Stocks Skid, Bonds Bid As Musk Mulls Imminent Recession

Elon Musk predicts a recession by 2023:

“Predicting macroeconomics is challenging, to say the least. My gut feel is maybe around spring or summer 2022, but not later than 2023”

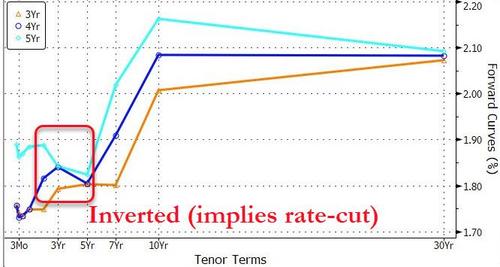

The market also predicts some kind of policy reversion, but more like 3-5 years out…

Source: Bloomberg

Some late-day selling after Musk’s comments ruined the party as The Dow ended its win-streak and the S&P failed to close at a 71st record high for the year. Small Caps desperately tried to hold on to gains…

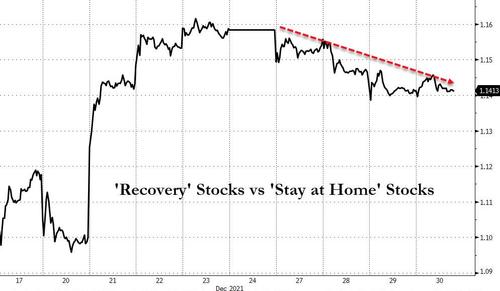

Recovery stocks underperformed modestly once again…

Source: Bloomberg

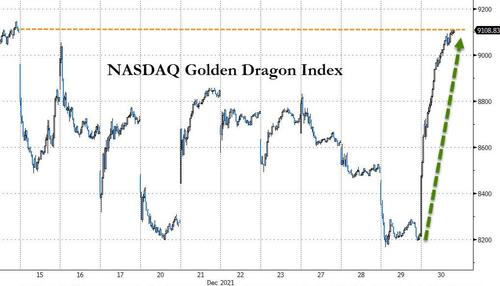

Chinese stocks soared today for no good reason today with Nasdaq Dragon up more than 10% – the biggest daily gain since 2008…

Source: Bloomberg

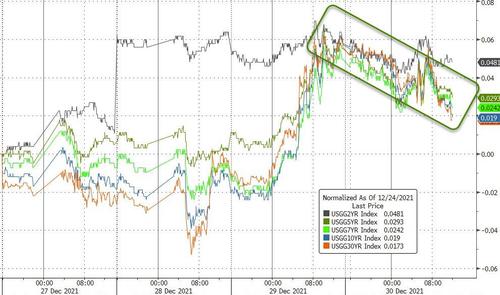

Treasury yields all slipped lower today with the long-end outperforming (30Y -4bps, 2y -1bp)…

Source: Bloomberg

10Y Remains above 1.50% for now but we note 30Y stalled perfectly at the pre-Omicron level and was bid today…

Source: Bloomberg

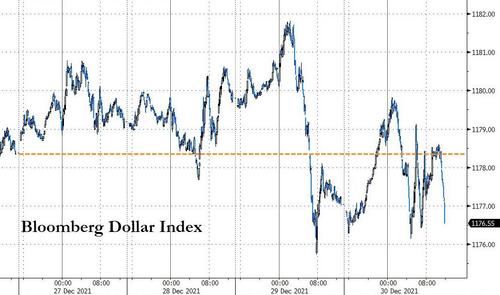

The Dollar chopped around today but ended very marginally lower…

Source: Bloomberg

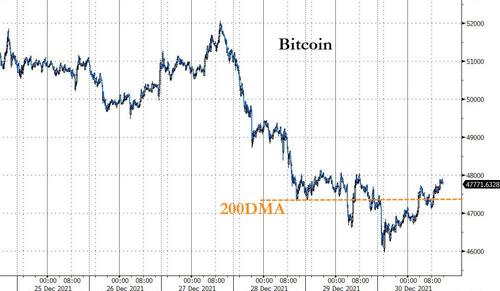

Bitcoin continued to hover around the 200DMA…

Source: Bloomberg

Commodities ended higher with silver back in the green on the week while Oil is easily leading…

Finally, a warning. As Bloomberg notes, the S&P 500 hasn’t dipped below its 200-day moving average on an intraday basis at all this year, a feat that has only happened four other times since 1981.

In the year following each of those occurrences, the S&P 500 fell by an average of 0.7% including declines of 6.2% in 2018, 1.5% in 1994 and 6.6% in 1990. The gauge’s 11.4% gain in 2014 is the only time it saw a positive return.

Tyler Durden

Thu, 12/30/2021 – 16:00

via ZeroHedge News https://ift.tt/3pFISTd Tyler Durden