Ferguson: Omicron Sounds The Death Knell For Globalization 2.0

Authored by Niall Ferguson, op-ed via Bloomberg.com,

On top of an intensifying cold war between the U.S. and China and other seismic changes, the rapid spread of Covid-19’s newest variant could finish off our most recent phase of global integration.

“Somewhere out there,” I wrote here two weeks ago, “may lurk what I grimly call the ‘omega variant’ of SARS-CoV-2: vaccine-evading, even more contagious than delta, equally or more deadly. According to the medical scientists I read and talk to … the probability of this nightmare scenario is very low, but it is not zero.”

Indeed. Little did I know, but even as I wrote those words something that appears to fit this description was spreading rapidly in South Africa’s Gauteng province: not the omega variant, but the omicron variant.

As I write today, major uncertainties remain, but what we know so far is not good. People are emotionally predisposed to look on the bright side — we are all sick of this pandemic and want it to be over — so it pains me to write this. Nevertheless, I’ll stick to my policy of applying history to the best available data, even if it means telling you what you really don’t want to hear.

First the data: South African cases were up 39% on Friday, to 16,055. The test positivity rate rose from 22.4% to 24.3%, suggesting that the true case number is rising even faster. A Lancet paper suggests that Omicron is likely by far the most transmissible variant yet. There are three possible explanations for this:

-

A higher intrinsic reproduction number (R0),

-

An advantage in “immune escape” to reinfect recovered people or evade vaccines, or

-

Both of the above.

An important preprint published on Dec. 2 pointed to immune escape. South Africa’s National Institute for Communicable Diseases has individualized data on all its 2.7 million confirmed cases of Covid-19 in the pandemic. From these, it identified 35,670 suspected reinfections. (Reinfection is defined as an individual testing positive for Covid-19 twice, at least 90 days apart.) Since mid-November, the daily number of reinfections in South Africa has jumped far faster than in any previous wave. In November, the hazard ratio was 2.39 for reinfection versus primary infection, meaning that recovered individuals were getting Covid at more than twice the rate of people who had never had Covid before. And this was when omicron made up less than a quarter of confirmed cases. By contrast, the same study found no statistically significant evidence that the beta and delta variants were capable of reinfection. And, crucially, at least some of these new infections are leading to serious illness. On Thursday, the number of Gauteng patients in intensive care for Covid almost doubled from 63 to 106.

Data from a private hospital network in South Africa that has over 240 patients hospitalized with Covid indicate that 32% of the hospitalized patients were fully vaccinated. Note that around three-quarters of the vaccinated in South Africa received the Pfizer Inc.-BioNTech SE vaccine. The rest got the Johnson & Johnson vaccine.

Yet these are not the data that worried me the most last week. Those had to do with children. Between Nov. 14 and 28, 455 people were admitted to hospital with Covid-19 in Tshwane metro area, one of the largest hospital systems in Gauteng. Seventy (15%) of those hospitalized were under the age of five; 117 (25%) were under 20. And this is not just a story of precautionary hospitalizations. Twenty of the 70 hospitalized toddlers progressed to “severe” Covid. Up until Oct. 23, before experts estimate omicron began circulating, under-fives represented only 1.8% of cumulative Covid hospital admissions in South Africa. As of Nov. 29, 10% of those now hospitalized in Tshwane were under the age of two.

If this trend holds as omicron spreads to advanced economies — and it is spreading very fast, confirming omicron’s high transmissibility — the market impact could be much bigger than is currently priced in. Unlike with the delta wave, many schools would return to hybrid instruction, parents would withdraw from the labor force to provide childcare and consumption patterns would again shift away from retail, hospitality and face-to-face services. Hospital systems would also face shortages of pediatric intensive care beds, which have not been much needed in prior Covid waves.

South Africa’s top medical advisor Waasila Jassat noted on Dec. 3 that hospitalizations on average are less severe than in previous waves and hospital stays are shorter. But she also noted a “sharp” increase in hospital admissions of under-fives. Children under 10 represent 11% of all hospital admissions reported since Dec. 1.

