Here Are The Best And Worst Performing Assets In August

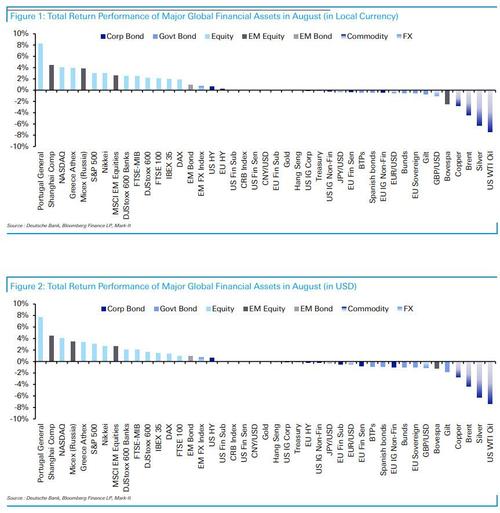

August proved to be a steady month for financial markets, as 21 of the 38 non-currency assets in Deutsche Bank’s sample closed in positive territory. As the bank strategist’s Henry Allen writes in his August Performance Review note, there were a number of factors helping to support risk appetite, which gave a lift to equities and high-yield credit, but the month also saw a number of key commodities lose ground, including oil for the first time since March. Otherwise it was pretty subdued though, with government bonds, credit and FX seeing little movement in either direction.

Starting at the top of the leaderboard, it’s clear that equities were the place to be in August, with various equity indices making up every one of the top 14 on the leaderboard last month. Those moves were propelled by a number of factors that proved supportive for investor risk appetite. First, Fed Chair Powell gave a dovish speech at Jackson Hole that calmed investor nerves about an imminent tapering of asset purchases. Second, the US jobs report for July that was released at the start of August showed nonfarm payrolls were up +943k, the strongest in 11 months, whilst the June number was also revised higher to show +938k growth. Third, there were further signs of progress on the Biden administration’s economic agenda, as the US Senate passed the bipartisan infrastructure package that includes $550bn of new spending over the next 8 years. And finally, concerns about the delta variant’s spread proved short-lived, with the number of new cases at the global level having plateaued and even showed signs of declining by the end of the month.

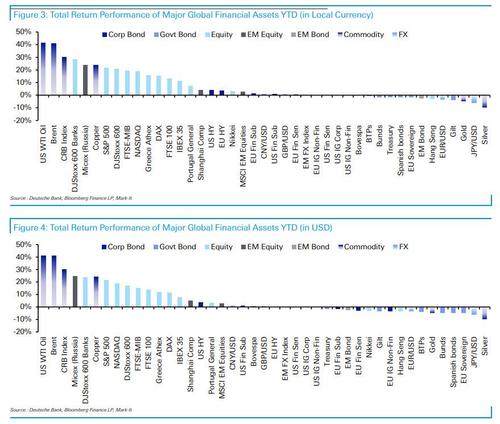

Given that backdrop, global equities advanced for a 7th consecutive month, with the S&P 500 (+3.0%) and the STOXX 600 (+2.2%) both recording further solid gains on a total returns basis. On the back of those gains in August, that means that both indices are now up by over +20% on a YTD basis in total return terms. In addition, financials recorded even stronger gains in August, with the S&P 500 financials up +5.1% last month, putting the index up +31.5% on a YTD basis.

Turning to commodities, oil remains the top performer in our sample on a YTD basis, with WTI up +41.2% since the start of the year, and Brent crude up +40.9%. However, for August alone, both WTI (-7.4%) and Brent Crude (-4.4%) experienced their first declines since March, as concern over slowing demand in China and the delta variant outweighed the supply shock caused by Hurricane Ida on production. Other commodities struggled as well, with silver (-6.3%) falling for a 3rd consecutive month, while copper was down -2.7%. And that poor performance from silver leaves it as the worst-performing asset in our main sample on a YTD basis, having lost -9.5% since the start of the year. A notable exception to the August decline in commodities was sugar however, which rose +10.8% in August, putting it up +28.1% YTD. As mentioned at the top, other asset classes were very subdued in August amidst a quiet period for financial markets. Government bonds saw modest declines, with Treasuries (-0.2%) experiencing their smallest move in either direction for over a year, whilst bunds (-0.5%), gilts (-0.8%) and OATs (-0.6%) fell back somewhat. On a YTD basis, all of the government bonds in our sample remain in negative territory though, as they still haven’t recovered fully from their losses in Q1 when the reflation theme was at its height.

Turning to FX, it was much the same story, with no massive movements in any of the major currency pairs, and the dollar index was up +0.5% over the month as a whole, thus slightly lifting its YTD gains to +3.0%. Finally in credit, HY outperformed in line with the broader increase in risk appetite, with USD, EUR and GBP HY continuing their run of having recorded a positive monthly performance in every month of 2021 so far.

Visually, this is how assets performed in August in both local currency and USD terms…

…. and here is the YTD data.

Tyler Durden

Wed, 09/01/2021 – 15:11

via ZeroHedge News https://ift.tt/38wDAA5 Tyler Durden