Handicapping The 2022 Market Casino

Authored by Sven Henrich via NorthmanTrader.com,

I trust you all had a good and safe holiday season. Before I’m handicapping the 2022 market casino with its head and tail winds I want to document some key market truths that give context for 2022. And yes, at this point it’s hard to call markets anything other than a casino or a video game that has detached itself from fundamental reality. For now anyway for I firmly believe reality will make its presence felt again.

But for now: The S&P 500 finished 2021 with its third consecutive year of double digit gains closing at 4766 again making mockery of any type of fundamental analysis and again putting to shame any price forecasts issued at the beginning of the year:

YEAR-END

4766 +27% https://t.co/d0ZMrpEH8N

— Jonathan Ferro (@FerroTV) December 31, 2021

Hence year end price targets, as in 2020, have again proven to be a mug’s game. The mockery of any type of fundamental analysis or diversification strategy probably best reflected by the horrid underperformance of most hedge funds:

All this effort for naught:

SPOTTED New Years’s Eve: Hedge fund manager realizing all he had to do is passively hold $SPX to track the Fed balance sheet to generate 27% as opposed to producing inferior returns by devising a complex diversification strategy based on fundamental valuation & cash flow models. pic.twitter.com/4ME4iLQm7N

— Sven Henrich (@NorthmanTrader) January 1, 2022

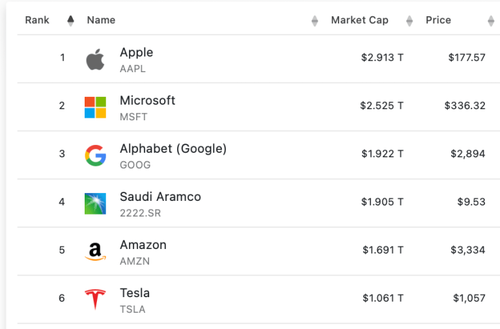

For at the end of the day the liquidity flowed to the biggest of the biggest that have grown to previously unfathomable sizes:

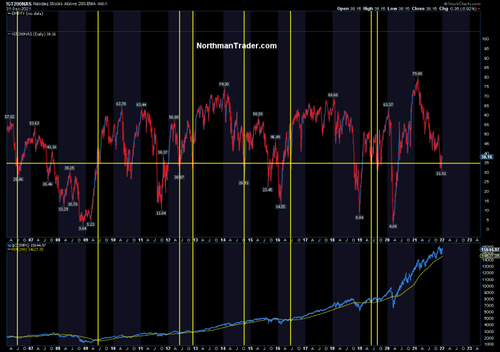

While the rest of the market floundered and corrected underneath with the Nasdaq ending the year with 62% of its components below their 200 day moving average despite the valiant effort to mark up performances at the end of year:

So while the headlines keep showing record highs the truth remains that there has been a lot of sizable corrective activity taking place beneath the indices. One might argue the bubble is already in process of bursting.

Most people will want to tie the double digit earnings growth of 2021 to the performance of the market, but let me dissuade you from that notion. The S&P 500 produced double digit growth in 2019 when there was no earnings growth, it produced double digit growth in 2020 when there was double digit negative earnings growth. The last year $SPX showed a down year was in 2018 when earnings growth was positive. The only discernible constant in influencing market direction has been the US Federal Reserve, not earnings. This directional influence has come with the consequence of ever rising multiple expansion. I’ve highlighted this point for a long time and I will do so again today as it is so incredible important for handicapping 2022.

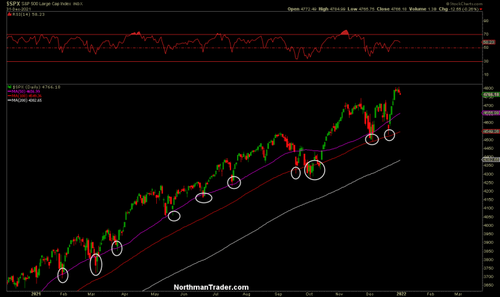

First note that any concerns of valuations, technical gap fills or technical reconnects I had at the beginning of 2021 simply didn’t matter in 2021. By March of 2021 I was pretty much already resigned that the overwhelming liquidity coming in from the fiscal and the monetary side would likely keep any corrections limited to 50MA and 100MA tags to then be buying opportunities. Using the 2013 QE3 market as the reference point these MA reconnects was the basic path to be expected:

Three 100MA tags, a few 50MA tags, constant new highs, tapped off with a rally to new highs by the end of the year for the Santa rally. The liquidity script.

