Rabobank: Brushing Up Our Greek Alphabets

By Michael Every of Rabobank

Brushing up our Greek alphabets

After a ‘sell first, ask questions later’ Friday, markets regained some confidence on Monday. News that Omicron may lead to relatively mild symptoms may have helped the mood, though much about the new strain still remains unclear, including how infectious it is compared to other variants and whether it requires updated vaccines. The health ministers of the G7 issued a joint statement that contained little new information on the strain, but did warn that it “requires urgent action”. European equities also defied news that Germany is now the next country to consider stricter measures to curb the rise in cases.

The risk-on tone weighed on fixed income, with 10y Bund yields rising 2bp on the day, though that reverses only part of Friday’s decline. And the German inflation numbers didn’t provide much support for Bunds either. High inflation was already expected, with a 5.5% consensus forecast. Nevertheless, the German HICP managed to surpass that, as prices rose 6.0% y/y in November. With similar inflation rates already observed in other European countries, including Spain (5.6%) and Belgium (5.6%), a high Eurozone-aggregate HICP today shouldn’t come as a surprise.

In addition to German inflation being higher than expected, it was also a bit more broad-based: certainly, energy was an important contributor, but clothing, furnishing and household equipment, and particularly recreation and culture -though notably a volatile component- also drove prices higher. Despite the wider base of inflationary pressures, that doesn’t take away from the fact that most of these effects are probably still temporary factors that result from the reopening of the economy, supply chain disruptions, and the changes to German VAT at the start of the year. Indeed, the Bundesbank had already warned for a near-6% inflation rate this month, and the ECB’s Isabel Schnabel stated in a TV interview that “November will prove to be the peak.”

Nikkei reported some reassuring news to that extent, noting that the supply chain disruptions in the auto sector are starting to ease. According to the newspaper, the global supply of chips used in the auto industry may finally be improving: “after months of shortages, inventories have risen for the first time in nine months.” While it may still take some time before shortages across the entire supply chain are resolved, this does suggest that some bottlenecks are indeed gradually easing, boding well for both price pressures and for the output of one of Germany’s key industries. That said, bear in mind that the chip shortages were at the forefront of the global disruptions; since then shortages in many other materials and sectors have followed.

The rebound in China’s manufacturing PMI may also offer some reassurance about the recovery of the global value chain. The headline recovered to an expansionary reading of 50.1, but this may understate the improvements in actual output, seeing that one of the main drags on this headline relates to a sharp decline in energy prices faced by manufacturers. This likely reflects the government’s interventions in the coal sector, boosting production. Bloomberg reports that the National Development and Reform Commission met with coal producers last week and that prices would have to be guided towards to a “reasonable range”.

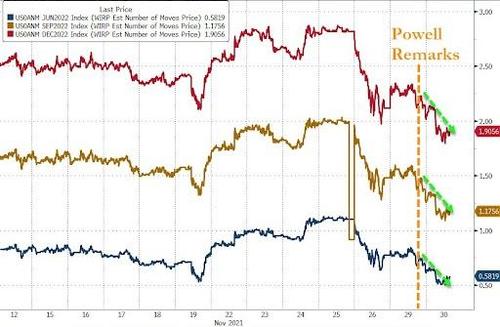

That is, of course, assuming that omicron does not throw a spanner in the works here. It certainly does make central bankers’ jobs that bit harder again. Fed Chair Powell said yesterday that the new strain, as well as the general rise in Covid-19 cases, poses downside risks to the full employment mandate and adds uncertainty to the inflation outlook. While he didn’t specifically mention any implications for the Fed’s current policy trajectory, it adds to the markets’ doubts whether the FOMC will still decide to accelerate the pace of tapering in its December meeting, and whether the market wasn’t too aggressive in its pricing of rate hikes next year. EUR/USD continues to find some support in this revaluation of potential for US policy moves.

Certainly, uncertainty also clouds the ECB’s decisive December meeting. However, with a more dovish starting point, that is less of a marked change. If anything, the European Central Bank may want to commit less in December, leaving more options open for earlier in the year when the Governing Council has more clarity on the outlook and omicron’s impact. A key case in point are Vice President De Guindos’ remarks on the TLTRO-IIIs this morning: he is clear that “the TLTROs are not finished yet”, confirming that -in his view- this year’s long-term liquidity providing operations certainly weren’t the last. However, he added that “it’s not going to be a decision we discuss in December”. Assuming that the future of (or rather after) PEPP will still be decided in December, that does put much more weight on the few other tools the ECB could use to mitigate the expected end of pandemic purchases. This could set markets up for an initial disappointment.

Tyler Durden

Tue, 11/30/2021 – 10:45

via ZeroHedge News https://ift.tt/3D7ESOQ Tyler Durden