Buying The Dip Is Suddenly A More Risky Business

By Michael Msika and Jan-Patrick Barnert, Bloomberg Markets Live commentators

A lot of investors finally have what they wished for: a chance to buy the dip. The problem is uncertainty is much higher now.

Friday’s selloff, fueled by the emergence of a new Covid-19 variant, brought a firm halt to the market’s exuberance of recent weeks. The Stoxx 600 Index is now more than 5% below its record closing high of mid-November, opening a window for those who have been awaiting weakness to add positions.

“Many investors had been complaining about ever-rising markets that give little entry opportunities,” says Martin Moeller, co-head of Swiss and global portfolio management at Union Bancaire Privee in Geneva. “Here is the next one shaping up, given that in 2022, the easing of supply chains and delayed execution of very strong prior order intake should be supportive for economic growth.”

But, is now the right time to buy? Prior to Friday’s developments, markets had become complacent about a potential resurgence of the virus, both from a fundamental and a technical standpoint. With a new mutation having emerged, much will depend on how it impacts society. A return to restrictions and lockdowns would be a cause for concern.

The probability of that increases with uncertainty over how effective vaccines will be on the new strain, says Peter Garnry, head of equity strategy at Saxo Bank. “As a result, traders are selling off physical companies in energy, mining, financials, and consumer discretionary against healthcare, utilities, and technology stocks,” he says.

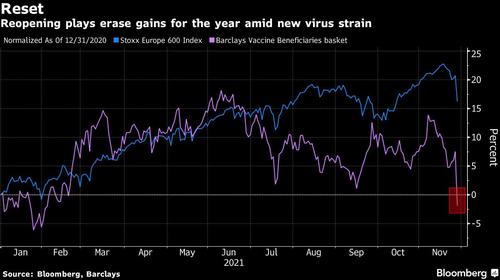

The potential impact can be seen in disarray among reopening plays. A Barclays basket of vaccine beneficiaries has now erased all gains for the year, while a Bloomberg gauge of airlines has dropped 21% in dollar terms and is close to erasing all induced gains since Pfizer and BioNTech announced their vaccine breakthrough a year ago.

All strategies are feeling the hit of the pullback, with styles from growth to cyclicals and value falling sharply. With the potential impact on economies, value stocks are now back to flat since March.

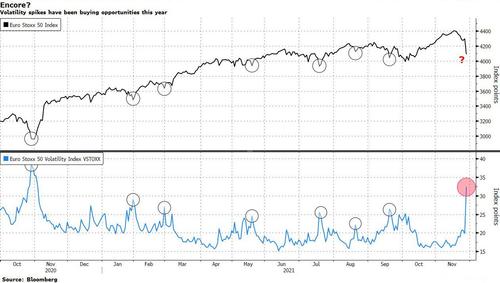

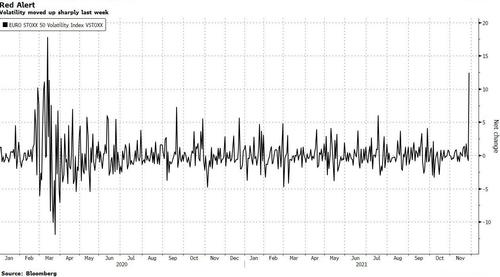

High levels of volatility and derivatives trading also points toward a loss of confidence among equity bulls. The VStoxx Index gained 51% at one point Friday, the biggest intraday jump since February 2020. And twice as many Euro Stoxx 50 put options were traded versus normal.

An increased need for downside protection may in itself lead to exaggerated market moves from here. For the S&P 500, market makers who sold puts may need to sell more futures to hedge themselves should the market fall further. By the same token, they may have to cover themselves the other way should stocks bounce back.

“We believe equity volatility will be the best asset class in 2022,” says Jefferies strategist Sean Darby. He expects “a further unwinding of flows from risky assets into safe assets after risk appetite reached seemingly insatiable levels.”

Tyler Durden

Mon, 11/29/2021 – 09:10

via ZeroHedge News https://ift.tt/3D3nkDA Tyler Durden