Voila, 2021:

I submit this is exactly what happened, virtually the same script.

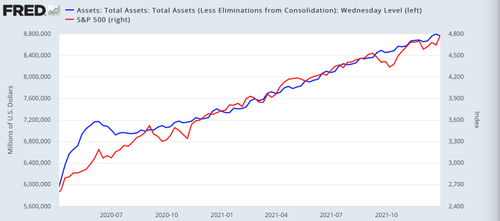

Indeed 13 months of consecutive new monthly record highs on $SPX matching the 13 months of consecutive new highs of the Fed balance sheet:

The only times of corrective activities occurring during times when the Fed balance sheet either temporarily dropped or paused. The last time the Fed balance sheet failed to make new highs on a temporary basis was the fall of 2020 coinciding with the last 10% correction in $SPX, hence I’ve called the S&P 500 an in essence Fed balance sheet tracker.

It is indeed as such: “QE is inflating asset prices. Benefits of central bank’s bond buying program are ‘fading’, while it may cause ‘excessive risk taking.” Not my words, although I’ve stated similar over the years, but this is from an executive board member of the ECB.

The reason I mention all this again is because the result of all this excess are excessive valuations and I submit to you they can’t be sustained without continued inflow of excessive liquidity. Hence the 2022 market casino will have to contend with the reduction and ultimate cessation of these artificial liquidity flows.

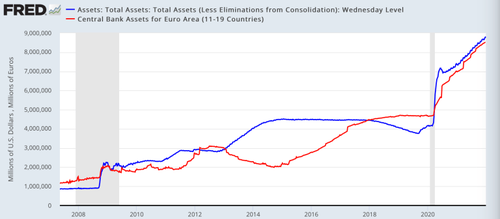

And please everyone be aware of the staggering nature of all this. Since 2019 the Fed has added $5 trillion to their balance sheet, the ECB $4.5 trillion for a combined $9.5 trillion:

Not to mention money supply:

During the entire history of the United States 75% of its money supply was added in just the past 14 years.

Stunning. pic.twitter.com/NI8Dz7YnGN— Sven Henrich (@NorthmanTrader) December 21, 2021

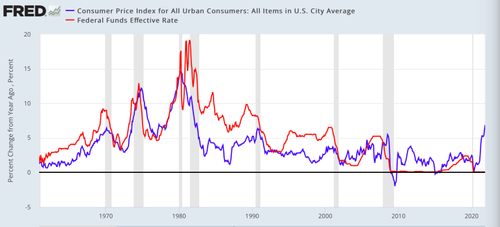

All this on autopilot in complete disregard of the incoming data. The once self proclaimed data dependent Fed ignored all data and ended up not only relentlessly continuing its balance sheet expansion despite rapidly exploding inflation data it also kept rates at zero entirely disconnecting its rate policy from all historic precedence:

The obvious analogy is that they kept throwing fuel on the fire while insisting the fire was going to be transitory, a term Jay Powell was forced to abandon and opt for a more rapid tapering in 2022 and then opening the prospect for rate hikes following the end of QE.

Let there be no doubt: The Fed flooded the system with money. Not only in 2020 during the depths of the Covid crisis but they kept printing money like never before even in 2021 when inflation data kept ripping, with markets continually producing new record highs and jobless claims dropping to the lowest in 50 years.

Never forget. pic.twitter.com/zUb1HoT5bB

— Sven Henrich (@NorthmanTrader) March 17, 2021

And let there also be no doubt about the consequences:

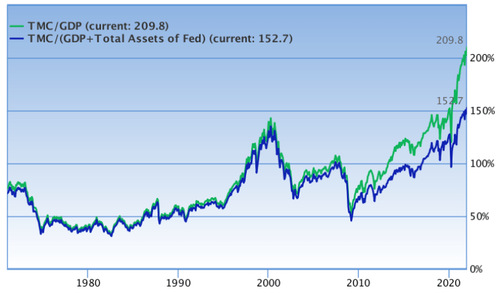

Firstly, the largest disconnect of asset prices from the economy ever closing the year at an obscene 210% market cap to GDP:

But also at the consequence of the most distorted wealth inequality curve ever setting the poor up with the pain of inflation but also the risk that the Fed’s excess in creating this asset bubble also has set the stage for the next recession as the Fed is now forced to fight the very entrenched inflation it denied it existed in the first place:

You know where I stand on the Fed & Powell & their denials on exacerbating wealth inequality & the danger of the insane asset bubble they have created.

