The Inflation That Central Banks Don’t See Doesn’t Count

By Ven Ram, Bloomberg Markets Live Commentator and Analyst

A sundial near Venice is engraved with the words, “Horas non numero nisi serenas.” That line — attributed to the philosopher William Hazlett — roughly means, “I don’t count the time that isn’t tranquil.”

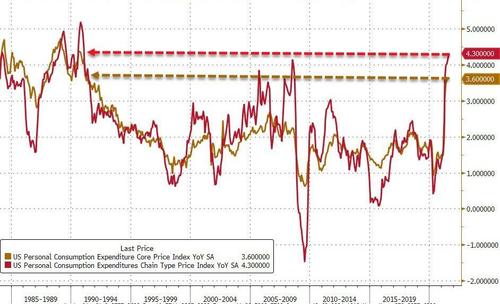

Modern-day central bankers have taken that adage to heart when it comes to inflation: they don’t count things that seem to matter to most of us. On Wednesday we heard from the Big Four — Jerome Powell, Christine Lagarde, Haruhiko Kuroda and Andrew Bailey, all pressing home, more or less, the same message: inflation is here, but it’s transitory.

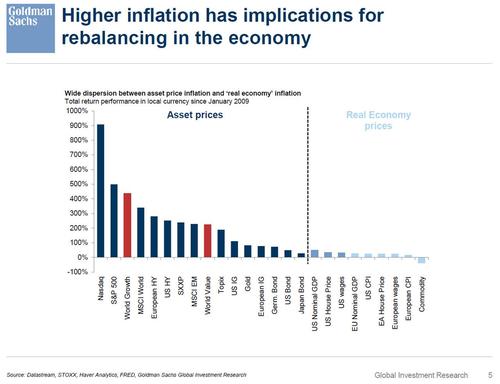

But just how transitory is transitory? That depends on what the central banks want to count. If they considered house prices almost anywhere since the turn of the millennium, they would know that inflation is running well above what they define as their threshold of toleration. And that’s true of a host of other assets that have simply gone up, up and away, beyond the reach of most. Well, it has been that way for two decades, if not longer. Surely, that’s transitory by anyone’s definition?

While central banks have experimented with all kinds of innovation that has probably caused more heartburn than really cured any malaise, where they haven’t kept up is clearly in the area of measuring inflation. By not taking into account asset-price inflation that has grown astronomically, monetary authorities have ensured they are behind the curve.

Little wonder that it’s always buy-the-dip mantra for stocks. Indeed, if bonds compensate investors poorly for inflation, where else does one go for some “real” earnings?

Still, for the policy makers who dominate our world, it doesn’t matter. After all, if it’s not a tranquil thought, it’s best not to count it, like the sundial in Venice has instructed us — and the central banks know it only too well.

Tyler Durden

Fri, 10/01/2021 – 17:40

via ZeroHedge News https://ift.tt/3F8h0wJ Tyler Durden