Here’s what we don’t know yet. We do not know how far prior infection and vaccination will protect against severe disease and death in northern hemisphere countries, where adult vaccination rates are much higher than in South Africa (just 24%). And we do not know if omicron will prove as aggressive toward children in those countries, especially the very young children we have not previously contemplated vaccinating. (Because South Africa has limited testing capacity, we do not know the total number of under-fives infected with omicron in Gauteng, so we do not know what percentage of children are falling sick.) We may not know these things for another week, possibly longer. So panic is not yet warranted. Nor, however, is wishful thinking. It may prove a huge wave of mild illness, signaling the final phase of the transition from pandemic to endemic. But we don’t know that yet.

Now the history.

First, it makes all the difference in the world whether or not children fall gravely ill in a pandemic. Covid has so far spared the very young to an extent rarely seen in the recorded history of respiratory disease pandemics. (The exception seems to be the 1889-90 “Russian flu,” which modern researchers suspect was in fact a coronavirus pandemic.) The great influenza pandemics of 1918-19 and 1957-58 killed the very young as well as the very old. The former also carried off young adults in the prime of life. The latter caused significant excess mortality among teenagers. Up until this point, Covid was the social Darwinist disease: It disproportionately killed the old, the sick and the gullible (the vulnerable people who allowed themselves to be persuaded that the vaccine was more dangerous than the virus).

A hundred years ago, many experts would have hailed such a disease for the same reasons they promoted eugenics. We think differently now. However, emotionally and rationally, we still dread the deaths of children much more than the old, the sick and the foolish. The moment children become seriously ill — as has already happened in Gauteng — the nature of the pandemic fundamentally alters. Risk aversion will be far higher in the Ferguson family, for example, if its youngest members are vulnerable for the first time.

The second historical point is that this may be how our age of globalization ends — in a very different way from its first incarnation just over a century ago. The first age of globalization, from the 1860s until 1914, ended with a bang, not a whimper, with the outbreak of World War I. Within a remarkably short space of time, that conflict halted trade, capital flows and migration between the combatant empires. Moreover, the war and its economic aftershocks strengthened and ultimately empowered new political movements, notably Bolshevism and fascism, that fundamentally repudiated free trade and free capital movements in favor of state control of the economy and autarky. By 1933, the outlook for liberal economic policies seemed so utterly hopeless that, in a lecture he gave in Dublin, even John Maynard Keynes threw in the towel and embraced economic self-sufficiency.

Now, there is an argument (made by my Bloomberg colleague and occasional editor James Gibney) that the pandemic will not kill globalization. I am not so sure. Defined too broadly, to include any kind cross-border interaction, the word loses its usefulness. Yes, there were all kinds of “transnational networks in science, health, entertainment,” as well as increasingly ambitious international agencies between the wars. But the fact that (for example) the Pan European movement was founded by Richard von Coudenhove-Kalergi in the 1920s does not mean that the subsequent decades were a triumph of European integration. There was a great deal of international cooperation and cross-border activity between 1939 and 1945, too. That does not mean that the 1940s were a time of globalization. For the word to be meaningful, globalization must refer to relatively higher volumes of trade, capital flows, migration flows and perhaps also cultural integration on a global scale.

On that basis, globalization peaked — or maybe “maxed out” would be more accurate — in around 2007. Calculate it how you like: Whether the ratio of global exports to GDP, the ratio of gross foreign assets to GDP, global or national migrant flows in relation to total population, they all tell the same story of a sustained rise of globalization hitting a peak around 14 years ago.

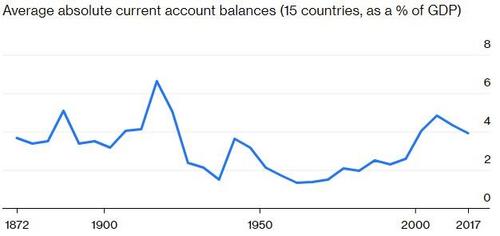

The economic historian Alan M. Taylor has long argued that we should measure globalization by looking at current account imbalances, which tell us when a lot of trade and lending are happening. On that basis, too, globalization peaked in 2007.

