US Coal Miners “All Sold Out” For 2022

Top U.S. coal miners are experiencing a massive surge in demand as power companies restart coal-fired power plants due to high natural gas prices to prevent electricity shortages ahead of the winter season.

According to Bloomberg, Arch Resources, the second-largest U.S. coal miner, has sold every lump of coal it will extract out of the ground for 2022. The company has sold next year’s coal for 20% over the current spot. Peabody Energy Corp., the top U.S. coal miner, has sold 90% of all its coal from the Powder River Basin area for 2022.

Arch’s CEO Paul Lang said the company’s thermal coal output for 2022 is “fully committed.” According to S&P Global Market Intelligence, Arch sold the coal for $16 per ton, well over last week’s $13.25 spot price.

“It’s pretty much sold out,” Peabody CEO Jim Grech said Thursday during a conference call. “We only have a small portion left to be sold for 2022 and for 2023.”

Alliance Resource Partners LP, a coal miner that will ship 32 million tons this year, has already locked in 2022 contracts to deliver 30 tons and 16 tons in 2023.

“Our challenge in America is most producers are all sold out,” Alliance CEO Joe Craft said last week.

Surging demand for coal ahead of the Northern Hemisphere winter comes as the global energy crunch has forced natural gas prices to record highs worldwide. Power plants are transitioning away from natgas generation because it’s uneconomical at current prices, hence the increasing demand for the dirtiest fossil fuel.

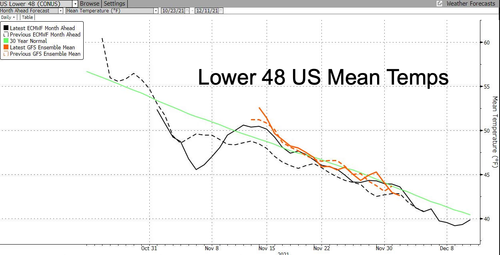

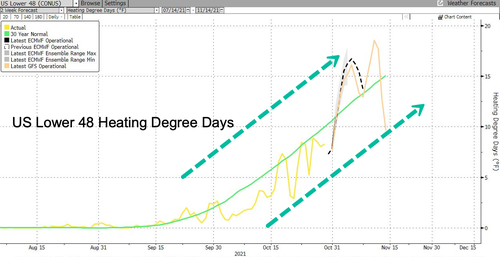

Over the next month, average temperatures for the US-Lower 48 will begin to dive.

This means electricity demand to heat building structures will increase.

One of the biggest ironies this year is the transition to coal despite a push by politicians for green energy. One of the culprits behind the global energy crunch is alternative power, such as wind and solar, are unreliable.

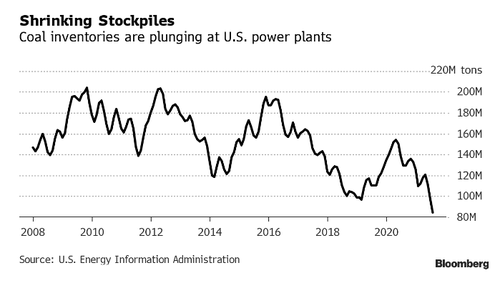

The latest Bloomberg data shows U.S. coal supplies are at two-decade lows ahead of the winter.

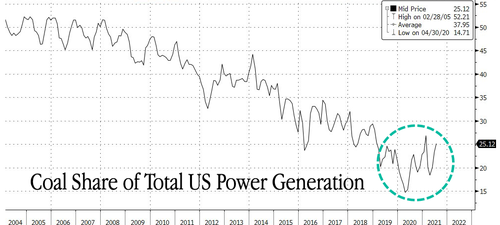

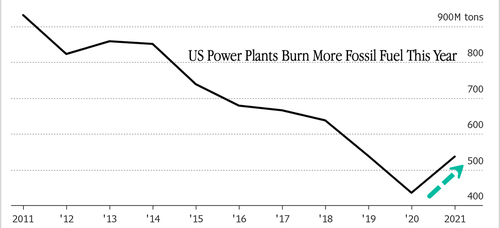

U.S. power generation derived from coal is increasing.

Power plants are expected to burn 19% more coal this year.

Arch’s Lang recently warned that coal producers might not have the capacity to respond to demand.

Weeks ago, Ernie Thrasher, CEO of Xcoal Energy & Resources, the largest U.S. exporter of fuel, said demand for coal will remain robust well into 2022. He warned about domestic supply constraints and power companies already “discussing possible grid blackouts this winter.”

All of this new founded coal demand has been a boon for Peabody Energy shares as earnings have tripled.

The rebound of coal under a Biden administration must be puzzling for many, but it has shown the green transition will take decades, not years. In the meantime, the world returns to coal.

Tyler Durden

Sun, 10/31/2021 – 21:25

via ZeroHedge News https://ift.tt/2ZGGAcy Tyler Durden