Despite Soaring Inflation, US Consumer Are Googling “Cheap” At The Lowest Rate In 2 Years

Submitted by Nicholas Colas of DataTrek

An update on what we’ve been calling the strangest Google search volume charts out there: US consumer searches for the words “cheap”, “coupon” and “discount”. They are strange because, despite fast-rising inflation, search volumes for each are declining.

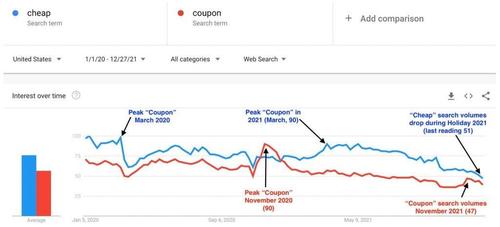

Here is the Google Trends chart showing search volumes for the words “cheap” (blue line) and “coupon” (red line) from January 2020 to now.

- As noted in the chart, searches for “cheap” hit their peak at the start of the pandemic (March 2020) and saw similar levels in March 2021 as inflation started to become evident. Since then, however, search volumes for “cheap” have come down almost 50 percent. Even holiday shopping couldn’t get consumers interested in finding lower-priced gift options.

- “Coupon” search volumes, which would include any sort of online coupon, look very similar to “cheap”. The peak came around Holiday 2020, but search volumes during Holiday 2021 were barely half those.

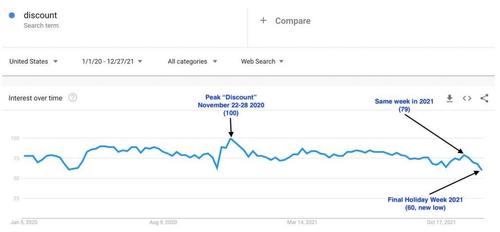

And here are US search volumes for “discount” over the same 2-year timeframe. The peak was in the 2020 Black Friday week, with search volumes down 21 percent during 2021’s final week of November. Searches for “discount” just made a 2-year low, as noted on the rightmost part of the graph.

Takeaway (1): as much as US consumers may think about inflation (and numerous surveys show they clearly do), they are not yet responding to higher prices by seeking out better deals. We think there are 2 reasons for that. First, Google Trends data is an aggregate reading and since overall US employment/wage growth has improved in 2021 it is reasonable to expect fewer searches for lower-priced goods and services. Second, that same employment/wage growth makes it easier for consumers to afford higher prices. Adding words like “cheap”, “coupon” and “discount” to their online searches is not yet necessary.

Takeaway (2): this is good news for US corporate earnings power, especially among larger companies which also enjoy economies of scale and scope. Consumers may complain about inflation, but they don’t seem to be changing their buying habits very much. This allows companies to pass through cost structure inflation, preserving margins and returns on capital. We don’t expect this phenomenon to last forever, but it is certainly in place as we start 2022.

Tyler Durden

Thu, 12/30/2021 – 10:47

via ZeroHedge News https://ift.tt/3EHiooP Tyler Durden