Even Before Covid, Trade and Lending Were Trending Down

Source: Our World in Data from Maurice Obstfeld and Alan M. Taylor, “Global Capital Markets: Integration, Crisis, and Growth,” Japan–US Center UFJ Bank Monographs on International Financial Markets; and International Monetary Fund, World Economic Outlook Database.

Note: The data shown is the average absolute current account balance (as a percentage of GDP) for 15 countries in five-year blocks. The countries in the sample are Argentina, Australia, Canada, Denmark, Finland, France, Germany, Italy, Japan, Netherlands, Norway, Spain, Sweden, U.K., U.S..

Since the financial crisis of 2008-9, however, the volume of world trade has flatlined relative to the volume of industrial production. The U.S. current account deficit peaked in the third quarter of 2006 at -6.3% of GDP. The latest read? -3.3%.

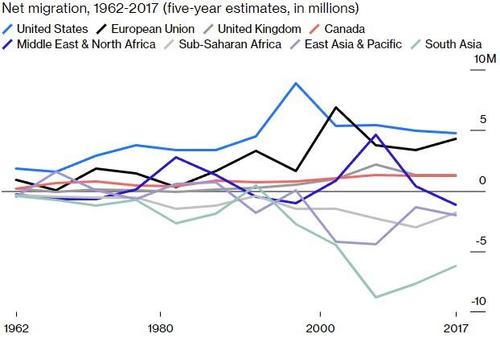

The same story emerges when one turns to migration. The foreign-born share of the U.S. population rose rapidly from its nadir in 1970 (4.7%) to a peak of 13.7% in 2019. But the rate of growth clearly slowed after 2012. It remains below its historic peak of 14.7%, back in 1890. Data for net migration similarly point to peaks prior to the financial crisis. Net emigration from South Asia peaked in 2007, for example. So did net immigration to the United Kingdom.

Not-So-Open Borders

Source: United Nations Population Division

What about cultural globalization? My guess is that peaked in 2012, which was the last year that imported films earned more at the Chinese box office than domestic productions. The highest-grossing movie in the history of the People’s Republic is this year’s “Battle of Lake Changjin,” a Korean War drama in which heroic Chinese troops take on the might of the U.S. Army—and win. (Watch the trailer. Then tell me globalization is going to be fine.)

What has caused globalization to recede? Let me offer a six-part answer.

First, global economic convergence. This may come as a surprise. An influential story over the past two decades was Branco Milanovic’s thesis that globalization had increased inequality. In particular, Milanovic argued in 2016 that “large real income gains [had] been made by people around the median of the global income distribution and by those in the global top 1%. However, there [had] been an absence of real income growth for people around the 80-85th percentiles of the global distribution.” He illustrated this argument with a famous “elephant chart” of cumulative income growth between 1988 and 2008 at each percentile of the global income distribution.

On closer inspection, the elephant was a statistical artifact. Strip out the data for Japan, the former Soviet Union and China, and the elephant vanishes. The story Milanovic’s chart told was of the decline of ex-Soviet and Japanese middle-class incomes following the collapse of the USSR and the bursting of Tokyo’s bubble in 1989-90, and the surge of Chinese middle-class incomes, especially after China’s entry into the World Trade Organization in 2001.

The real story of globalization turns out to be a sustained reduction in global inequality as Chinese incomes caught up rapidly with those in the rest of the world, combined with big increases in national inequality as the “one percent” in some (not all) countries got a whole lot richer. At the heart of globalization was what Moritz Schularick and I called “Chimerica”—the symbiosis between the Chinese and American economies that allowed American capital to take advantage of low-cost Chinese labor (offshoring or outsourcing), American borrowers to take advantage of abundant Chinese savings, and American consumers to take advantage of cheap Chinese manufactures.

