Bitcoin & Bonds Battered, Tech Tumbles, As COVID Cases Hit Record

Bitcoin & bonds stole the market headlines today along with COVID (Omicold) cases soaring and deaths tumbling as Europe came back to work from the Xmas break…

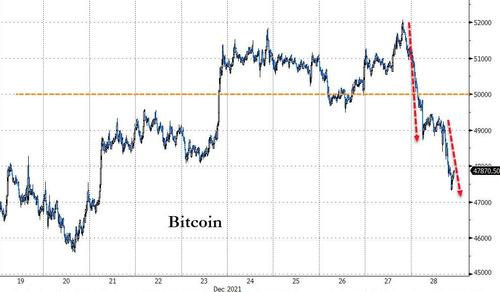

Cryptos started their decline in Asia (again) and the US session dragged it down further…

Source: Bloomberg

Bitcoin tumbled back below $50k…

Source: Bloomberg

But the drop stopped at the 200DMA, where it bounced back up to $48k…

Source: Bloomberg

Bond were chaotic too with early strength suddenly reversed leaving the long-end underperforming and short-end unch. The lack of liquidity is very evident in the 30Y yield’s moves which perfectly tagged high and low stops…

Source: Bloomberg

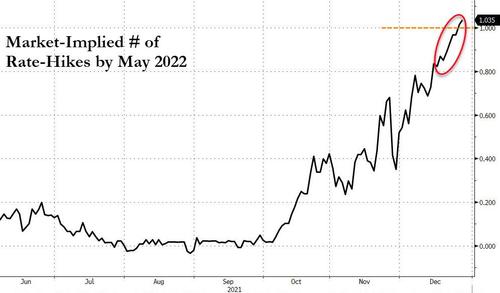

At the other end of the curve, STIRs shifted even more hawkishly, with a full rate-hike now priced in for May 2022…

Source: Bloomberg

Stocks were supported early by the headlines that the CDC relaxed the quarantine guidelines for people with COVID-19 yesterday, reducing the number of days in isolation from 10 to 5 – another potential sign we may be transitioning to ‘living with virus’ normalization, but as the cash market opened Small Caps and Big Tech were dumped while The Dow pumped. By the cash close, after a determined selling effort in the last 5 mins (biggest negative TICK in a week) as a slew of headline shit from Bowl game cancellations, AMD avoiding CES, Pentagon covid restrictions tightened, and US warships staying in the med, the S&P ended red, Dow small green, and Nasdaq and Russell 2000 lower…

Small Caps are glued around their 100- and 200-DMA once again…

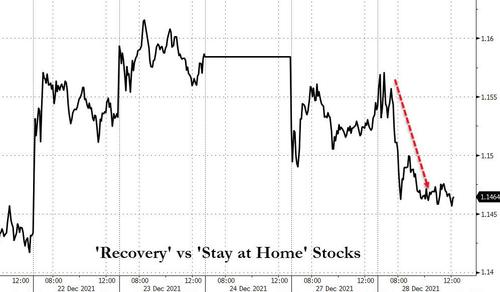

Interestingly, ‘recovery’ stocks underperformed the ‘stay at home’ stocks today, perhaps as the number of cruise ships with covid outbreaks spooked some…

Source: Bloomberg

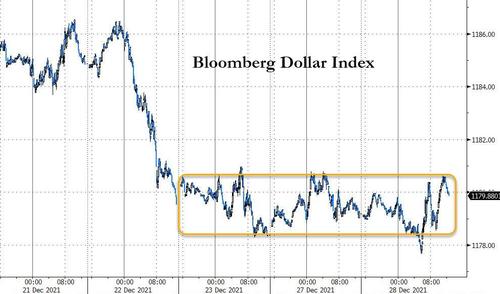

The dollar trod water for the second day…

Source: Bloomberg

Commodities were mixed today with crude and copper up and PMs down/flat…

Source: Bloomberg

Finally, all of these market moves come against a background of global COVID cases hitting a daily record on Monday, disrupting the holiday season a year after vaccines first started rolling out and two years after the emergence of the virus that many hoped would be fleeting. The seven-day rolling average of cases on Monday stood at about 841,000, a jump of 49% from a month ago when omicron was first identified in southern Africa.

Source: Bloomberg

The silver lining is that daily COVID deaths haven’t significantly increased as ‘Omicold’ spreads and the pandemic is over.

Tyler Durden

Tue, 12/28/2021 – 16:01

via ZeroHedge News https://ift.tt/3FFOMJG Tyler Durden