“Market Is Unstable”: Bonds & Stocks Bid Ahead Of OpEx, CTAs MaxShort Cash/TSYs

The US equity market has taken the taper threat in its stride and soared without a break since the Minutes dropped yesterday afternoon. Nasdaq is outperforming as yields drop… because the bond market is pricing in a Fed policy error…

Today’s rally lifted all the major indices green for the week (led by Small Caps and Nasdaq)…

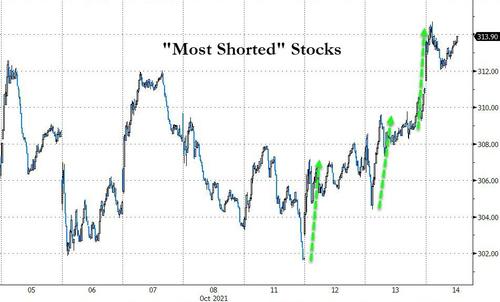

But, SpotGamma warned early on that this is a short cover rally, and the market is unstable.

Source: Bloomberg

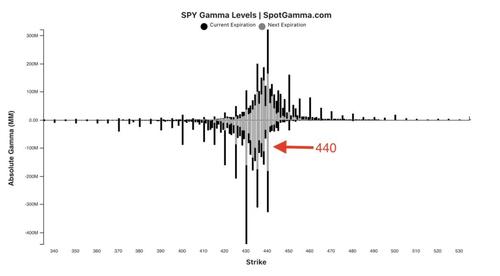

Notably, things could change quickly tomorrow as there is a lot of gamma set to expire (light grey)

This does not mean that the market has to decline sharply next week but SpotGamma believes that this squeeze move higher plus OPEX removes substantial put support.

S&P and Dow surged up to key technical resistance at their 50DMAs…

But as the close loomed, the major indices could not hold those gains as the algos ran out of ammo…

Financials rallied along with everything else today after a slew of big bank earnings but remain lower on the week. Materials are the week’s best performer…

Source: Bloomberg

WFC is the week’s biggest loser while MS and BAC are outperforming, The rest of the big banks are still red for the week…

Source: Bloomberg

VIX was monkeyhammered back to a 16 handle today – its lowest since Sept 7th…

As yields edged up and price pressures breaking out, the $340 billion complex of Commodity Trading Advisors is now “100% short” on everything from Dollar to British pound rates according to Nomura estimates. These systematic investors are also building outsized short positions across the entire yield curve, according to Dynamic Beta Investments. The firm, which runs an ETF that mimics a CTA, says such exposures are particularly intense in 10-year U.S. Treasury notes.

This systemic short may help explain why long-end yields are suddenly plunging and the curve flattening dramatically (2Y +4bps this week, 30Y -15bps)…

Source: Bloomberg

With 30Y Yields back down to 2.00%…

Source: Bloomberg

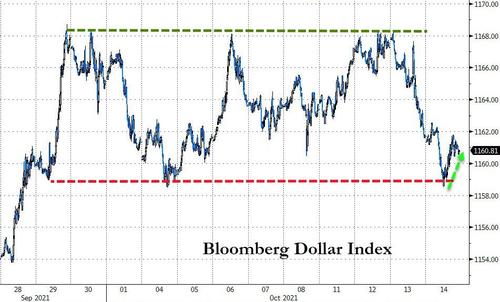

The Dollar ended lower – after extending yesterday’s bloodbath – but bounced off recent support…

Source: Bloomberg

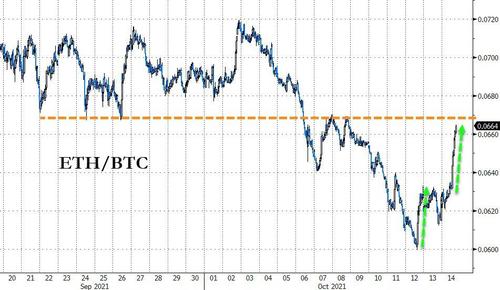

Crypto rallied once again but it was Ethereum’s turn to play catch up, topping $3800 for the first time since early September…

Source: Bloomberg

Bitcoin also rallied today (topping $58,000 intraday) but ETH continued its recent outperformance up to a resistance level…

Source: Bloomberg

Gold continued to rally, pushing up above $1800 again…

Breaking above its 200-, 100-, and 50-DMA…

Source: Bloomberg

The LME Metals Index surged to its record high…

Source: Bloomberg

Oil prices ended higher once again, after a choppy swing on a big crude inventory build…

And finally, while this year has already brought records for materials from copper to coal, today saw the oldest commodity index in the world finally take out an all-time high. The Commodity Research Bureau BLS/U.S. Spot Raw Industrials Index, which tracks its origins to January 1934, excludes energy products, focusing instead on less-glamorous materials like hides, tallow, burlap, print cloth, rosin and metal scraps.

Part of the index’s appeal is that most of its components trade only in the physical market, not on a futures exchange, so price formation isn’t impacted by financial speculative activity.

Tyler Durden

Thu, 10/14/2021 – 16:01

via ZeroHedge News https://ift.tt/3aKeq1T Tyler Durden