It could not last. In 2003 Chinese unit labor costs were around a third of those in the U.S. By 2018 the two were essentially on a par. In that sense, the glory days of globalization were bound to be numbered. For as Chinese incomes rose, the rationale for relocating production to China was bound to become weaker.

Secondly, and at the same time, new technologies — robotics, three-dimensional printing, artificial intelligence — were rapidly reducing the importance of human labor in manufacturing. With the surge of online commerce and digital services, globalization entered a new phase in which data rather than goods and people crossed borders, even if the Great Firewall of China partly cordoned off China’s internet from the rest of the world’s.

Chimerica, as Schularick and I argued back in 2007, was in many ways a chimera — a monstrous creature with the potential to precipitate a crisis, not least by artificially depressing U.S. interest rates and inflating a real estate bubble. When that crisis struck in 2008-9, it was the third blow to globalization. For those who suffered the heaviest losses in the United States and elsewhere, it was not illogical to blame free trade and immigration. A 2015 study by the McKinsey Global Institute showed clearly that people in the U.S., U.K. and France who saw themselves as “not advancing and not hopeful about the future” were much more likely than more optimistic groups to blame “legal immigrants,” “the influx of foreign goods and services,” and “cheaper foreign labor” for, respectively, “ruining the culture and cohesiveness in our society,” “leading to domestic job losses” and “creating unfair competition to domestic businesses.”

The only surprising thing was that these feelings took as long as seven years to manifest themselves as an organized political backlash against globalization, in the form of Britain’s vote to exit the European Union and America’s vote for Donald Trump. Dani Rodrik’s famous trilemma — which postulated that you could have any two of globalization, democracy and sovereignty — was emphatically answered in 2016: Voters chose democracy and sovereignty over globalization. This was the fourth strike against “the globalists,” a term invented by the populists to give globalization a more easily hateable human face.

The financial crisis and the populist backlash didn’t sound the death knell for globalization. They merely dialed it back — hence the plateau in trade relative to manufacturing and the modest decline (not collapse) of international capital flows and migration. The fifth blow was the outbreak of Cold War II, which should probably be dated from Vice President Mike Pence’s October 2018 Hudson Institute speech, the first time the Trump administration had taken its anti-Chinese policy beyond the confines of the president’s quixotic trade war (which only modestly reduced the bilateral U.S.-Chinese trade deficit).

Not everyone has come to terms with this new cold war. Joseph Nye (and the administration of President Joe Biden) would still like to believe that the U.S. and China are frenemies engaged in “coopetition.” But Hal Brands and John Lewis Gaddis, John Mearsheimer and Matt Turpin have all come round to my view that this is a cold war — not identical to the last one, but as similar to it as World War II was to World War I. The only question worth debating is whether or not, as in 1950, cold war turns hot. There is no Thucydidean law that says this is inevitable, as Graham Allison has shown. But I agree with Mearsheimer: The risk of a hot war in Cold War II may actually be higher than in Cold War I. Nothing would kill globalization faster than the outbreak of a superpower war over Taiwan. (And “The Battle of Lake Changjin” is blatantly psyching Chinese cinemagoers up for such a conflict.)

The decoupling of the U.S. and Chinese economies would almost certainly have continued even if the sixth blow — the Covid pandemic — had not struck. It has been astounding how little the Biden administration has changed of its predecessor’s China strategy. However, the pandemic has delivered the coup de grace — “a brutal end to the second age of globalization,” as Nicholas Eberstadt put it last year.

True, the volume of merchandise trade has recovered even more rapidly in 2021 than the World Trade Organization anticipated back in March. But the emergence of a new, contagious and lethal coronavirus has caused a collapse of international travel and tourism. The number of passengers carried by the global airline industry plunged by 60% in 2020. It will be not much better than 50% of its pre-pandemic level this year. International tourist arrivals are down by even more this year than last year — close to 80% below their 2019 level. In Asia, international tourism has all but ceased to exist this year.

