Gazprom Hikes Export Prices As Moscow Urges Europe To Fix Ties To Avoid More Gas Shortages

Russia’s nat gas giant, Gazprom, raised its 2021 price guidance for natural gas exports, while signaling caution on volumes it could ship, as Europe’s energy crisis worsens.

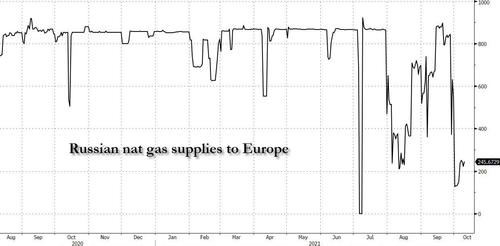

According to Bloomberg, the Russian state-controlled exporter that supplies 35% of European gas needs, reiterated that shoring up inventories at home was its top priority, and only after it has refilled its own storage facilities by the end of October, would the company look at potentially increasing exports to continental Europe, Wood & Co. and BCS Global Markets wrote in separate notes Friday following a webinar with Gazprom managers. It would, in theory, explain why Russian supplies to Europe remain well below recent levels.

At the same time, Russian research houses Wood & Co and Sova Capital noted that Gazprom increased its full-year gas-price guidance for exports to Europe and Turkey to a range of $295 to $330 per 1,000 cubic meters. The revised outlook on Gazprom’s average prices in the region is good news for the company’s investors as it signals higher dividends may be coming. Both Wood & Co. and Sova Capital also say that Gazprom is sticking with its conservative estimate of full-year gas supplies to Europe and Turkey, which is seen at 183 billion cubic meters.

That suggests that despite Putin’s suggestion last Wednesday that his country could boost deliveries to record levels, partially easing an energy crisis sweeping Europe which threatens to hamper the region’s economic recovery by driving up business costs and household bills and sending inflation soaring, Gazprom’s caution on shipments will disappoint some traders and policy makers hoping for an immediate hike in supply.

To be sure, it’s not unusual for Gazprom to offer a cautious supply outlook, due to the fact that its sales are highly dependent on the weather, both in Russia and abroad. However, the company has taken pains to reiterate in recent days that it is fulfilling all its contractual obligations and it will aim to boost exports whenever possible.

The analysts say that Gazprom sees longer-term contracts and longer-dated prices as a tool that would help Europe mitigate the impact of extreme volatility. Translation: turn on Nord Stream 2 and all shall be well.

Which brings us to the second point: according to the FT, the Kremlin’s ambassador to the EU called on Europe to mend ties with Moscow in order to avoid future gas shortages, even as he insisted that Russia had nothing to do with the recent jump in prices.

Vladimir Chizov, Russia’s permanent representative to the EU, said he expected Gazprom, to respond swiftly to instructions from president Vladimir Putin to adjust output.

Making it abundantly clear that the hurdles preventing Russia from pumping more gas to Europe are largely political, the ambassador said that action, which would help curb skyrocketing wholesale prices, was likely to come “sooner rather than later.” Putin “gave some advice to Gazprom, to be more flexible. And something makes me think that Gazprom will listen,” Chizov told the Financial Times.

While rejecting assertions from European lawmakers that Russia had played a role in Europe’s gas crunch, Chizov said Europe’s choice to treat Moscow as a geopolitical “adversary” had not helped.

“The crux of the matter is only a matter of phraseology,” he said. “Change adversary to partner and things get resolved easier . . . when the EU finds enough political will to do this, they will know where to find us.”

And there you have it: after demonizing Russia for much of the past decade, with countless fake news reports out of the liberal media in the US seeking to portray Putin as the world’s biggest mastermind and effectively in control of the Trump White House, while helping send western relations with Russia to fresh post-Cold War lows, the chicken are coming home to roost and they are finding the temperature to be rather frigid.

Ironically, for a gas-starved Europe, Russia has now emerged as the only source of incremental gas supply which stands between the continent and a very cold winter. At one point last week spot gas prices reached nearly 10 times their level from the beginning of the year, before abruptly dropping after Putin hinted that Gazprom might increase supplies.

Chizov insisted Moscow had no interest in gas price surges. “This does not promote stability,” he said. “People will start looking around, turning back from gas to coal, which some are already doing”, much to the chagrin of the ESG lobby.

Record high prices and low reserves have spooked EU governments fearful of a winter shortage and led to demands from some member states for Brussels to consider emergency remedies or new reforms. But energy commissioner Kadri Simson told the FT last week that the roots of the crisis were “not created here in Europe.” Which, of course, is laughable as even Reuters’ energy analyst John Kemp explained over the weekend in “Forget Russian Intentions, Fundamentals Drove Up Europe’s Gas Price.”

Cutting to the chase, Russian officials have said that regulatory approval to permit gas flows through the controversial Nord Stream 2 pipeline to Germany would help solve the crisis. Some analysts have suggested Moscow is exacerbating the price squeeze to force such an outcome (they wouldn’t be wrong). Meanwhile, the US and many eastern EU states oppose the pipeline, which they say was designed to circumvent gas transit through Ukraine.

Chizov said the EU’s own energy policies had worsened the bloc’s woes as well as a reluctance among European energy companies to pay more to replenish their reserves. “All the problems that are arising have been created artificially. Primarily for political reasons,” he said.

However, Klaus-Dieter Maubach, chief executive of German gas company Uniper, a Gazprom client, suggested last week that supplies were the issue. Uniper “would be happy if Gazprom . . . delivered more volumes to cool down the situation and lower the gas price,” he said at a conference in Russia.

Chizov also told the FT that the crisis had been aggravated by EU regulations that force Gazprom to supply a proportion of gas to Europe on the freely-traded spot market terms, rather than through long-term contracts, which Brussels has argued are uncompetitive.

“Long-term contracts . . . provided security of supply and stability of volumes and prices. Then came this idea, emanating from Brussels, that the system should be changed,” he said. “We know that market rules may be helpful in some situations but quite unhelpful in others. Things can change. And they did change.” And the result was the biggest surge in gas prices in history.

Chizov also said that Gazprom is fulfilling its obligations to European customers on long-term supply contracts, but has been reluctant to make additional volumes available on the spot market, instead supplying domestic Russian storage facilities. That was because European energy companies were delaying extra purchases in the hope that prices will fall.

“If prices are freely floated on the market, of course any energy company in this part of Europe will think what the best moment is to order additional volumes,” he said. “The serious buyers know perfectly well what is going on . . . they have their own calculations.”

But Chizov said he believed the commission, whose flagship renewable energy reform initiative aims for the bloc to achieve net zero emissions by 2050, was “underestimating the future role of gas” as a European energy source.

“Until mankind finds a way to store energy in a sizeable manner, all those propellers and solar panels will not become a decisive factor,” he said, and somewhere Greta Thunberg sobbed uncontrollably.

Tyler Durden

Sun, 10/10/2021 – 20:11

via ZeroHedge News https://ift.tt/2YDaxZP Tyler Durden