Futures Jump On Profit Optimism As Oil Tops $85; Bitcoin Nears $60,000

One day after the S&P posted its biggest one-day surge since March, index futures extended this week’s gains, helped by a stellar bank earnings, while the latest labor market data and inflation eased stagflation fears for the time being. . The 10-year Treasury yield rose and the dollar was steady. Goldman Sachs reports on Friday. At 715 a.m. ET, Dow e-minis were up 147 points, or 0.42%, S&P 500 e-minis were up 16.5 points, or 0.37%, and Nasdaq 100 e-minis were up 42.75 points, or 0.28%.

Oil futures topped $85/bbl, jumping to their highest in three years amid an energy crunch that’s stoking inflationary pressures and prices for raw materials. A gauge of six industrial metals hit a record high on the London Metal Exchange. Energy firms including Chevron and Exxon gained about half a percent each, tracking Brent crude prices that scaled the 3 year high.

Solid earnings in the reporting season are tempering fears that rising costs and supply-chain snarls will hit corporate balance sheets and growth. At the same time, the wider debate about whether a stagflation-like backdrop looms remains unresolved.

“We don’t sign up to the stagflation narrative that is doing the rounds,” said Hugh Gimber, global strategist at the perpetually optimistic J.P. Morgan Asset Management. “The economy is being supported by robust consumer balance sheets, rebounding business investment and a healthy labor market.”

“After a choppy start to the week, equity markets appear to be leaning towards a narrative that companies can continue to grow profits, despite the combined pressures of higher energy prices and supply chain disruptions,” said Michael Hewson, chief market analyst at CMC Markets in London.

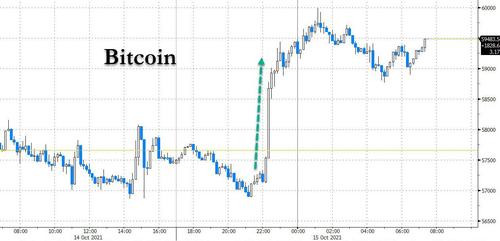

Bitcoin and the crypto sector jumped after Bloomberg reported late on Thursday that the Securities and Exchange Commission is poised to allow the first U.S. Bitcoin futures exchange-traded fund to begin trading in a watershed moment for the cryptocurrency industry. Bitcoin traded off session highs having tested $60k during Asian hours, but will likely rise to new all time highs shortly.

Also overnight, Joe Biden signed a bill providing a short-term increase in the debt limit, averting the imminent threat of a financial calamity. But it only allows the Treasury Department to meets its financial obligations until roughly Dec. 3, so the can has been kicked for less than two months – brace for more bitter partisan battles in the coming weeks.

This week’s move into rate-sensitive FAAMG growth names looked set to continue, with their shares inching up. Moderna rose 3.0% after a U.S. FDA panel voted to recommend booster shots of its COVID-19 vaccine for Americans aged 65 and older and high-risk people. Western Digital slipped 2.5% as Goldman Sachs downgraded the storage hardware maker’s stock to “neutral” from “buy”. Here are some of the key premarket movers on Friday morning:

- Virgin Galactic (SPCE US) shares slump as much as 23% in U.S. premarket trading as the firm is pushing the start of commercial flights further into next year after rescheduling a test flight, disappointing investors with the unexpected delay to its space tourism business plans

- Cryptocurrency-exposed stocks rise in U.S. premarket trading after a report that the Securities and Exchange Commission is poised to allow the first U.S. Bitcoin futures exchange-traded fund to begin trading. Bit Digital (BTBT US) +6.7%, Riot Blockchain (RIOT US) +4.6%, Marathon Digital (MARA US) +3.6%

- Alcoa (AA US) shares jump 5.6% in thin volumes after co. reported profits that beat the average analyst estimate and said it will be paying a dividend to its shareholders

- Moderna (MRNA US) extends Thursday’s gains; Piper Sandler recommendation on Moderna Inc. to overweight from neutral, a day after co.’s Covid-19 booster got FDA nod for use in older, high-risk people