Well, here’s Druckenmiller dropping truth bombs on Powell & the Fed on the very same subjects. pic.twitter.com/3PThE2I5B2

— Sven Henrich (@NorthmanTrader) May 15, 2021

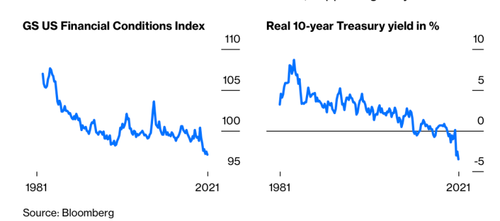

Which brings us to 2022: Is any of the policy action outlined by the Fed actually fighting inflation? It’s not, it’s lip service. You can’t fight inflation with the loosest finical conditions ever and real negative rates:

The very notion is ridiculous. Hence markets kept rallying into year end because the Fed is still running ultra loose policies, hasn’t tapered, hasn’t raised rates, in short: Has done absolutely nothing to fight inflation. Not a thing. Virtue signaling at best.

And, despite tapering becoming pronounced in January QE will not end until at least March and the ECB will keep expanding their balance sheet and has not even announced that they will stop, never mind when. So liquidity is still coming in at the beginning of the year and real rates will remain negative for the foreseeable future. But we’re fighting inflation. Right.

How soon will market react in earnest? Since 2009 history suggests that markets correct in earnest once QE ends:

Yet note prices are again jammed far above the upper quarterly Bollinger bands and a quarterly 5 EMA reconnect is still in the offing as is the reconnect with the daily 200MA which is about 10% lower from here at the moment and, unlike 2009-2020, inflation is now a real thing.

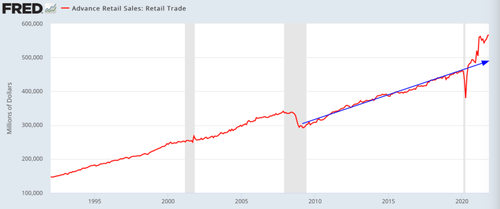

The chart above also highlights another important truth: Every time market react to the downside following the end of liquidity central banks react and again flip flop on policy and QE again resumes. It has been the go to drug since 2009 and markets are never allowed to correct for more than a few days or weeks. Why? Because markets have gotten too large and intertwined with consumer spending and confidence that any larger correction risks a recession. And herein lies the irony. The quickest way to curb inflation is to let markets correct for here’s another ugly truth: While the Fed likes to use supply chains issues as the excuse for inflation objective minded analysis may point to the far above trend of retail sales spurred not only the the Fed’s money spigot but also the record fiscal stimulus that flooded the system as well:

Get retail sales back to trend and inflation is over. Unfortunately that also now would imply a recession. See this is other truth here: They all totally overdid it. There was no thought out scientific process of what the right amount of combined liquidity would be to deal with the Covid crisis. They just threw a bunch of shit against the wall and hoped it would do the trick and it did the trick and when fiscal authorities followed through with massive stimulus the Fed should’ve pulled back, but being the insider trading and self dealing market beholden cowards that they are they never pulled back. And so now they’re chasing their tales hoping the bubble doesn’t implode for the fair value and systemic risk of too big to fail, record equity exposure and record margin debt leaves room for a major market accident.

What would be fair market value? Who is to say, fact is the 4 largest central banks have balance sheets of over $32 trillion combined, the global financial system is already entirely distorted and these balance sheet can’t be reduced without collapsing markets so they won’t normalize their balance sheets. Using liquidity normalized P/Es, earnings & historic market cap to GDP ratios I can make the case from anywhere between $SPX 2500 to $SPX 3,800 depending on what factor dominates. As we’ve seen in the past few years fair market value currently doesn’t apply. Maybe some day it will, but it would require central banks to either lose control or be out of the market.

Hence you can firmly small the script for 2022 can’t you? While we have initial tailwinds of still liquidity coming in and great initial earnings reports in February for Q4 2021 the party is rapidly coming to an end and the Fed will want to curb inflation without causing a recession which will be a real task. How to accomplish it?

