Revisiting 2021’s Themes

Goldman Sachs has unleashed its annual ‘themes of the year’ crossword, but before we dive into that, the following six quotes seemed to sum things up rather well:

“The volatility in individual stocks driven by casino-like trading is a by-product of a culture of extreme risk-taking… But today’s investors also don’t necessarily understand the amount of risk that they’re taking.”

– Arthur Levitt, Former Chair, US Securities and Exchange Commission

“All major commodity bull markets and inflationary episodes have been invariably tied to re-distributional, or populist, policies that have reduced income and wealth inequality.”

– Jeff Currie, GS Global Head of Commodities Research

“A core group of crypto people see this as – and I quote from the Blue Brothers here – “a mission from god”… They will never sell. And because of that, bitcoin and ether can’t go to zero.”

– Michael Novogratz, Co-Founder and CEO, Galaxy Digital Holdings

“The pandemic compressed about 20 years of change into 20 weeks, marking the biggest shift in the way people work since WWII.”

– Erik Brynjolfsson, Professor, Stanford Institute for Human-Centered AI

“Europe has seldom missed an opportunity to miss an opportunity over the last decade.”

– Timothy Garton Ash, Professor, University of Oxford

“The Fed’s delayed and slow reaction to inflationary pressures has unfortunately increased the probability that it will have to slam on the brakes by raising rates very quickly after tapering and at a more aggressive pace than it would have if it started to tighten policy earlier.”

– Mohamed A. El-Erian, President, Queens’ College, Cambridge University

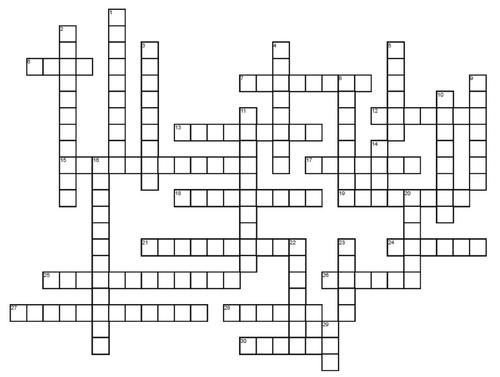

Now, get to scribbling:

* * *

Across:

6. Nicholas Bloom, Professor of Economics at Stanford University, finds that about _______ of all working days were spent working from home during the height of the pandemic (Issue 100).

7. Christian Mueller-Glissmann, GS Senior Multi-Asset Strategist, has found that _______ portfolios often suffer during or after periods of high and rising inflation (Issue 97).

12. In the process of going public, a SPAC sells units consisting of a common share and a fractional _______ , with each whole _______ allowing an investor to purchase one common share (Issue 95).

13. According to George Magnus, Associate at the China Center, Oxford University, President Xi Jinping’s personal agenda is to revamp the party-centered China model to put _______ back into the phrase ” _______ with Chinese characteristics” (Issue 101).

15. Mohamed A. El-Erian, Chief Economic Advisor at Allianz, argues that survey-based inflation _______ are not well anchored, as both short and long-term _______ have risen lately (Issue 103).

17. The _______ Inflation Targeting framework was adopted by the Fed at the 2020 Jackson Hole Symposium (Issue 97).

18. Enrico Moretti, Professor of Economics at the University of California, Berkeley, argues that pandemic-related shifts in work are unlikely to cause a permanent shift in the economic _______ of the US (Issue 100).

19. David Brady, Professor of Political Economy at the Stanford Graduate School of Business, argues that the Senate tends to be more _______ than the House, and this more _______ tendency is apparent in the historic pattern of failed legislation (Issue 99).

21. _______ are the building blocks of technology, and are central inputs in many everyday devices (Issue 103).

24. Jeff Currie, GS Global Head of Commodities Research, argues that a _______ tax/price is the most efficient way to solve climate change (Issue 104).

25. In order to be approved to receive funds from the EU Recovery Fund, EU member states must commit to spending a minimum of 20% of expenditures on _______ (Issue 102).

26. Dean Baker, Co-Founder of the Center for Economic Policy Research, believes that there has been a permanent shift in thinking about the role of _______ policy in supporting the economy (Issue 99).

27. Political _______ in the US has increased over the past several decades as both the Democratic and Republican parties have become more ideological (Issue 99).

28. A Special Purpose Acquisition Company (SPAC) takes a company public through a _______ (Issue 95).

30. Nouriel Roubini, Professor of Economics at NYU’s Stern School of Business, doesn’t believe that cryptocurrencies are _______ , because cryptocurrencies have no income or utility that can be used to determine their fundamental value (Issue 98).

Down:

1. According to Michele Della Vigna, GS Head of Energy Industry Research, capital markets are driving de-carbonization through a _______ in the cost of capital between high and low carbon investments (Issue 104).

2. Jan Hatzius, GS Head of GIR and Chief Economist, doesn’t find the discussion of _______ very illuminating in the context of one-off spending increases, because _______ are a longer-run concept (Issue 97).

3. According to Romano Prodi, former Prime Minister of Italy and former President of the European Commission, _______ is the biggest obstacle to further EU integration (Issue 102).

4. Michael Klausner, Professor of Business and Professor of Law at Stanford Law School, believes that the shareholder _______ inherent in the structure of SPACs has made them a bad deal for post-merger investors (Issue 95).

5. A wage-price _______ occurs when wage increases lead to prices increases, which in turn lead to further wage increases (Issue 103).

8. Many Decentralized Finance (DeFi) applications currently live on this network (Issue 98).

9. Michael Novogratz, CEO of Galaxy Digital Holdings, believes that _______ adoption and the macro factors behind it are a mega bull trend (Issue 98).

10. A-Shares, which are RMB-traded shares of China-based companies, represent the _______ of China’s equity market (Issue 101).

11. A change of the _______ Treaty is required for a permanent change of EU fiscal rules (Issue 102).

14. David Li, Professor at Tsinghua University, notes that China still has significant work to do to catch up with other countries in _______ technologies, like high-quality electronic components (Issue 101).

16. Erik Brynjolfsson, Professor at the Stanford Institute for Human-Centered AI, believes that despite the big jump in _______ over the course of the pandemic, the opportunities that technologies like AI and machine learning offer mean that we’re not even close to seeing peak _______ (Issue 100).

20. Evidence suggests that the volume and impact of _______ trading has grown a lot since the advent of widespread commission-free trading (Issue 96).

22. A short _______ occurs when the price of a heavily-shorted security moves sharply higher, forcing short-sellers to buy it back in order to cover their position (Issue 96).

23. Arthur Levitt, former chair of the SEC, and Owen Lamont, Associate Director of Multi-Asset Research for Wellington Management’s Quantitative Investment Group, believe that despite a perception that short-sellers create volatility, they actually play a vital role in _______ discovery (Issue 96).

29. Chris James, Founder and Executive Chairman of Engine No. 1, has found a clear linkage between _______ criteria and a company’s ability to create value over the long term (Issue 104).

* * *

Good luck

.

.

.

.

.

Tyler Durden

Thu, 12/30/2021 – 18:40

via ZeroHedge News https://ift.tt/3HnU7Wr Tyler Durden