Meanwhile, both the U.S. and the Chinese governments keep devising new ways to discourage their nationals from investing in the rival superpower. Didi Global Inc., the Chinese Uber, just announced it is delisting its shares from the New York Stock Exchange. And the pressure mounts on Wall Street financiers — as Bridgewater Associates founder Ray Dalio discovered last week — to wind up their “long China” trade and stop turning a blind eye to genocide in Xinjiang and other human rights abuses. Next up: the campaign to boycott the 2022 Winter Olympics in Beijing.

Strikingly, a growing number of Western sports stars and organizations such as the Women’s Tennis Association are already willing to defy Beijing — in the case of the WTA by suspending tournaments in China in response to the disappearance of the tennis star Peng Shuai, who accused a senior Communist Party official of sexually assaulting her. China’s leaders should be even more worried by a recent Chicago Council of World Affairs poll, which showed that just over half of Americans (52%) favor using U.S. troops to defend Taiwan if China invades the island — the highest share ever recorded in surveys dating back to 1982.

Last month I asked a leading American lawmaker how he explained the marked growth in public hostility toward the Chinese government. His answer was simple: “People blame China for Covid.” And not without reason, as Matt Ridley’s new book “Viral” makes clear.

For the avoidance of doubt, I do not foresee as complete a collapse of globalization as happened after 1914. Globalization 2.0 seems to be going out with a whimper — or perhaps a persistent cough — rather than with a bang. Income convergence and technological change were bound to reduce its utility. Having overshot by 2007, globalization settled at a lower level after the financial crisis and was less damaged by populist policies like tariffs than might have been anticipated. But the advent of Cold War II and Covid-19 struck two severe blows. How far globalization is rolled back depends on how far the two phenomena persist or worsen.

Maybe — let us pray — the alarming data from Gauteng will not imply a major new wave of illness and death in the wider world. Maybe the omicron variant will not, after all, be that nightmare variant I have feared: more infectious, more lethal, vaccine-evading, not ageist.

But omicron is only the 15th letter in the Greek alphabet. In all of Africa only 7.3% of the population are fully vaccinated and there are countless immunocompromised individuals with HIV. Even if omicron turns out to be, like delta, a variant we can live with, there is still some non-zero chance that at some point we get my “omega variant.” In that scenario, the pandemic does not oblige us, weary as we are of it, by ending, but recurs in a succession of waves extending for years. One begins to wonder if China will ever lift its stringent restrictions on foreign visitors. Under such circumstances, I see little chance of Cold War II reaching the détente phase earlier than Cold War I.

In addition to applying history, I have come to believe that we should also apply science fiction, on the principle that its authors are professionally incentivized to envision plausibly the impact of social, technological and other changes on the future. (Fact: an Italian sci-film called “Omicron,” in which an alien takes over a human body, was released in 1963.) No living author is better at this kind of thing than Neal Stephenson, whose “Snow Crash” coined the word “metaverse,” and whom I got to know — appropriately via Zoom — through my friends at the Santa Fe Institute.

When Stephenson and I met for a late-night Scotch at a bar in Seattle a few weeks back, we swiftly found common ground. Never have I seen a longer list of wines and spirits: We could have scrolled down on the iPad the server handed us for an hour and still not reached the end. Eventually, we found the malt whisky. And immediately we agreed: Laphroaig — the standard 10-year-old version.

Stephenson’s latest novel is “Termination Shock.” Buy it. You will be catapulted into a future Texas of intolerable heat, man-eating hogs, and other nightmares, the effect of which will be to make your present circumstances seem quite tolerable. Part of Stephenson’s genius is his use of the throwaway detail.

“RVs,” he writes, were “already at a premium because of Covid-19, Covid-23 and Covid-27.”

It’s not really part of the plot, but it stopped my eyeballs in their tracks. And remember: He predicted the metaverse. In 1992.

Tyler Durden

Mon, 12/06/2021 – 05:00

via ZeroHedge News https://ift.tt/3xYm1ET Tyler Durden