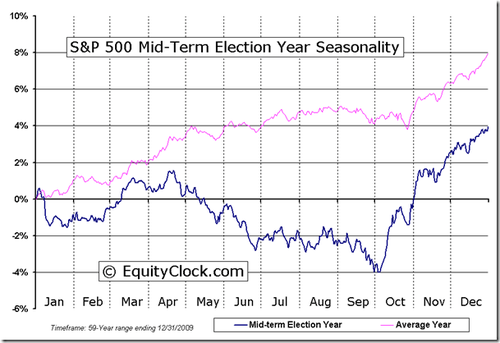

Easy, let markets drop, but not so much that it causes a systemic event but enough that year over year inflation numbers drop, declare victory and then flip flop policy again to prevent any major damage to markets by the time mid terms are on everybody’s mind. In short: Follow the seasonal script for mid term elections:

For we all know another truth: Once the Fed capitulates and Powell pivots again markets will bottom and rally again. The Fed will get 3 new Biden appointed members in 2022 and no political party will win the mid terms with markets carpet bombing. As the Fed has already devolved into a political tool by those in power and Powell has already shown himself multiple times to react to political pressure the script is already written: The Fed will switch policy again in 2022 when and if markets drop too much in their eyes. The question is the when and by how much.

Before I close out I do want to follow up on what I consider to be an important set of charts I’ve been highlighting throughout 2021: Volatility.

Ponder this: Despite all the record highs, despite all the interventions and stimulus, the insane amounts of money thrown at the economy and markets there is no denying that $VIX has defied all efforts to compress it:

Even during the record setting and correction free year of 2021 $VIX has maintained its steady trend of higher lows since 2017. In addition it broke above its compression pattern since the March 2020 market lows. Indeed I can point to higher highs on $VIX as well. All this is suggestive that $VIX, once free of perverse liquidity injections, will target higher levels in 2022 than in 2021. The nightmare scenario would be a run at the upper trend line in 2022 or 2023 which not only implies a recession but a complete collapse of the asset bubble. I can’t call for it, but I can merely highlight the possibility as remote as it appears now.

Generally I can make the case that the year end rally managed to back test the breakouts that occurred in the fall.

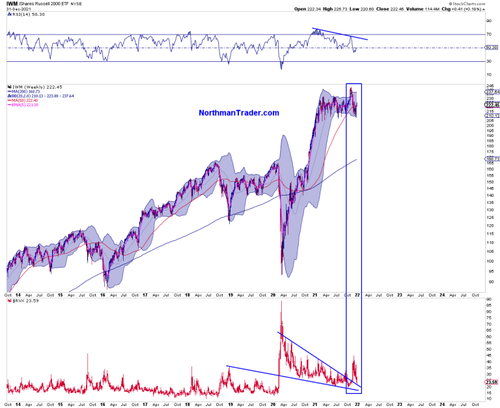

Be it on small caps:

Or on tech:

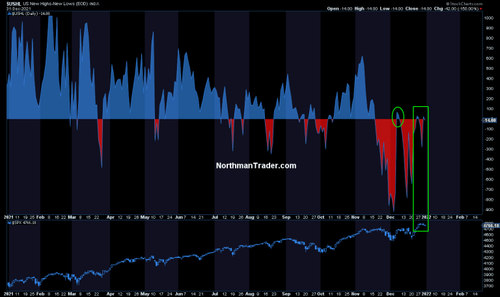

All this is reflective of how pitiful the closing end of year highs really were as seen in US hew highs/new lows:

No, the sinister truth may just be that the broader market is already correcting, anticipating the incrementally slowing growth to come and the reduced and disappearing liquidity to be felt in the first half of 2022.

How will crypto fit in all this? I’ll publish a separate dedicated article on this in the days ahead, so stay tuned.

While the mid term seasonality chart and still flowing liquidity along with record earnings and buybacks may prove to be tailwinds that permit for still further new highs to come in Q1, the broader valuation, reduced liquidity and inflation headwinds suggest rallies to be selling opportunities to turn into an eventual buying opportunity once markets have sizably corrected, victory over inflation has been declared and once the Fed flip flops again. My base expectation for 2022 hence will be much broader price ranges in indices and for the things that haven’t mattered to matter again. As always we will let technical levels and signals be our guide to navigate through what is promising to be a much more volatile year. Welcome to 2022.

* * *

For the latest public analysis please visit NorthmanTrader and the NorthCast. To subscribe to our directional market analysis please visit Services.

Tyler Durden

Sun, 01/02/2022 – 13:00

via ZeroHedge News https://ift.tt/3HuWze0 Tyler Durden