- Duck Creek Technologies (DCT US) shares fell 12% in Thursday postmarket trading after the software company projected 2022 revenue that fell short of the average analyst estimate

- 23andMe Holdings (ME US) soared 14% in Thursday postmarket trading after EMJ Capital founder Eric Jackson called the genetics testing company “the next Roku” on CNBC

- Corsair Gaming (CRSR US) shares fell 3.7% in post-market trading after it cut its net revenue forecast for the full year

Early on Friday, China’s PBOC broke its silence on Evergrande, saying risks to the financial system are controllable and unlikely to spread. Authorities and local governments are resolving the situation, central bank official Zou Lan said. The bank has asked lenders to keep credit to the real estate sector stable and orderly.

In Europe, gains for banks, travel companies and carmakers outweighed losses for utilities and telecommunications industries, pushing the Stoxx Europe 600 Index up 0.3%. Telefonica fell 3.3%, the most in more than four months, after Barclays cut the Spanish company to underweight. Temenos and Pearson both slumped more than 10% after their business updates disappointed investors. Here are some of the biggest European movers today:

- Devoteam shares rise as much as 25% after its controlling shareholder, Castillon, increased its stake in the IT consulting group to 85% and launched an offer for the remaining capital.

- QinetiQ rises as much as 5.4% following a plunge in the defense tech company’s stock on Thursday. Investec upgraded its recommendation to buy and Berenberg said the shares now look oversold.

- Hugo Boss climbs as much as 4.4% to the highest level since September 2019 after the German apparel maker reported 3Q results that exceeded expectations. Jefferies (hold) noted the FY guidance hike also was bigger than expected.

- Mediclinic rises as much as 7.7% to highest since May 26 after 1H results, which Morgan Stanley says showed strong underlying operating performance with “solid metrics.”

- Temenos sinks as much as 14% after the company delivered a “mixed bag” with its 3Q results, according to Baader (sell). Weakness in Europe raises questions about the firm’s outlook for a recovery in the region, the broker said.

- Pearson declines as much as 12%, with analysts flagging weaker trading in its U.S. higher education courseware business in its in-line results.

Earlier in the session, Asian stocks headed for their best week in more than a month amid a list of positive factors including robust U.S. earnings, strong results at Taiwan Semiconductor Manufacturing Co. and easing home-loan restrictions in China. The MSCI Asia Pacific Index gained as much as 1.3%, pushing its advance this week to more than 1.5%, the most since the period ended Sept. 3. Technology shares provided much of the boost after chip giant TSMC announced fourth-quarter guidance that beat analysts’ expectations and said it will build a fabrication facility for specialty chips in Japan.

Shares in China rose as people familiar with the matter said the nation loosened restrictions on home loans at some of its largest banks. Conditions are good for tech and growth shares now long-term U.S. yields have fallen following inflation data this week, Shogo Maekawa, a strategist at JPMorgan Asset Management in Tokyo. “If data going forward are able to provide an impression that demand is strong too — on top of a sense of relief from easing supply chain worries — it’ll be a reason for share prices to take another leap higher.” Asia’s benchmark equity gauge is still 10% below its record-high set in February, as analysts stay on the lookout for higher bond yields and the impact of supply-chain issues on profit margins.

Japanese stocks rose, with the Topix halting a three-week losing streak, after Wall Street rallied on robust corporate earnings. The Topix rose 1.9% to close at 2,023.93, while the Nikkei 225 advanced 1.8% to 29,068.63. Keyence Corp. contributed the most to the Topix’s gain, increasing 3.7%. Out of 2,180 shares in the index, 1,986 rose and 155 fell, while 39 were unchanged. For the week, the Topix climbed 3.2% and the Nikkei added 3.6%. Semiconductor equipment and material makers rose after TSMC said it will build a fabrication facility for specialty chips in Japan and plans to begin production there in late 2024. U.S. index futures held gains during Asia trading hours. The contracts climbed overnight after a report showed applications for state unemployment benefits fell last week to the lowest since March 2020. “U.S. initial jobless claims fell sharply, and have returned to levels seen before the spread of the coronavirus,” said Nobuhiko Kuramochi, a market strategist at Mizuho Securities in Tokyo. “The fact that more people are returning to their jobs will help ease supply chain problems caused by the lack of workers.”

