For The First Time Since The ’70s, Demographics Support Higher Rates

Authored by Bryce Coward via Knowledge Leaders Capital blog,

New projections of the labor force growth rate by the US Bureau of Labor Statistics show the US labor force growth accelerating in the 2020s for the first time since the 1970s.

How could this be?

There are two reasons.

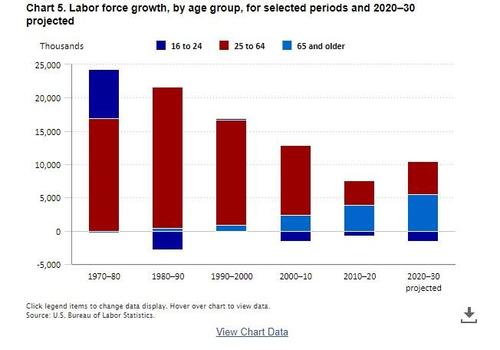

More people are working past 65 and the millennial generation is entering the labor force en masse.

Why is this important?

There are lots of reasons, but here are five.

-

A labor force growing at a faster rate is associated with rising aggregate income and more spending power.

-

Second, after people enter the labor force and get steady, well-paying jobs, they do things like get married, buy houses, and have kids. All of those things are associated with increased spending.

-

Third, increased labor force growth implies faster GDP growth.

-

Fourth, higher aggregate incomes, household formation, and increased spending is associated with firm to higher inflation.

-

Fifth, all of these things are associated with higher interest rates.

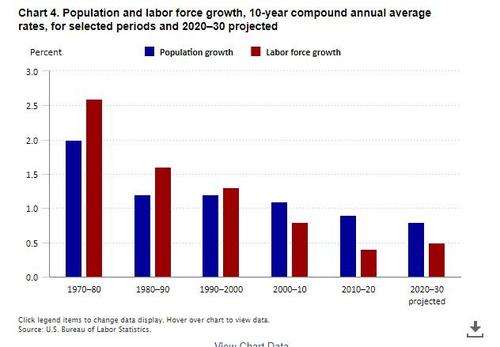

In this first chart below, we can see that population growth (the blue bars) will continue to slow in the 2020s, but labor force growth will actually rise decade-on-decade for the first time since the 1970s.

The rise is due to both the 25-64 age cohort growing relative to the size of the population as well as people over the age of 65 remaining in the labor force for longer.

The BLS estimates that, as a result, trend economic growth will accelerate from 1.5% to closer to 2.5% in the 2020s. This would be the first decade-on-decade increase in growth since the 1990s. At that time, growth accelerated due to productivity gains rather than brute labor force growth.

Not surprisingly, labor force growth is highly correlated with interest rates. The last time labor force growth accelerated was from 1960-1980. Over that period 10-year Treasury yields increased from 6% to 16% as spending increased and inflation surged. Since then 10Y rates fell from 16% to basically 0% as labor force growth deflated and other factors like globalization contributed to outright disinflation. Now, for the first time in 40 years, labor force growth will accelerate for the next several years.

This boomlet in the labor force is likely to coincide with increases in rates, as it did the last time labor force growth picked up. This is to say nothing of deglobalization and climate change mitigation that add incremental pressure to inflation trends.

Tyler Durden

Sun, 10/17/2021 – 13:10

via ZeroHedge News https://ift.tt/3aLtpc5 Tyler Durden