Key Events This Very Busy Week: Fed, Payrolls, Hiking Central Banks, PMIs And Much More

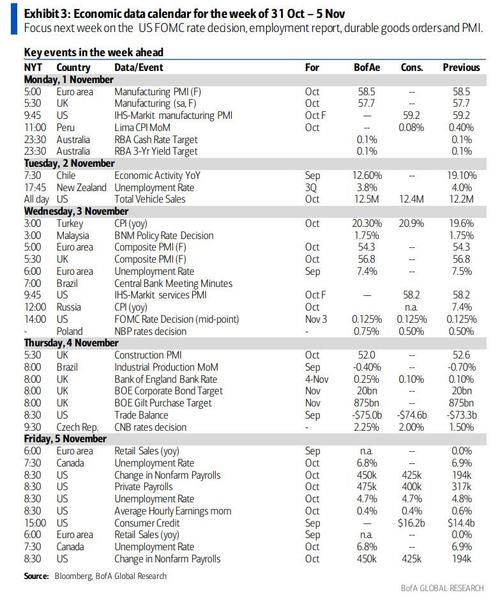

Last week may have seen the peak of earnings season with the GAMMA companies (fka as FAAMG) reporting earnings that left quite a bit to be desired, but it gets even busier this week with the Fed’s Wednesday taper announcement, Friday’s nonfarm payrolls report and a slew of other events taking place in the coming five days.

In addition to two very closely watched meetings from the RBA (Tuesday) and BOE (Thursday), where the central banks will likely announce some form of tightening/tapering (more in a subsequent preview) to contain soaring inflation, on Wednesday the Fed will announce a well flagged taper on Wednesday. In line with recent guidance, DB expect that the Fed will announce monthly reductions of $10bn and $5bn of Treasury and MBS purchases, respectively. With the first cut to purchases coming mid-November, this will bring the latest round of QE to a conclusion in June 2022. As noted last night, Goldman pulled forward its first rate hike forecast by one year to July 2022.

The Fed has some flexibility with this timetable but it will be interesting to hear how much Powell pushes back on markets that price in two hikes in 2022, including one almost fully priced for before the taper ends. If markets attacked the Fed in the same way they have the RBA the global financial system would have a lot of issues so it’s a fine balance for the Fed. They won’t want to push back too aggressively on market pricing given the uncertainty but they won’t want an outright attack on forward guidance.

Of far lower importance will be this week’s payrolls report on Friday, where consensus expects a +425k vs. +194k payrolls print while the unemployment rate is expected to fall by a tenth to 4.7% and average hourly earnings to post another strong gain (+0.4% vs. +0.6%) amidst still-elevated hours worked (34.8hrs vs. 34.8hrs).

Outside of all this excitement, we have the COP26 which will dominate all news outlets with its utter boondoggle uselessness. The other main data highlight are the global PMIs (today and Wednesday mostly) which will give insight into how the economic recovery has progressed in the first month of Q4 with the surveys shedding light onto how inflation is affecting suppliers. There is lots more in store for us this week but see the day by day calendar at the end for the full run down

The market also enters the second half of the 3Q earnings season. There are 168 S&P 500 and 85 Stoxx 600 companies reporting this week with 52% of the S&P 500 and 48% of the STOXX 600 having already reported.

DB’s Binky Chadha published an update on earnings season over the weekend (link here). In the US, the size of the earnings beat has declined over the course of the season and is on track to hit 7%, well below the record 14-20% range post pandemic. Excluding the lumpy loan-loss reserve releases by banks, the beat is even lower at 5%, bringing it back in line with the historical norm. Quarterly earnings are on track to be down sequentially from Q2 to Q3 by -1.1% (qoq seasonally adjusted), the first drop since Q2 2020. The flat to down read of earnings is broad based across sector groups. Forward consensus estimates have fallen outside of the Energy sector. The S&P 500 nevertheless has seen one of the strongest earning season rallies on record. See much more in Binky’s piece.

This week’s highlights include NXP Semiconductors, Zoom, and Tata Motors today before Pfizer, T-Mobile, Estee Lauder, BP, Mondelez, Activision Blizzard, and AP Moller-Maersk tomorrow. Then on Wednesday we’ll hear from Novo Nordisk, Qualcomm, CVS, Marriott, Albemarle, and MGM resorts. Thursday sees reports from Toyota, Moderna, Square, Airbnb, Uber, and Deutsche Post and then a busy Friday with Alibaba Group, Dominion Energy, Honda, and Mitsubishi.

Finally, focusing on just the US, Goldman writes that the key economic data releases this week are the ISM manufacturing index on Monday, the ISM services index on Wednesday, and the employment report on Friday. The November FOMC meeting is this week, with the release of the statement at 2:00 PM ET on Wednesday, followed by Chair Powell’s press conference at 2:30 PM.