Australian stocks also advanced, posting a second week of gains. The S&P/ASX 200 index rose 0.7% to close at 7,362.00, with most sectors ending higher. The benchmark added 0.6% since Monday, climbing for a second week. Miners capped their best week since July 16 with a 3% advance. Hub24 jumped on Friday after Evans & Partners upgraded the stock to positive from neutral. Pendal Group tumbled after it reported net outflows for the fourth quarter of A$2.3 billion. In New Zealand, the S&P/NZX 50 index fell 0.3% to 13,012.19

In rates, the U.S. 10-year Treasury yield rose over 3bps to 1.54%. Treasuries traded heavy across long-end of the curve into early U.S. session amid earning-driven gains for U.S. stock futures. Yields are higher by more than 3bp across long-end of the curve, 10- year by 2.8bp at about 1.54%, paring its first weekly decline since August; weekly move has been led by gilts and euro-zone bonds, also under pressure Friday, with U.K. 10-year yields higher by 3.3bp. Today’s bear-steepening move pares the weekly bull-flattening trend. U.S. session features a packed economic data slate and speeches by Fed’s Bullard and Williams.

In FX, the Bloomberg Dollar Spot Index was little changed even as the greenback weakened against most of its Group-of-10 peers; the euro hovered around $1.16 while European and U.S. yields rose, led by the long end. Norway’s krone led G-10 gains as oil jumped to $85 a barrel for the first time since late 2018 amid the global energy crunch; the currency rallied by as much as 0.6% to 8.4015 per dollar, the strongest level since June. New Zealand’s dollar advanced to a three-week high as bets on RBNZ’s tightening momentum build ahead of Monday’s inflation data; the currency is outperforming all G-10 peers this week. The yen dropped to a three-year low as rising equities in Asia damped demand for low-yielding haven assets. China’s offshore yuan advanced to its highest in four months while short-term borrowing costs eased after the central bank added enough medium-term funds into the financial system to maintain liquidity at existing levels.

In commodities, crude futures trade off best levels. WTI slips back below $82, Brent fades after testing $85. Spot gold slips back through Thursday’s lows near $1,786/oz. Base metals extend the week’s rally with LME nickel and zinc gaining over 2%.

Today’s retail sales report, due at 08:30 a.m. ET, is expected to show retail sales fell in September amid continued shortages of motor vehicles and other goods. The data will come against the backdrop of climbing oil prices, labor shortages and supply chain disruptions, factors that have rattled investors and have led to recent choppiness in the market.

Looking at the day ahead now, and US data releases include September retail sales, the University of Michigan’s preliminary consumer sentiment index for October, and the Empire State manufacturing survey for October. Central bank speakers include the Fed’s Bullard and Williams, and earnings releases include Charles Schwab and Goldman Sachs.

Market Snapshot

- S&P 500 futures up 0.3% to 4,443.75

- STOXX Europe 600 up 0.4% to 467.66

- German 10Y yield up 2.4 bps to -0.166%

- Euro little changed at $1.1608

- MXAP up 1.3% to 198.33

- MXAPJ up 1.2% to 650.02

- Nikkei up 1.8% to 29,068.63

- Topix up 1.9% to 2,023.93

- Hang Seng Index up 1.5% to 25,330.96

- Shanghai Composite up 0.4% to 3,572.37

- Sensex up 0.9% to 61,305.95

- Australia S&P/ASX 200 up 0.7% to 7,361.98

- Kospi up 0.9% to 3,015.06

- Brent Futures up 1.0% to $84.83/bbl

- Gold spot down 0.5% to $1,787.54

- U.S. Dollar Index little changed at 93.92

Top Overnight News from Bloomberg

- China’s central bank broke its silence on the crisis at China Evergrande Group, saying risks to the financial system stemming from the developer’s struggles are “controllable” and unlikely to spread

