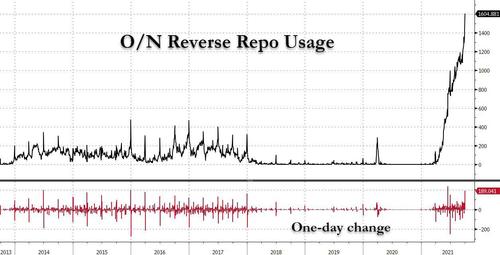

Quarter-End Pushes Fed’s Reverse Repo To Record $1.6 Trillion

Back in July, when we forecast that the Fed’s reverse repo would hit $2.5 trillion by year end, we thought that this projection was too aggressive even for a Fed as clueless as this one. Maybe not.

Moments ago, the NY Fed reported that today’s overnight repo saw a record $1.604 trillion in usage, the highest number on record distributed among 92 counterparties, also the most on record.

Oh, just $1.6 trillion flowing onto the Fed’s books via reverse repos for the last day of the month and the quarter. pic.twitter.com/6rnT0lzmEQ

— Michael S. Derby (@michaelsderby) September 30, 2021

Putting this explosion in context:

To be sure, a substantial portion of today’s surge was due to month and quarter-end window dressing, and we expect about $200 billion in the total to drop tomorrow once we enter October, however even at $1.4 trillion to say that liquidity conditions are anywhere close to normal would be a joke.

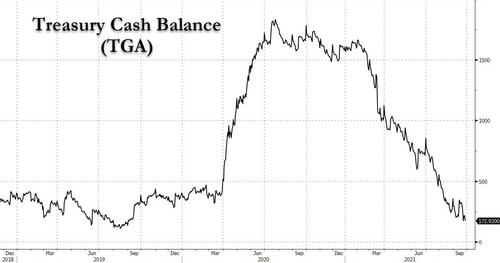

That said, one reason we don’t anticipate a continued surge in the rev repo facility is because one of the biggest sources of funding, the Treasury’s cash balance, has been almost drained and at $173 billion was the lowest since August 2020. This number will likely drop to just shy of zero by Oct 18 when the debt ceiling D-date hits and the Treasury runs out of cash.

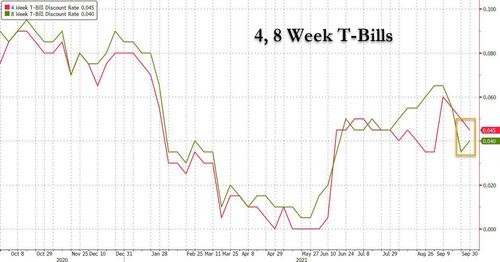

Meanwhile, in other broken market observations, today was the 2nd consecutive Bill auction which saw rate on the 4 Week come higher than that on the 8 Week, typically an unprecedented inversion yet one made possible because the bond market is clearly concerned that the debt ceiling drama will not be resolved on time, or worse.

Tyler Durden

Thu, 09/30/2021 – 13:48

via ZeroHedge News https://ift.tt/3B9yvKA Tyler Durden