Cryptos & Crude Soar As Stocks End 2021 At Most Expensive Level Ever

Biden ‘outperformed’ Trump in terms of the number of Americans who died from/with COVID under his watch…

Source: Bloomberg

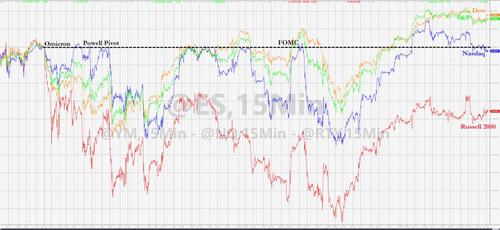

Despite more deaths, more cases, and a lack of the big stimmy BBB deal, all the major US equity indices were upon the year with Trannies leading the way (and Small Caps lagging, but still up over 14%)…

Source: Bloomberg

For some recent context, The Dow and S&P managed to close around 1-2% higher since Omicron’s unleashing, Nasdaq faded back in the red today and Small Caps are down almost 4% since the new variant headlines hit…

All of which left US stocks at their most expensive ever…

Source: Bloomberg

And the “Buffett Indicator” has never been higher…

With the biggest 10 stocks trading at a level the 10 largest stocks have traded at before…

Chinese stocks lagged heavily on the year and while European markets put in a good performance, they lagged US…

Source: Bloomberg

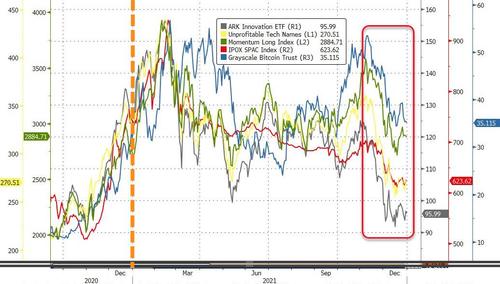

So-called “bubble markets” ended the year on a big downswing…

Source: Bloomberg

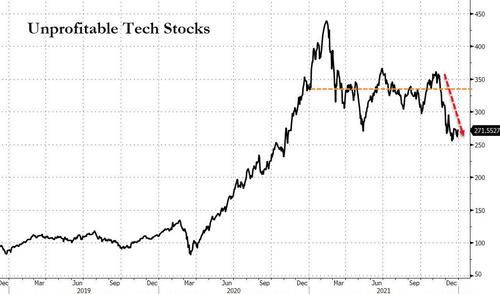

Unprofitable tech stocks had quite a year, ripping higher to start 2021, giving back all their gains and then slumping into year-end…

Source: Bloomberg

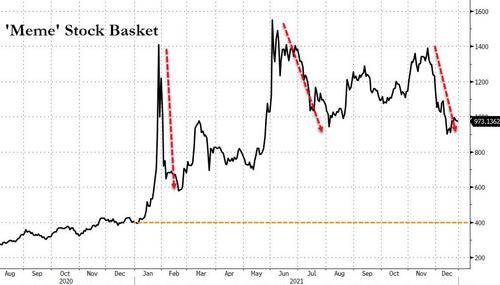

Interestingly, ‘Meme’ Stocks managed to hold on to gains overall (though many individual stocks did not)…

Source: Bloomberg

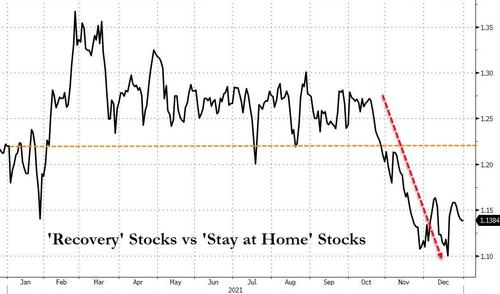

Despite all the optimism, the recent Omicron wave hammered ‘recovery’ stocks leaving them big underperformers on the year…

Source: Bloomberg

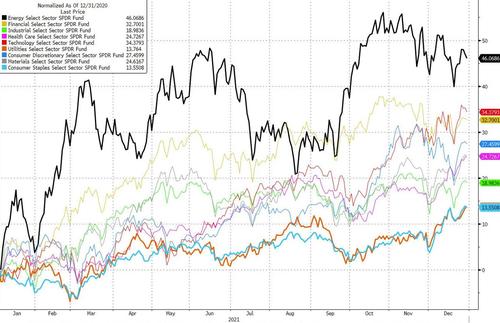

Energy stocks were 2021’s biggest winners while Utes and Staples lagged…

Source: Bloomberg

Nasdaq has pushed ahead recently relative to Small Caps, suggesting real yields are going lower again…