- The ECB has a good track record when it comes to flexibly deploying its monetary instruments and will continue that approach even after the pandemic crisis, according to policy maker Pierre Wunsch

- Italian Ministry of Economy and Finance says fourth issuance of BTP Futura to start on Nov. 8 until Nov. 12, according to a statement

- The world’s largest digital currency rose about 3% to more than $59,000 on Friday — taking this month’s rally to over 35% — after Bloomberg News reported the U.S. Securities and Exchange Commission looks poised to allow the country’s first futures-based cryptocurrency ETF

- Copper inventories available on the London Metal Exchange hit the lowest level since 1974, in a dramatic escalation of a squeeze on global supplies that’s sent spreads spiking and helped drive prices back above $10,000 a ton

A more detailed look at global markets courtesy of Newsquawk

Asia-Pac stocks traded higher amid tailwinds from the upbeat mood across global peers including the best day for the S&P 500 since March after strong US bank earnings, encouraging data and a decline in yields spurred risk appetite. The ASX 200 (+0.7%) was positive as the tech and mining sectors continued to spearhead the advances in the index in which the former took impetus from Wall St where the softer yield environment was conducive to the outperformance in tech, although mining giant Rio Tinto was among the laggards following weaker quarterly production results. The Nikkei 225 (+1.8%) was buoyed as exporters benefitted from the JPY-risk dynamic but with Fast Retailing failing to join in on the spoils despite an 88% jump in full-year net as its profit guidance underwhelmed with just 3% growth seen for the year ahead, while Taiwan’s TAIEX (+2.2%) surged with the spotlight on TSMC earnings which reached a record high amid the chip crunch and with the Co. to also build a factory in Japan that could receive JPY 500bln of support from the Japanese government. The Hang Seng (+1.5%) and Shanghai Comp. (+0.4%) were initially indecisive amid the overhang from lingering developer default concerns although found some mild support from reports that China is to relax banks’ mortgage limits through the rest of 2021. Focus was also on the PBoC which announced a CNY 500bln MLF operation, although this just matched the amount maturing this month and there are mixed views regarding prospects of a looming RRR cut with ANZ Bank’s senior China strategist recently suggesting the potential for a 50bps cut in RRR or targeted MLF as early as today, although a recent poll showed analysts had pushed back their calls for a RRR cut from Q4 2021 to Q1 2022. Finally, 10yr JGBs marginally pulled back from this week’s advances after hitting resistance at the 151.50 level, with demand hampered amid the firm gains in Japanese stocks and the lack of BoJ purchases in the market today.

Top Asian News

- Hong Kong Probes Going Concern Reporting of Evergrande

- U.S. Futures Hold Gains as Oil Hits 3-Year High: Markets Wrap

- Toyota Cuts November Outlook by 15% on Parts Shortage, Covid

- Yango Group Wires Repayment Fund for Onshore Bond Due Oct. 22

Bourses in Europe have held onto the modest gains seen at the cash open (Euro Stoxx 50 +0.4%; Stoxx 600 +0.3%), but the region is off its best levels with the upside momentum somewhat faded heading into the US open, and amidst a lack of fresh newsflow. US equity futures have remained in positive territory, although the latest leg lower in bonds has further capped the tech-laden NQ (+0.2%), which underperforms vs the ES (+0.3%), YM (+0.3%) and RTY (+0.7%), with traders on the lookout for another set of earnings, headlined by Goldman Sachs at 12:25BST/07:25EDT. Back to Europe, bourses see broad-based gains, whilst sectors are mostly in the green with clear underperformance experienced in defensives, with Telecoms, Utilities, Healthcare and Staples at the foot of the bunch. On the flipside, Banks reap rewards from the uptick in yields, closely followed by Travel & Leisure, Autos & Parts and Retail. Renault (+4%) drives the gains in Autos after unveiling a prototype version of the Renault Master van that will go on sale next year. Travel & Leisure is bolstered by the ongoing reopening trade with potential tailwinds heading into the Christmas period. Retail meanwhile is boosted by Hugo Boss (+1.8%) topping forecasts and upgrading its guidance.

