ISM Manufacturing Unexpectedly Rebounds But Contracting Employment Flashes Warning Ahead Of Friday’s Payrolls

Amid the continued plunge in “hard” economic data as captured by the worst print in the Citi US Econ Surprise index since the covid pandemic, we are finally starting to lose “soft” survey data as well, with the final Markit August Manufacturing PMI dipping again, from a flash print of 61.2 to 61.1 (if just barely below its July all time high of 63.4) however unlike last month when the PMI jumped to record and the ISM dropped, this time it was the much more closely watched ISM Manufacturing survey’s turn to rebound, rising from 59.5 to 59.9, beating expectations of a small drop to 58.5.

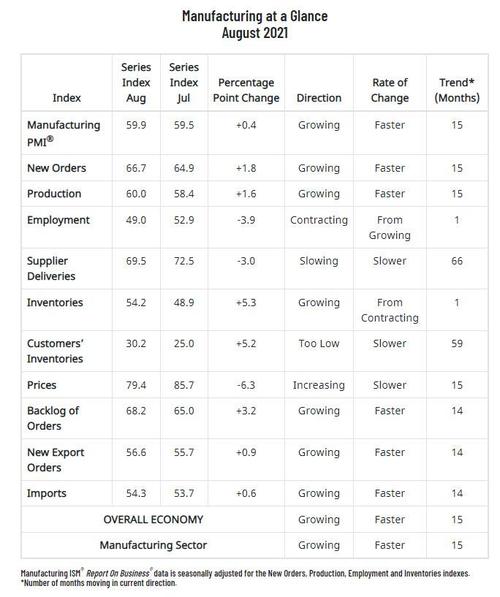

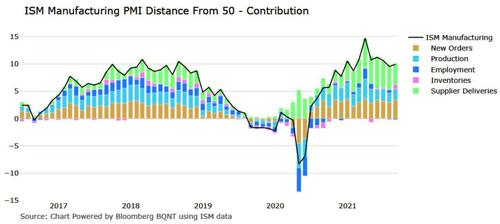

A look at the components of the ISM reveals that the strength in the headline print was the result of an increase in New Orders, Production, Inventories and Backlogs offset by declines in Employment, Deliveries and especially Prices.

While the two key components of the ISM index were flat…

… two of the most closely watched components – Employment and Prices Paid – declined, with Employment actually dipping into contraction for the first time this year, and adding to concerns from this morning’s dismal ADP print.

A full breakdown in the ISM’s components is shown below courtesy of Bloomberg’s Michael McDonough.

Despite the rebound in the ISM headline print on the back of New Orders, Inventories and Deliveries, ISM Chair Tom Fiore was anything but cheerful:

“Business Survey Committee panelists reported that their companies and suppliers continue to struggle at unprecedented levels to meet increasing demand. All segments of the manufacturing economy are impacted by record-long raw-materials lead times, continued shortages of critical basic materials, rising commodities prices and difficulties in transporting products. The new surges of COVID-19 are adding to pandemic-related issues — worker absenteeism, short-term shutdowns due to parts shortages, difficulties in filling open positions and overseas supply chain problems — that continue to limit manufacturing-growth potential. However, optimistic panel sentiment remained strong, with eight positive comments for every cautious comment. Demand expanded, with the (1) New Orders Index growing, supported by continued expansion of the New Export Orders Index, (2) Customers’ Inventories Index remaining at very low levels and (3) Backlog of Orders Index staying at a very high level. Consumption (measured by the Production and Employment indexes) declined in the period, with a combined 2.3-percentage point decrease to the Manufacturing PMI® calculation. The Employment Index returned to contraction after one month of expansion; hiring difficulties at panelists’ companies were the most significant hurdle to further output in August, as validated by the growth in inventory accounts. Inputs — expressed as supplier deliveries, inventories, and imports — continued to support input-driven constraints to production expansion, at slower rates compared to July. The Supplier Deliveries Index softened while the Inventories Index made a strong move into expansion territory due to improvements in raw material deliveries as well as work in progress inventory being held longer due to key part shortages. The Prices Index expanded for the 15th consecutive month, indicating continued supplier pricing power and scarcity of supply chain goods.

“All of the six biggest manufacturing industries — Computer & Electronic Products; Fabricated Metal Products; Chemical Products; Food, Beverage & Tobacco Products; Transportation Equipment; and Petroleum & Coal Products, in that order — registered moderate to strong growth in August.

