“The Fire Is Hot”: Why Morgan Stanley Is Bracing For A Collapse In The US Consumer Early Next Year

By Michael Wilson, chief equity strategist at Morgan Stanley

Trick or Treat, or Both?

Over the past few weeks, I have been highlighting the increasing probability of a colder winter but a later start than previously expected. In other words, our ‘fire and ice‘ narrative remains intact, but timing of ice has been pushed out (see “”Our Fire And Ice Narrative Remains Intact”: Why Wall Street’s Most Bearish Analyst Simply Refuses To Capitulate“).

Having said that, with inflation running hot in both consumer and corporate channels, the Fed is expected to formally announce its tapering schedule at this week’s meeting, with perhaps a more hawkish tone to convince markets that it isn’t falling too far behind the curve. So, the fire segment (higher rates driven by a less accommodative Fed spurring multiple compression) is clearly under way and has been a focus for investors since the Fed started prepping the markets at Jackson Hole.

With rising inflation now getting so much attention from both investors and the Fed, we shift our focus to the ice segment – i.e., the ongoing macro growth slowdown – and when we can expect it to bottom and reverse course. As regular readers know, we have been expecting a material slowdown in both economic and earnings growth amid a mid-cycle transition. The good news is that so does consensus, with 3Q economic growth forecasts having come down sharply before last week’s disappointing outcome. While its estimates of 4Q GDP have also declined, the consensus expects growth to reaccelerate sharply from here. Most have blamed the Delta variant, China’s crackdown on real estate or supply shortages for the economic disappointment in 3Q, with the assumption that all three will get better as we move into year-end and 2022.

Needless to say, we’re not as sure about that assumption, mainly because we think the more important driver of the slowdown has been a mid-cycle transition from an extreme post-recession peak, an adjustment that is not yet finished. In our view, it would be intellectually inconsistent to think that the mid-cycle transition slowdown won’t be worse than normal, given the greater-than-normal amplitude of this entire economic cycle so far. We can’t help but recall our position over a year ago, when we argued for much faster earnings growth than the consensus. We argued then that the record fiscal stimulus would effectively serve as a government subsidy for corporations to over-earn. Today, we find ourselves on the direct opposite side of consensus again, but for the same reasons. Since we believe consensus failed to see that logic last year, it seems plausible it could now be missing the corollary.

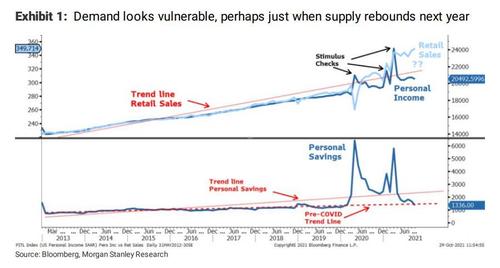

In short, we think the earnings growth slowdown will be worse and last longer than expected as the payback in demand arrives early next year with a sharp year-over-year decline in personal disposable income. While many have argued that the large increase in personal savings will keep consumption well above trend, it looks to us as if personal savings have already been depleted to pre-COVID-19 levels.

Granted, the run-up in stock, real estate and crypto asset prices does provide an additional buffer to savings, but much of that wealth is concentrated in the upper quartile of the population. At the lower end of the income spectrum, consumer confidence has fallen sharply the past few months and it’s not just due to the Delta variant. Instead, surveys suggest that many lower-income consumers are worried about their finances again with inflation increasing at double-digit rates in necessities like food, energy, shelter and healthcare – i.e, the fire is hot.

Bottom line, the fundamental picture for stocks is deteriorating as the Fed starts to tighten monetary policy and earnings growth slows further into next year, turning outright negative for some companies.

However, asset prices are continuing to rise as retail investors keep plowing excess cash into these same investments. Meanwhile, with strong seasonal trends and pressure to perform high at this time of year, many institutional investors we speak with are staying fully invested for these technical reasons. If our analysis is correct, we think that this bullish trend can continue into Thanksgiving, but not much longer.

Enjoy the treat for now, but beware the trick, and manage your risk accordingly.

Tyler Durden

Sun, 10/31/2021 – 15:10

via ZeroHedge News https://ift.tt/3BwAyYA Tyler Durden