Top European News

- Autumn Heat May Curb European Gas Demand, Prices Next Week

- Bollore Looking for Buyers for Africa Logistics Ops: Le Monde

- U.K. Offers Foreign Butchers Visas After 6,000 Pigs Culled

- Europe’s Car-Sales Crash Points to Worse Year Than Poor 2020

In FX, the Greenback was already losing momentum after a relatively tame bounce on the back of Thursday’s upbeat US initial claims data, and the index failed to sustain its recovery to retest intraday highs or remain above 94.000 on a closing basis. However, the Buck did reclaim some significant and psychological levels against G10, EM currencies and Gold that was relishing the benign yield environment and the last DXY price was marginally better than the 21 DMA from an encouraging technical standpoint. Nevertheless, the Dollar remains weaker vs most majors and in need of further impetus that may come via retail sales, NY Fed manufacturing and/or preliminary Michigan Sentiment before the spotlight switches to today’s Fed speakers featuring arch hawk Bullard and the more neutral Williams.

- GBP/NZD/NOK – Sterling has refuelled and recharged regardless of the ongoing UK-EU rift over NI Protocol, though perhaps in part due to the fact that concessions from Brussels are believed to have been greeted with welcome surprise by some UK Ministers. Cable has reclaimed 1.3700+ status, breached the 50 DMA (at 1.3716 today) and yesterday’s best to set a marginal new w-t-d peak around 1.3739, while Eur/Gbp is edging closer to 0.8450 having clearly overcome resistance at 1.1800 in the reciprocal cross. Similarly, the Kiwi continues to derive impetus from the softer Greenback and Aud/Nzd flows as Nzd/Usd extends beyond 0.7050 and the Antipodean cross inches nearer 1.0500 from 1.0600+ highs. Elsewhere, the Norwegian Crown is aiming to add 9.7500 to its list of achievements relative to the Euro with a boost from Brent topping Usd 85/brl at one stage and a wider trade surplus.

- CAD – The Loonie is also profiting from oil as WTI crude rebounds through Usd 82 and pulling further away from 1.5 bn option expiry interest between 1.2415-00 in the process, with Usd/Cad towards the base of 1.2337-82 parameters.

- EUR/AUD/CHF/SEK – All narrowly mixed and rangy vs the Greenback, or Euro in the case of the latter, as Eur/Usd continues to straddle 1.1600, Aud/Usd churn on the 0.7400 handle, the Franc meander from 0.9219 to 0.9246 and Eur/Sek skirt 10.0000 having dipped below the round number briefly on Thursday.

In commodities, WTI and Brent front month futures remain on a firmer footing, aided up the overall constructive risk appetite coupled with some bullish technical developments, as WTI Nov surpassed USD 82/bbl (vs 81.39/bbl low) and Brent Dec briefly topped USD 85/bbl (vs 84.16/bbl low). There has been little in terms of fresh fundamental catalysts to drive the price action, although Russia’s Gazprom Neft CEO hit the wires earlier and suggested that reserve production capacity could meet the increase in oil demand, whilst a seasonal decline in oil consumption is possible and the oil market will stabilise in the nearest future. On the Iranian JCPOA front, Iran said it is finalising steps to completing its negotiating team but they are absolutely decided to go back to Vienna discussions and conclude the negotiations, WSJ’s Norman. The crude complex seems to have (for now) overlooked reports that the White House is engaged in diplomacy” with OPEC+ members regarding output. UK nat gas prices were higher as European players entered the fray, but prices have since waned off best levels after Russian Deputy PM Novak suggested that gas production in Russia is running at maximum capacity. Elsewhere, spot gold has been trundling amid yield-play despite lower despite the Buck being on the softer side of today’s range. Spot gold failed to hold onto USD 1,800/oz status yesterday and has subsequently retreated below its 200 DMA (1,794/oz) and makes its way towards the 50 DMA (1,776/oz). LME copper prices are on a firmer footing with prices back above USD 10,000/t – supported by technicals and the overall risk tone, although participants are cognizant of potential Chinese state reserves releases. Conversely, Dalian iron ore futures fell for a third straight session, with Rio Tinto also cutting its 2021 iron ore shipment forecasts due to dampened Chinese demand.