“Manufacturing performed well for the 15th straight month, with demand, consumption and inputs registering month-over-month growth, in spite of unprecedented obstacles. Panelists’ companies and their supply chains continue to struggle to respond to strong demand due to difficulties in hiring and a clear cycle of labor turnover as workers opt for more attractive job conditions. Disruptions from COVID-19, primarily in Southeast Asia, are having dramatic impacts on many industry sectors. Ports congestion in China continues to be a headwind as transportation networks remain stressed. Demand remains at strong levels, despite increased prices for nearly everything.”

The ISM respondents as usual, were complaining about massive supply chain bottlenecks:

- “The chip shortage is impacting supply lines. So far, we’ve been able to manage it without impacting clients.” [Computer & Electronic Products]

- “Some factories have been impacted by COVID-19 cases. Malaysian government says factories can operate at only 60 percent of capacity.” [Computer & Electronic Products]

- “We continue to see extended lead times due to port delays and sea container tightness. Manufacturing capacities are impacted by a lack of workers reducing output. Several chemical facilities have experienced fires, explosions and spills, further challenging suppliers’ ability to deliver on time and in full.” [Chemical Products]

- “Strong sales continue, but production is limited due to supply issues with chips.” [Transportation Equipment]

- “Supply chain functions have been relentlessly challenging. All things from freight (both over the road and ocean), already constrained labor forces are further exacerbated by COVID-19 absenteeism. Also, high prices everywhere are wearing our employee base down.” [Food, Beverage & Tobacco Products]

- “Oil prices have remained higher than planned and is helping to secure capital funds and project sanctions for 2021-22 projects.” [Petroleum & Coal Products]

- “Bookings/sales continue to be strong. Persistent supply issues — including availability of materials, freight/logistics/containers, and allocation of key commodities — continue to hamper production ramp to meet demand. Also struggling with lack of labor in several factories. Commodities are still inflationary, but price increases have leveled.” [Furniture & Related Products]

- “Business is strong. Part shortages are our largest business constraint. We cannot fulfill orders to customers in reasonable lead times. Now booking out into 2022, and it will get worse as we hit our cyclical high demand in the fourth quarter.” [Electrical Equipment, Appliances & Components]

- “Business is going strong, but raw material prices still under increasing price pressure. Labor is still an issue.” [Plastics & Rubber Products]

- “Continue to be unable to hire hourly personnel or machine operators due to few applicants. Steel and aluminum remain in short supply. New business continues to grow and come in. Unable to handle influx of orders without staff, both hourly and salaried.” [Fabricated Metal Products]

- “Customer order backlog continues to climb because we are unable to raise production rates due to supplier parts and manpower challenges. Continue to see price increases with key commodities, and logistics is an ongoing challenge that has no end in sight.” [Machinery]

Meanwhile, Siân Jones, Senior Economist at IHS Markit was even more gloomy:

“US goods producers continued to register marked upturns in output and new orders in August, as demand flourished once again. That said, constraints on production due to material shortages exerted further pressure on capacity as backlogs of work rose at a near-record rate.

“Not only were firms facing difficulties trying to clear outstanding work, they also faced further hikes in supplier costs. The pace of cost inflation exceeded the previous series record amid a pervasive scarcity of inputs. Favourable demand conditions allowed finished goods prices to also rise at an unprecedented rate, as firms sought to protect their margins.

“Delivery times lengthened at the second-sharpest rate in over 14 years of data collection, with purchasing activity still rising markedly. It was not only producers who highlighted stockpiling, however, as reports of customers shoring up their holdings of finished items resulted in a substantial drop in post-production inventories. Challenges rebuilding such stocks, including material and labour shortages, and everburgeoning levels of incomplete work are likely to remain a feature for some time to come.”

All in all, there is something for everyone here – manufacturing dropping (PMI) in line with the global trend, but also rebounding as per the ISM on the back of new order and inventory strength… while record high prices are rolling over… while contracting employment – coupled with today’s poor ADP print – means Friday’s payrolls will likely be a dud, forcing the Fed to either minimize its upcoming taper or delay it entirely.

Tyler Durden

Wed, 09/01/2021 – 10:19

via ZeroHedge News https://ift.tt/2WNKGhg Tyler Durden