Source: Bloomberg

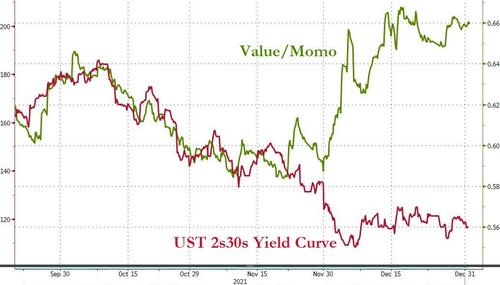

Value/Momentum stocks have decoupled from the yield curve that it hugged all year…

Source: Bloomberg

STIRs have surged higher matching The Fed’s renewed hawkish jawboning with 1 full rate-hike priced in by May 2022 and 3 full hikes by Dec 2022…

Source: Bloomberg

Treasury yields were all higher on the year but the last few months, since The Fed shifted tone towards hawkish, has seen the belly underperforming as the long-end rallied…

Source: Bloomberg

The yield curve flattened on the year with 2s30s down around 35bps…

Source: Bloomberg

The Dollar ended 2021 higher, but faded back below its 50DMA on the last day of the year (and below 2019’s closing price)…

Source: Bloomberg

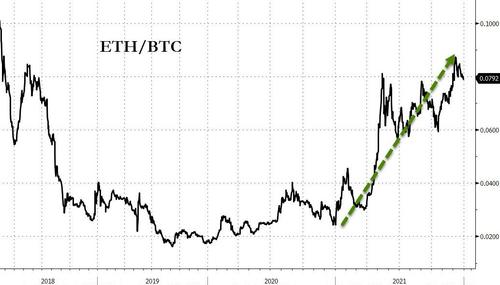

Cryptos had another big year (even with headlines more than willing to focus on recent price action). Bitcoin ended the year up 65% while Ethereum rose over 400%…

Source: Bloomberg

Bitcoin has been hovering around its 200DMA for a few weeks…

Source: Bloomberg

Ethereum’s major outperformance pushed it to the strongest relative to Bitcoin since early 2018…

Source: Bloomberg

Oil prices saw their biggest annual gain since 2009, but gold was lower and Silver suffered its worst year since 2014…

Source: Bloomberg

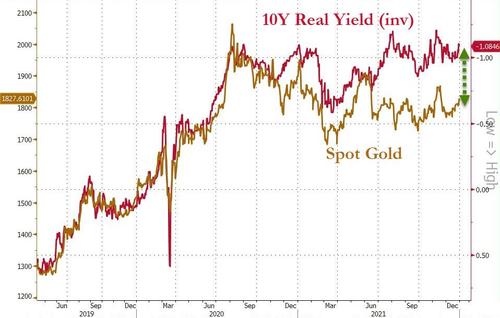

Gold did managed to get back above $1800…

Given where real yields ended the year, we suspect gold has some upside…

Source: Bloomberg

And while WTI did take a hit from Omicron and Biden’s jawboning, it’s back above $75 again now…

Unfortunately for President Biden, the de minimums drop in gas prices of the last few days is likely as good as it gets as oil and wholesale gasoline prices have rebounded amid fading omicron fears…

Source: Bloomberg

One of the biggest stories of the year was European NatGas prices, but the last week has seen an armada of LNG vessels heading across the Atlantic to solve Europe’s demand and EU gas prices have crashed back to reality. The following chart compares apples to apples across us/uk/eu energy prices (in oil barrel equivalents)…

Finally, global central banks added over $2 trillion to their balance sheets in 2021…

Source: Bloomberg

But remember, correlation is not causation, this is just a coincidence and it’s all about fun-durr-mentals…

Source: Bloomberg

And on that note, happy new year!

Tyler Durden

Fri, 12/31/2021 – 16:00

via ZeroHedge News https://ift.tt/3sP0zlk Tyler Durden