Goldman Lost $820MM Trading Stocks In Q2 As It Quietly Liquidated Billions In Equities

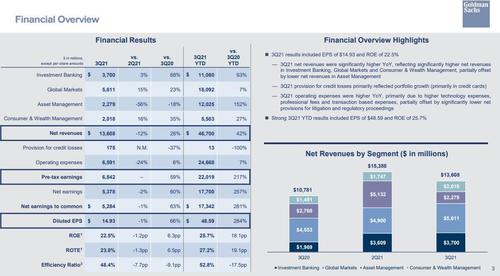

While most analysts and traders were digging through Goldman’s Q3 earnings report and focusing on the investment banking and markets (i.e., commission-based flow trading ) results – all of which came in stellar especially on the banking advisory side and equity trading…

… there was something odd in the bank’s Asset Management division, formerly known as Goldman Prop.

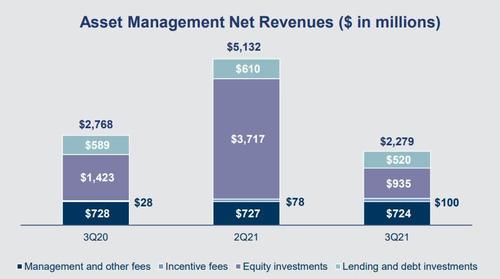

Here, after a stellar Q2 in which Goldman generated a record $5.132BN, more than double the $2.1BN in Q2 2020 and driven by “significantly higher net gains from investments in private equities, driven by company-specific events, including capital raises and sales”, Q3 saw a dramatic drop in net revenues, which shrank to just $2.279BN, a whopping 56% drop from Q2 and down even compared to Q3 2020, with revenue from Equity Investment plunging to just $935MM, down from $3.717BN the previous quarter.

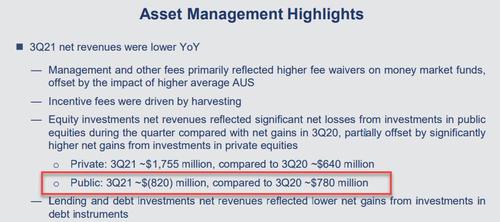

According to Goldman’s investor presentation, “equity investments net revenues reflected significant net losses from investments in public equities during the quarter compared with net gains in 3Q20, partially offset by significantly higher net gains from investments in private equities.”

Goldman further breaks down the equity revenue, and notes that whereas investments in private equity brought in $1.755BN, public equities actually led to a whopping $820 Million loss (compared to $780 Million profit a year ago).

Wait, “significant losses” from investments in public stocks in Q3, a quarter in which the S&P barely had any dips and only neared a 5% drawdown toward the end, on Sept 30, on the combination of soaring energy prices, China’s property crisis, stagflation fears and the Fed’s taper. For the most part, however, Q3 was just as quiet and buoyant as Q2, a quarter in which Goldman’s prop trading desk made a whopping $5.1 billion. Or… was Goldman short the market as it ripped higher in Q3?

Surely someone on the Goldman call would or should ask this question, although we doubt it – analysts there seemed far too starstruck with DJ D-Sol’s banking and flow trading revenue.

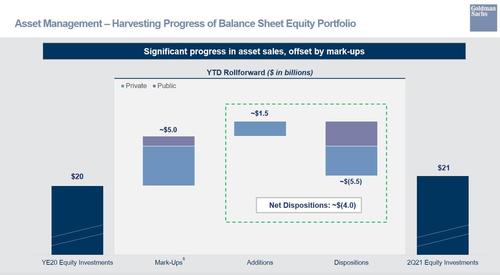

But if they don’t ask about how Goldman lost almost a billion trading stocks, surely someone will ask why the bank keeps dumping stocks, pardon “harvesting” gains, hand over fist.

Recall, last quarter we reported that “Goldman Has “Aggressively” And Quietly Liquidated A Quarter Of Its Equity Investments” showing that “having started the year with a $20BN equity portfolio which has enjoyed a $5BN increase in market prices, Goldman dumped a whopping $5.5 billion of its equity assets so far (excluding a modest $1.5BN in purchases) or more than a quarter of its entire portfolio as of Dec 31. “

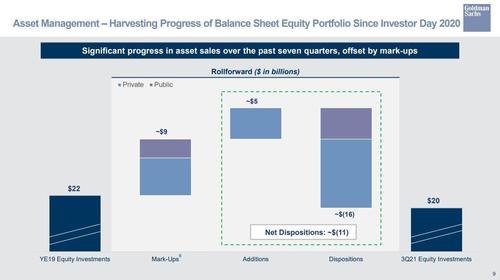

Fast forward to today, when the infamous “harvesting” slide is back if with some adjustments. First, Goldman no longer uses YE20 as the starting point for its asset sales bridge, and instead has picked YE19 as the starting reference. Back then the bank had some $22 billion in equity investments, $2BN more than the $20BN at YE 20.

What we find next is that unlike last quarter when the bank showed it has sold a whopping $5.5BN in stocks in the first half of 2021 (excluding a modest $1.5BN in purchases), this time the bank went even bolder and sold a total of $16 Billion (presumably split between equities and debt, although whoever did the chart forgot to add the table). This number was offset by $5 billion in equity additions, for a total Net Dispositions amount of $11 billion, or “harvesting” since the bank’s 2020 Investor Day.

Who is Goldman selling to? Anyone who will buy, but here we would wager that retail investors – who have been on tilt buying in 2021 – have been the proud recipients of billions in Goldman sales. This, in the financial literature is called the “distribution phase.“

Unfortunately, with the investor call now over, there were virtually no discussion of harvesting this time. At least one quarter ago some analyst asked a question about Goldman’s efforts to reduce its equity investment portfolio, to which the bank said that it it has “made progress on improving its capital efficiency and is moving ‘aggressively’ to manage equity positions, especially since the environment is supportive.”

What does that mean in English? Simple: Goldman continues to “aggressively” dump its positions which are in the money in an environment that is “supportive”, i.e., in which the dumb money is providing a constant bid into which whales such as Goldman can sell.

The last time Goldman was “aggressively” selling into a “supportive” market? Well, we have to go back all the way to 2007 and 2008 when Goldman was busy creating the very CDOs which its prop desk would then “aggressively” short. We all remember how prophetic that particular move turned out to be.

As to what was behind Goldman’s unexplained $820 million equity loss, one wonders if Goldman’s wasn’t one of those who were steamrolled by the sequence of powerful short squeeze observed during the previous three months.

Tyler Durden

Fri, 10/15/2021 – 12:29

via ZeroHedge News https://ift.tt/3p7B4di Tyler Durden