US Event Calendar

- 8:30am: Sept. Retail Sales Advance MoM, est. -0.2%, prior 0.7%

- 8:30am: Sept. Retail Sales Ex Auto MoM, est. 0.5%, prior 1.8%

- 8:30am: Sept. Retail Sales Control Group, est. 0.5%, prior 2.5%

- 8:30am: Sept. Retail Sales Ex Auto and Gas, est. 0.3%, prior 2.0%

- 8:30am: Oct. Empire Manufacturing, est. 25.0, prior 34.3

- 8:30am: Sept. Import Price Index MoM, est. 0.6%, prior -0.3%; YoY, est. 9.4%, prior 9.0%

- 8:30am: Sept. Export Price Index MoM, est. 0.7%, prior 0.4%; YoY, prior 16.8%

- 10am: Aug. Business Inventories, est. 0.6%, prior 0.5%

- 10am: Oct. U. of Mich. 1 Yr Inflation, est. 4.7%, prior 4.6%; 5-10 Yr Inflation, prior 3.0%

- 10am: Oct. U. of Mich. Sentiment, est. 73.1, prior 72.8

- 10am: Oct. U. of Mich. Current Conditions, est. 81.2, prior 80.1

- 10am: Oct. U. of Mich. Expectations, est. 69.1, prior 68.1

DB’s Jim Ried concludes the overnight wrap

A few people asked me what I thought of James Bond. I can’t say without spoilers so if anyone wants my two sentence review I will cut and paste it to all who care and reply! At my age I was just impressed I sat for over three hours (including trailers) without needing a comfort break. By the time you email I will have also listened to the new Adele single which dropped at midnight so happy to include that review as well for free.

While we’re on the subject of music, risk assets feel a bit like the most famous Chumbawamba song at the moment. They get knocked down and they get up again. Come to think about it that’s like James Bond too. Yesterday was a strong day with the S&P 500 (+1.71%) moving back to within 2.2% of its all-time closing high from last month. If they can survive all that has been thrown at them of late then one wonders where they’d have been without any of it.

The strong session came about thanks to decent corporate earnings releases, a mini-collapse in real yields, positive data on US jobless claims, as well as a further fall in global Covid-19 cases that leaves them on track for an 8th consecutive weekly decline. However, inflation remained very much on investors’ radars, with a range of key commodities taking another leg higher, even as US data on producer prices was weaker than expected.

Starting with the good news, the equity strength was across the board with the S&P 500 experiencing its best daily performance since March, whilst Europe’s STOXX 600 (+1.20%) also put in solid gains. It was an incredibly broad-based move higher, with every sector group in both indices rising on the day, with a remarkable 479 gainers in the S&P 500, which is the second-highest number we’ve seen over the last 18 months. Every one of the 24 S&P 500 industry groups rose, led by cyclicals such as semiconductors (+3.12%), transportation (+2.51%) and materials (+2.43%). A positive start to the Q3 earnings season buoyed sentiment, as a number of US banks (+1.45%) reported yesterday, all of whom beat analyst estimates. In fact, of the nine S&P 500 firms to report yesterday, eight outperformed analyst expectations. Weighing in on recent macro themes, Bank of America Chief, Brian Moynihan, noted that the current bout of inflation is “clearly not temporary”, but also that he expects consumer demand to remain robust and that supply chains will have to adjust. I’m sure we’ll hear more from executives as earnings season continues today.

