Key Events This Week: CPI, Jolts And Consumer Confidence

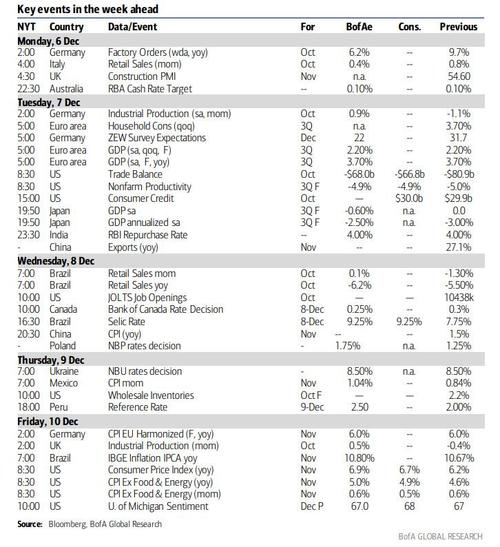

In the traditional post-payrolls lull, this week the focus will be on the US CPI inflation, job openings, consumer confidence and trade balance. There is a monetary policy meeting in Australia and Canada, while the US in blackout mode ahead of next week’s FOMC meeting. GDP data in the Euro area and Japan. In Emerging Markets, there are monetary policy meetings in Brazil, India, Poland, Ukraine and Peru. CPI and exports data in China.

The rest of the week ahead is published in the day by day calendar at the end but the other key events are the RBA (Tuesday) and BoC (Wednesday) after the big market disruptions post their previous meetings, Chinese CPI and PPI (Thursday), final German CPI (Friday) and the US UoM consumer confidence (Friday). Also look out for Congressional newsflow on how the year-end debt ceiling issue will get resolved and also on any progress in the Senate on the “build back better” bill which they want to get through before year-end. Mr Manchin remains the main powerbroker.

Courtesy of DB, here is a day-by-day calendar of events:

Monday December 6

- Data: Italy October retail sales, Germany October factory orders, Germany and UK November construction PMI

- Central Banks: BoE’s Broadbent speaks

Tuesday December 7

- Data: Japan October leading index, balance of payments, final 3Q GDP, Eurozone final 3Q GDP, Germany October industrial production and ZEW survey, US trade balance

- Central Banks: RBA monetary policy decision

Wednesday December 8

- Data: Japan November money stock, Russia November CPI, US MBA mortgage applications, October JOLTS job openings

- Central Banks: Reserve Bank of India, Bank of Canada, and Banco do Brasil monetary policy decisions

Thursday December 9

- Data: China November CPI and PPI, Japan November PPI, Germany October current account balance, US weekly initial jobless claims

Friday December 10

- Data: Germany final November CPI, Italy October industrial production, UK October monthly GDP, industrial production, and trade balance, US November CPI and University of Michigan surveys

Finally, focusing on just the US, the key economic data release this week is CPI on Friday. There are no speaking engagements from Fed officials this week, reflecting the FOMC blackout period.

Monday, December 6

- There are no major economic data releases scheduled.

Tuesday, December 7

- 08:30 AM Nonfarm productivity, Q3 final (GS -4.9%, consensus -4.9%, last -5.0%); Unit labor costs, Q3 final (GS +8.3%, consensus +8.3%, last +8.3%): We estimate nonfarm productivity growth was revised up to -4.9% in Q3 (qoq ar) following last week’s GDP report. We expect that Q3 unit labor costs—compensation per hour divided by output per hour—were unchanged at +8.3% (qoq ar).

- 08:30 AM Trade Balance, October (GS -$67.5bn, consensus -$66.9bn, last -$80.9bn): We estimate that the trade deficit decreased by $13.4bn to $67.5bn in October, reflecting a sharp increase in exports in the advanced goods report.

Wednesday, December 8

- 10:00 AM JOLTS Job Openings, October (consensus 10,500k, last 10,438k)

Thursday, December 9

- 08:30 AM Initial jobless claims, week ended December 4 (GS 200k, consensus 225k, last 222k); Continuing jobless claims, week ended November 27 (consensus 1,910k, last 1,956k): We estimate initial jobless claims declined to 200k in the week ended December 4.

- 08:30 AM Wholesale inventories, October final (consensus +2.2%, last +2.2%)

Friday, December 10

- 08:30 AM CPI (mom), November (GS +0.82%, consensus +0.7%, last +0.9%); Core CPI (mom), November (GS +0.60%, consensus +0.5%, last +0.6%); CPI (yoy), November (GS +6.90%, consensus +6.7%, last +6.2%); Core CPI (yoy), November (GS +5.01%, consensus +4.9%, last +4.6%): We estimate a 0.60% increase in November core CPI (mom sa), which would boost the year-on-year by 0.4pp to 5.0%. Our forecast reflects a further rise in used car auction prices, a rebound in airfares, and upward pressure on most core goods categories due to supply chain bottlenecks and low promotionality during the holiday season. A Netflix price increase is also likely to boost inflation in the recreation services category. We also expect another strong gain in health insurance prices reflecting the gradual flow-through of the annual source data. We estimate rent +0.42% and OER +0.38%, reflecting the strength in our shelter tracker but an OER drag from imputed utilities. We estimate a 0.82% increase in headline CPI (mom sa), reflecting higher restaurant, grocery, and energy prices.

- 10:00 AM University of Michigan consumer sentiment, December preliminary (GS 68.4, consensus 68.0, last 67.4): We expect the University of Michigan consumer sentiment index rose by 1pt to 68.4 in the preliminary December reading, as other confidence measures increased slightly relative to their November average.

Source: DB, BofA, Goldman

Tyler Durden

Mon, 12/06/2021 – 09:37

via ZeroHedge News https://ift.tt/3rJGegH Tyler Durden