richardson, chief economist, ADP.

“Despite the slowdown, job gains are approaching 4 million this year, yet still 7 million jobs short of pre-COVID-19 levels. Service providers continue to lead growth, although the Delta variant creates uncertainty for this sector. Job gains across company sizes grew in lockstep, with small businesses trailing a bit more than usual.”

Mark Zandi, chief economist of Moody’s Analytics, said, “The Delta variant of COVID-19 appears to have dented the job market recovery. Job growth remains strong, but well off the pace of recent months. Job growth remains inextricably tied to the path of the pandemic.”

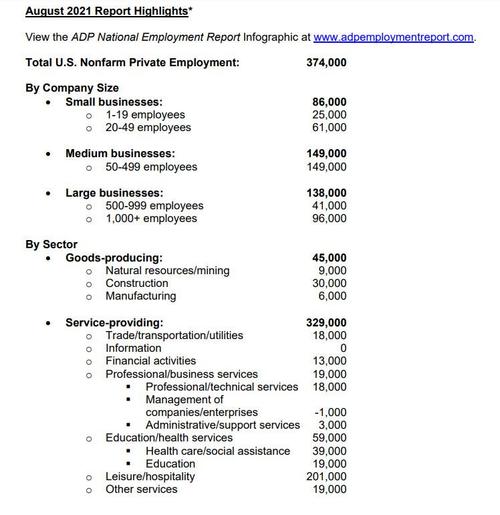

For the second month in a row, medium-sized businesses added the most jobs:

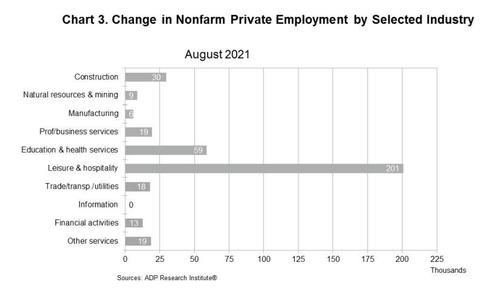

The Services economy continues to dominate the recovered jobs in June, with only 12k manufacturing jobs added.

More ominously, the only jobs added were waiters and bartenders (i.e., leisure and hospitality).

Finally, it is worth noting that ADP has under-guessed Nonfarm Payrolls in 5 of the last 7 months, and remember that Fed Governor Christopher Waller recently said the U.S. central bank could start to reduce its support for the economy by October if the next two monthly jobs reports show employment rising by 800,000 to 1 million, as he expects, adding that there’s “no reason” to go slow on tapering the Fed’s bond purchase program.

So if today’s ADP print is anything to go by, and if for once the ADP is predictive of what this Friday’s payrolls will reveal, then we may have a major taper problem, as inflation soars yet as the job market suddenly crumbles leading to the dreaded stagflation.

Tyler Durden

Wed, 09/01/2021 – 08:27

via ZeroHedge News https://ift.tt/3t2i0gq Tyler Durden