Why Goldman Sees Ethereum Soaring To $8,000 By Year End

Are cryptocurrencies an inflation hedge?

Few questions in the financial universe prompt a more forceful, vigorous, polarizing – and often angry – response than what may well be the simplest, if most far-reaching one: are cryptos truly digital gold, and do they offer protection against inflation during times of soaring prices? Needless to say, an affirmative answer would have huge consequences in a time when the US is experiencing the highest inflation since the 1970s.

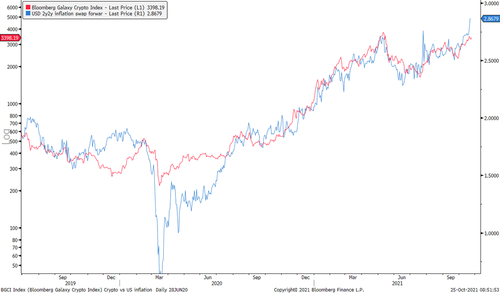

Now, Goldman appears to have finally found the answer: in a note from the bank’s Global Markets managing director Bernhard Rzymelka, the bank shows that crypto assets have traded in line with inflation breakevens since 2019. Specifically, he charts the Bloomberg Galaxy Crypto Index (red) on a log axis, versus the USD 2y forward 2y inflation swap (blue). While correlation may no be causation, the chart below is clear enough to indicate that inflation certainly is a driving force behind the relentless crypto meltup to all time highs (which is delightfully ironic as some of crypto’s biggest detractors are also some of the biggest Fed fanboys, who habitually cheer on the Fed’s catastrophic monetary policy; little did they know that the record surge in cryptos would be most direct outcome of said policy).

What does this mean practically?

Well, if market-based views of inflationary pressures persist, we may soon see a meltup across the crypto universe and especially one token.

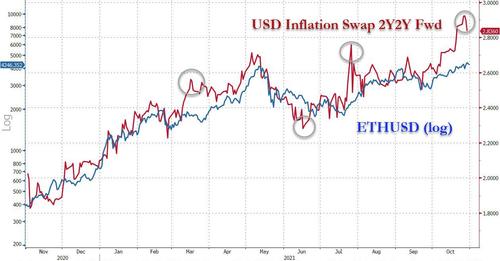

As the Goldman strategist writes, the local backdrop looks supportive for Ethereum as “it has tracked inflation markets particularly closely, likely reflecting the pro-cyclical nature as “network based” asset.” And, as Rzymelka notes, “the latest spike in inflation breakevens suggests upside risk if the leading relationship of recent episodes was to hold (grey circles below).”

This, according to Goldman, lines up well with the Ethereum chart. In the past few days, the price of the crypto broke out to new all time highs, rising just shy of $4,500 with a narrowing wedge, which to Goldman is “either a sign of exhaustion and peaking… or a starting point of an accelerating rally upon a break higher.” To Goldman, the answer to this rhetorical question is easy, and the bank hints that ethereum could surge as high as $8000 in the next two months if the historical correlation with inflation fwds persists.

And while some could argue that ETH is due for a pullback, Goldman counters that while the recent surge may appear stretched, “the RSI has yet to hit the overbought levels seen at past market highs.”

One final word of caution. As the Goldman traders notes, US inflation swaps imply core PCE inflation at or above 2.50% for the next 5 years. That’s a lot of overheating, and current market levels hence price a rather aggressive interpretation of the Fed’s AIT framework of “moderately above 2% for some time” already.

On one hand, the upside to inflation markets – and possibly crypto assets – hence looks limited unless the market starts doubting the FOMC’s inflation credibility (much) more fundamentally. In other words, as we have been saying since 2014, cryptos have emerged as the asset class that will benefit the most if we have another major inflationary/stagflationary scare.

As Goldman concludes, “this lines up rather well with the Ethereum chart, suggesting a late stage rally with longer term market top ahead.”

Tyler Durden

Sun, 10/31/2021 – 15:35

via ZeroHedge News https://ift.tt/3pTkr5b Tyler Durden