Kemp: European Gas Prices Jump Again As Freezing Temps Pressure Inventories

By John Kemp, Reuters Senior Market Analyst

Europe’s gas prices have started rising again as a colder-than-normal start to winter makes unusually large inroads into the already meagre volume of gas in storage.

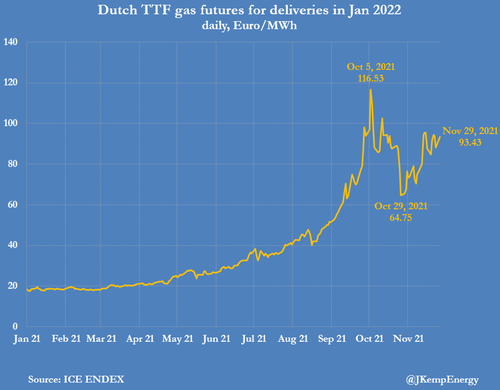

Futures prices for gas delivered in January 2022 via the Dutch Title Transfer Facility have climbed to more than 93 euros per megawatt-hour (MWh), up from a recent low of 65 euros a month ago. Previous market expectations Russia would begin large-scale gas deliveries to Europe via existing pipelines and the newly completed but not yet approved Nord Stream 2 have not been borne out.

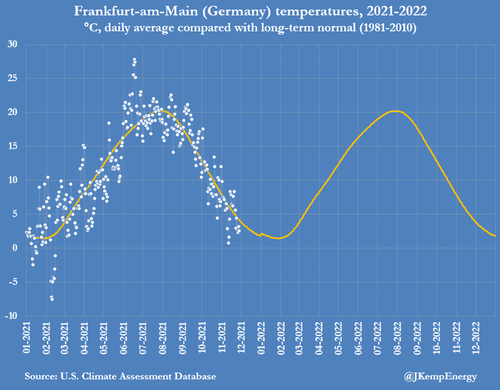

Instead the winter heating season has started with unusually low temperatures which have led to a big increase in demand for gas for heating and power generation (https://tmsnrt.rs/3cZ9qrp).

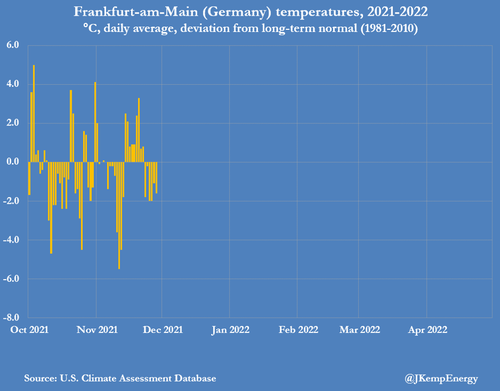

Northwest Europe has been hit by repeated waves of colder-than-average temperatures over the last two months, according to temperature records compiled by the U.S. Climate Assessment Database.

Daily temperatures at Frankfurt airport, a proxy for the major population centers of Northwest Europe, have averaged more than 0.4 degrees Celsius below the long-term seasonal average since the start of October.

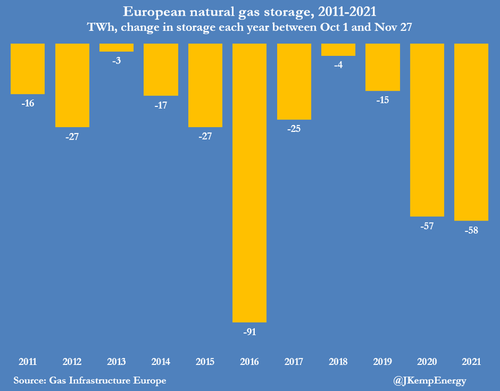

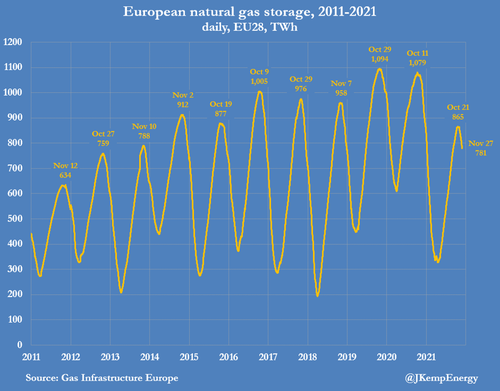

As a result, the volume of gas in storage across the 27 countries of the European Union and Britain has fallen by the equivalent of 58 terawatt-hours (TWh) compared with the start of October, one of the largest drawdowns over the last decade.

Gas stocks were already low going into winter, with volumes at the lowest level since 2013, according to Gas Infrastructure Europe.

The inventory position has failed to improve since then and stocks are still at the lowest level for the time of year since 2013.

Prices are rising again in an effort to slow the rate of inventory depletion by rationing demand from industrial users and power generators.

Europe’s energy crunch has not gone away, even if it has been displaced in the headlines by the new variant of coronavirus and the violent gyrations in oil prices. In consequence, the risk of a price spike if there is a sustained period of exceptionally cold temperatures between now and the end of February remains very high.

Tyler Durden

Tue, 11/30/2021 – 02:00

via ZeroHedge News https://ift.tt/3p6bhAg Tyler Durden