China 10-Year Yields Plunge To 18 Month Low On Surging Easing Expectations, Liquidity Injections

The PBOC held its Q4 monetary policy committee meeting last Friday, December 24th, with the meeting statement released on the evening of 25th December. The PBOC’s Q4 MPC meeting echoed Beijing’s new stance at the recent Central Economic Working Conference (CEWC) – it emphasized policymakers would step up support to the real economy, a reversal from the austere approach that marked much of the post-covid era.

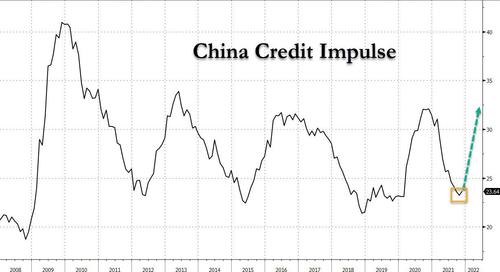

Compared with the Q3 PBOC monetary policy committee meeting statement, the Q4 statement turned more cautious on its growth outlook, indicated an intention to use broad and targeted policy tools to support the real economy in a more pro-active manner (i.e., was more pro growth), and on the margin eased its tone on the property sector. However, these new changes were in line with key messages from the recent CEWC, signaling more policy easing measures underway. It also stated an intention to increase the use of structural monetary policies, especially favoring SMEs, high-tech sectors and green industries. Coming just as China’s credit impulse has bottomed…

… we are confident that Beijing’s new stimulative approach, will mean much more reflationary tailwinds in 2022.

Meanwhile, as Goldman notes, the PBOC continued to call for a boost in domestic demand, a lowering of the average financing costs for firms, increasing policy coordination among ministries, and keeping the economy growing in a reasonable range.

Below are several key points from the Chinese central bank statement:

- On growth outlook, in the Q4 statement, the PBOC dropped its judgement that “the overall economy continues to recover” from Q3, and echoed the CEWC stance to emphasize the “three types of downward pressure” the economy is facing: i.e., contracting demand, supply-side shocks and weakening market expectations. Besides, PBOC continue to believe the external environment has become more complex and uncertain.

- On policy stance, the PBOC reiterated the need to “keep liquidity conditions reasonably adequate, increase the stability of credit growth, keep M2 and aggregate financing growth largely in line with nominal GDP growth, maintain a broadly stable macro leverage and lower the financing costs for the corporate sector”, the same wordings as the Q3 meeting. PBOC further added its intention “to strengthen cross-cycle policy adjustments, combined with counter-cyclical adjustments” and required monetary policy to be more pro-active (a new phrase in the statement), forward-looking, precise, and independent, in an effort to better support the real economy. PBOC also stated it would proactively increase the use of structural monetary policy tools, and guide financial institutions to better support SMEs, high-tech sectors and green industries.

- On the RMB, the PBOC’s tone remained unchanged from its Q3 statement, as it continued to require increasing flexibility of the RMB exchange rate, striking a good balance between internal and external equilibrium, and keeping the RMB exchange rate basically stable at a reasonable equilibrium level.

- On the property sector, in the Q4 statement, the PBOC said it would safeguard the lawful rights of housing consumers, better meet the reasonable housing demand from homebuyers, and promote the healthy development and a virtuous circle in the property markets. By comparison, in Q3, it only stated to safeguard the healthy development of the property markets and lawful rights of housing consumers.

- In line with the CEWC, the PBOC reiterated the importance to ensure “Six Stabilities” and “Six Guarantees” (i.e., stability in employment, financial operations, foreign trade, foreign investment, domestic investment, and expectations; guaranteeing job security, basic living needs, operations of market entities, food and energy security, stable industrial and supply chains, and the normal functioning of primary-level governments). Meanwhile, unchanged from its Q3 statement, the PBOC called for strengthening the coordination with fiscal, industrial and regulatory policies, better planning and implementing financial policies to support growth and contain risk, and keeping the economy growing in a reasonable range, “in preparation for the 20th National Congress of the Chinese Communist Party (NCCCP)”.

The Q4 monetary policy meeting statement is consistent with our repeated prediction of much more monetary policy easing, which has been validated in recent weeks with the recent RRR cut and modest trim in Loan Prime Rate (i.e., China’s “Libor”). That, however, is not enough and we expect the central bank to inject even more long-term liquidity via RRR cuts (at least one more cut in Q1 2022) and various lending facilities, on-budget fiscal expenditures to be more supportive to growth compared with 2021, and local governments to ease property policies at local levels.

That said, headwinds to growth will remain, as the property market continues to cool, the zero-Covid strategy drags on consumption amid recurring Covid waves (especially the latest breakout in Xian), and Beijing’s anti-pollution measures prior to the Winter Olympic Games early next year could also weigh on industrial production.

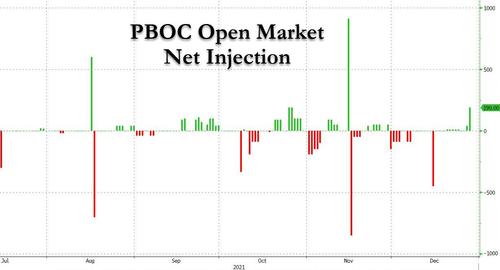

And perhaps just to signal how much more easing is coming, on Tuesday morning the People’s Bank of China boosted its injection of short-term liquidity into the financial system to 190 billion yuan ($29.8 billion), the most in two months.

The short-term liquidity boosting operation pushed an indicator for interbank rates lower, after it soared the most in a year in the previous session. The drop in interbank borrowing costs also pushed yields on China’s 10-year sovereign bonds to the lowest level since June 2020. The government yields have been trending down since mid-December in the wake of a reserve-requirement ratio cut by the PBOC and a marginal reduction in the loan prime rate earlier this month.

Speaking to Bloomberg, Mitul Kotecha, chief emerging markets Asia & Europe strategist at TD Securities, said that there is “more room for bond yields to decline in the weeks ahead,” adding that “markets are expecting this to be followed up into next year with more liquidity provision, and lower interbank rates feeding into positive sentiment for bonds.”

In any case, many more easing measures are expected in the near term – just as Western central banks overtighten into a global slowdown – with the Chinese economy showing strain from a property slump, weak private consumption and sporadic virus outbreaks.

Tyler Durden

Tue, 12/28/2021 – 12:21

via ZeroHedge News https://ift.tt/3sFutIA Tyler Durden