Alongside those earnings releases, yesterday saw much better than expected data on the US labour market, which makes a change from last week’s underwhelming jobs report that showed the slowest growth in nonfarm payrolls so far this year. In terms of the details, the weekly initial jobless claims for the week through October 9, which is one of the most timely indicators we get, fell to a post-pandemic low of 293k (vs. 320k expected). That also saw the 4-week moving average hit a post-pandemic low of 334.25k, just as the continuing claims number for the week through October 2 hit a post-pandemic low of 2.593m (vs. 2.670m expected). We should get some more data on the state of the US recovery today, including September retail sales, alongside the University of Michigan’s consumer sentiment index for October.

That optimism has fed through into Asian markets overnight, with the Nikkei (+1.43%), the Hang Seng (+0.86%), the Shanghai Comp (+0.29%) and the KOSPI (+0.93%) all moving higher. That came as Bloomberg reported that China would loosen restrictions on home loans amidst the concerns about Evergrande. And we also got formal confirmation that President Biden had signed the debt-limit increase that the House had passed on Tuesday, which extends the ceiling until around December 3. Equity futures are pointing to further advances in the US and Europe later on, with those on the S&P 500 (+0.30%) and the STOXX 50 (+0.35%) both moving higher.

Even with the brighter news, inflation concerns are still very much with us however, and yesterday in fact saw Bloomberg’s Commodity Spot Index (+1.16%) advance to yet another record high, exceeding the previous peak from early last week. That was partly down to the continued rise in oil prices, with WTI (+1.08%) closing at $81.31/bbl, its highest level since 2014, just as Brent Crude (+0.99%) hit a post-2018 high of $84.00/bbl. Both have posted further gains this morning of +0.58% and +0.61% respectively. Those moves went alongside further rises in natural gas prices, which rose for a 3rd consecutive session, albeit they’re still beneath their peak from earlier in the month, as futures in Europe (+9.14%), the US (+1.74%) and the UK (+9.26%) all moved higher. And that rise in Chinese coal futures we’ve been mentioning also continued, with their rise today currently standing at +13.86%, which brings their gains over the week as a whole to +39.02% so far.

As well as energy, industrial metals were another segment where the recent rally showed no sign of abating yesterday. On the London metal exchange, a number of multi-year milestones were achieved, with aluminum prices (+1.60%) up to their highest levels since 2008, just as zinc prices (+3.73%) closed at their highest level since 2018. Separately, copper prices (+2.56%) hit a 4-month high, and other winners yesterday included iron ore futures in Singapore (+1.16%), as well as nickel (+1.99%) and lead (+2.43%) prices in London.

With all this momentum behind commodities, inflation expectations posted further advances yesterday. Indeed, the 10yr US Breakeven closed +1.0bps higher at 2.536%, which is just 3bps shy of its closing peak back in May that marked its highest level since 2013. And those moves came in spite of US producer price data that came in weaker than expected, with the monthly increase in September at +0.5% (vs. +0.6% expected). That was the smallest rise so far this year, though that still sent the year-on-year number up to +8.6% (vs. +8.7% expected). That rise in inflation expectations was echoed in Europe too, with the 10yr UK breakeven (+5.6bps) closing at its highest level since 2008, whilst its German counterpart also posted a modest +0.7bps rise.

In spite of the rise in inflation expectations, sovereign bonds posted gains across the board as the moves were outweighed by the impact of lower real rates. By the end of yesterday’s session, yields on 10yr Treasuries were down -2.6bps to 1.527%, which came as the 10yr real yield moved back beneath -1% for the first time in almost a month. Likewise in Europe, yields pushed lower throughout the session, with those on 10yr bunds (-6.3bps), OATs (-6.2bps) and BTPs (-7.1bps) all moving aggressively lower.

To the day ahead now, and US data releases include September retail sales, the University of Michigan’s preliminary consumer sentiment index for October, and the Empire State manufacturing survey for October. Central bank speakers include the Fed’s Bullard and Williams, and earnings releases include Charles Schwab and Goldman Sachs.

Tyler Durden

Fri, 10/15/2021 – 07:50

via ZeroHedge News https://ift.tt/3mVwkVp Tyler Durden