Monday, November 1

- 10:00 AM Construction spending, September (GS +0.3%, consensus +0.5%, last flat); We estimate a 0.3% increase in construction spending in September.

- 10:00 AM ISM manufacturing index, October (GS 60.3, consensus 60.5, last 61.1); We estimate that the ISM manufacturing index declined 0.8pt to 60.3 in October, reflecting supply constraints in the automotive sector and the elevated level of the ISM measure relative to regional manufacturing surveys.

- 09:45 AM Markit manufacturing PMI, October final (consensus 59.2, last 59.2)

Tuesday, November 2

- 5:00 PM Wards Total Vehicle Sales, October (GS 12.5m, consensus 12.5m, last 12.2m)

Wednesday, November 3

- 08:15 AM ADP employment report, October (GS +425k, consensus +400k, last +568k): We expect a 425k rise in ADP payroll employment for the month of October. Our forecast assumes strong underlying job gains and reflects the mixed statistical inputs to the ADP model this month.

- 09:45 AM Markit services PMI, October final (consensus 58.2, last 58.2)

- 10:00 AM ISM services index, October (GS 62.3, consensus 62.0, last 61.9): We estimate that the ISM services index rose 0.4 points to 62.3, reflecting improving public health, rebounding dining activity, and the strength in the GSAI. Our services tracker rose 1.9pt to 58.1.

- 10:00 AM Factory orders, September (GS +0.1%, consensus -0.1%, last +1.2%); Durable goods orders, September final (last -0.4%); Durable goods orders ex-transportation, September final (last +0.4%); Core capital goods orders, September final (last +0.8%); Core capital goods shipments, September final (last +1.4%): We estimate that factory orders increased 0.1% in September following a 1.2% increase in August. Durable goods orders declined 0.4% in the September advance report, but core capital goods orders increased 0.8%.

- 02:00 PM FOMC statement, November 1-2 meeting: As discussed in our FOMC preview, we expect that the FOMC will announce the start of tapering at this meeting, and that the taper will conclude in June 2022. We pulled forward our forecast for the first rate hike to July 2022, as we now expect core PCE inflation to remain above 3%—and core CPI inflation above 4%—when the taper concludes.

Thursday, November 4

- 08:30 AM Initial jobless claims, week ended October 30 (GS 270k, consensus N.A., last 281k); Continuing jobless claims, week ended October 23 (consensus N.A., last 2,243k): We estimate initial jobless claims decreased to 270k in the week ended October 30.

- 08:30 AM Nonfarm productivity, Q3 preliminary (GS -2.0%, consensus -1.3%, last +2.1%); Unit labor costs, Q3 preliminary (GS +6.0%, consensus +5.4%, last +1.3%): We estimate nonfarm productivity growth of -2.0% in Q3 (qoq saar), reflecting a larger increase in hours worked than in business output. We expect that Q3 unit labor costs—compensation per hour divided by output per hour—increased by 6.0%.

- 08:30 AM Trade Balance, September (GS -$80.1bn, consensus -$74.8bn, last -$73.3bn): We estimate that the trade deficit increased by $5.3bn to $80.1bn in September, reflecting a sharp decline in exports in the advanced goods report.

Friday, November 5

- 08:30 AM Nonfarm payroll employment, October (GS +525k, consensus +450k, last +194k); Private payroll employment, October (GS +500k, consensus +400k, last +317k); Average hourly earnings (mom), October (GS +0.5%, consensus +0.4%, last +0.6%); Average hourly earnings (yoy), October (GS +5.1%, consensus +4.9%, last +4.6%); Unemployment rate, October (GS 4.7%, consensus 4.7%, last 4.8%): We estimate nonfarm payrolls rose 525k in October following the disappointing 194k gain in September (mom sa). This report reflects the first full month of hiring following the expiration of federal enhanced unemployment benefits, and coupled with improving public health and strong labor demand, we expect this report to mark a step-up in trend. Big Data employment measures generally improved relative to September, and dining activity picked up further as Delta fears ebbed. We also expect education payrolls to reverse some of the 180k September decline (public and private), as schools gradually fill positions left open by the janitors and support staff who did not return for the fall school year. On the negative side, the seasonal factors may have evolved to fit the strong October 2020 data, raising the seasonal hurdle in this week’s report.

- We estimate a one-tenth drop in the unemployment rate to 4.7%, reflecting a strong household employment gain but a likely rebound in the labor force participation rate—the latter driven by expiring benefits, improving public health, and the easing of childcare constraints. We estimate a 0.5% rise in average hourly earnings (mom sa) that boosts the year-on-year rate by five tenths to 5.1%, reflecting continued wage pressures, positive calendar effects, and a pay raise at Wal-Mart.

Source: Deutsche Bank, BofA, Goldman

Tyler Durden

Mon, 11/01/2021 – 09:11

via ZeroHedge News https://ift.tt/3nK6vYJ Tyler Durden