Reverse QE Begins: Treasury To Drain $480 Billion Starting Monday

Back in February, when looking at the Treasury’s debt and cash projections, we warned that the market was about to be hit with “Mind-Boggling Liquidity” as the Treasury was about to release some $1.1 trillion in cash from its account at the Fed (the Treasury General Account or TGA) , in effect conducting a parallel – and stealth – QE to the Fed’s.

That’s precisely what happened, and since then the Treasury cash collapsed from an all time high of $1.8 trillion down to the previous target of $300 billion, and then continued dropping as the Treasury used up most of its cash to plug holes associated with the ongoing debt ceiling drama.

But that’s now over, and with Treasury cash dropping to a 4 year low of $59 billion on Wednesday, the Treasury is now set for a sharp liquidity drain as it seeks to build up some $480 billion in funding through early December, which is how much time and capacity Janet Yellen bought herself with the stop-gap debt ceiling deal that passed just in the nick of time last week when Senator McConnell caved to the democrats.

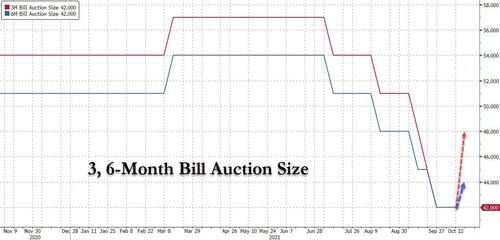

What does this mean in practice? As the Treasury announced today, T-Bill sizes are set to jump. Indeed, the size of its three- and six-month bill auctions will rise for the first time since March as the department rebuilds its cash buffer following the short-term extension of the debt ceiling. Specifically, the Treasury plans to sell $48 billion of three-month bills on Oct 18, up from $42 billion as of Oct 12, and $45 billion of six-month bills up from $42 billion.

Additionally, as part of the cash rebuild, the Treasury will flood the market with a flurry of Cash Management Bill issuance, the first of which hits on Tuesday, Oct 19, for $60 billion.

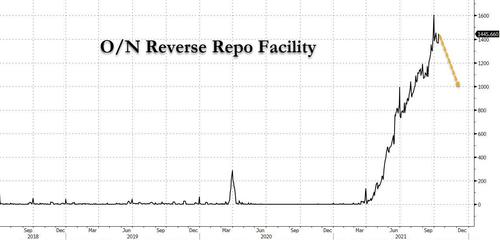

Where will the funds for this drain come from? Most likely from the Fed’s reverse repo facility which as of today had $1.445 trillion and which even after the accelerated liquidity drain will still have just about $1 trillion left. Of course, it will continue to be replenished by the Fed QE which even after the tapering begins next month will still inject about $110 billion in November and approximately $90 billion in December if the Fed drains $15BN in TSYs/MBS every month.

Of course, the real liquidity drain will resume in earnest in December, when we presume Democrats will find a way to permanently kick the can on the debt ceiling at which point the Treasury will continue rebuilding its cash until it hits its previous cash target of approximately $800 billion at year end.

What are the market implications: while we don’t expect there to be an immediate impact on risk assets – after all liquidity is merely rotating out of the inert reverse repo facility into Bills – the psychology of the market is bound to change and between the taper and the Treasury cash rebuild, we would not be surprised to see that long awaited 10-20% correction (which Morgan Stanley’s Michael Wilson has been predicting every month since the summer) some time in late November or December as the realization that infinite liquidity is ending finally hits trading desks.

Tyler Durden

Thu, 10/14/2021 – 17:01

via ZeroHedge News https://ift.tt/3BIdBTl Tyler Durden