“Just In Case Fiat Money Goes To Hell”: Billionaires Are Finally Flooding Into Cryptos

It was back in September 2015, when we first predicted that bitcoin would surge exponentially (back then it traded at $250 and we said it would “soar past $500, past $1,000 and rise as high as $10,000 or more”… in retrospect it was “or much more”) as millions realized that cryptocurrencies are the logical alternative to failing monetary systems. Fast forward almost seven years later and several thousand percent higher, and only now is the “real” money (not to mention the really dumb money… you know who you are), finally throwing in the towel and starting to load up on crypto.

Note, we said “real” money not smart money, because institutional investors entered crypto at the start of 2021 (just as we predicted at the start of last January), around the time Elon Musk discovered his infatuation with cryptos. And now that all the early – and easy – gains have been made, the slow, dumb money, read billionaires, are finally rushing in. Take Thomas Peterffy, the Hungarian-born billionaire founder of Interactive Brokers. It was just a few years ago, back in 2017, when he took out a full-page ad in the Wall Street Journal warning of the dangers that bitcoin futures posed to capital markets. Well, it looks like those dangers are not as dire as he first predicted. These days Peterffy, worth $25 billion, said it’s prudent to have 2% to 3% of one’s personal wealth in cryptocurrencies, just in case fiat currency goes to “hell.”

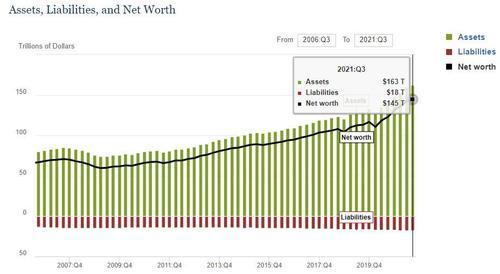

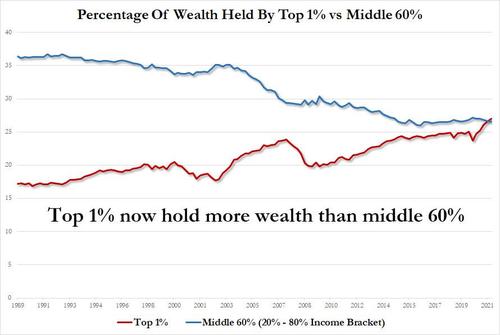

A couple points here: fiat currency is going to hell, as even central banks admit with their relentless push to launch CBDCs (although if China is anything to go by, the rollout will be catastrophic), it’s just a matter of time. As for what 2-3% of personal wealth being allocated to crypto means, consider that just since the covid pandemic, household net worth has risen by $34 trillion, and was $145 trillion at last check (of course, most of that belongs to the 1%).

So in a banana republic where the top 1% of Americans own more wealth than the entire middle class (i.e., those in the 20% to 80% range, as shown in the chart below) for the first time since the Great Depression …

… what would happen if 3% of just US wealth was converted into cryptos? Well, 3% of $145 is $4.35 trillion, or about double the market cap of all cryptocurrencies in circulation today. So Bitcoin at $100,000, Ethereum at $10k and so on…

Of course, if one held much more of their net worth in cryptos over the past decade they would be, to loosely paraphrase Hans Gruber, sitting on a beach, not caring if they earn 20 percent.

To be sure, Peterffy is one such billionaire who has made the full conversion from skeptic to believer, and even endorser – as Bloomberg reports, he owns some himself, while his firm Interactive Brokers recently offered customers the ability to trade Bitcoin, Ethereum, Litecoin and Bitcoin Cash, after detecting “urgency” from its clients to get in on the action. Peterffy said Interactive Brokers will offer the ability to trade another five to 10 coins or so starting this month.

It’s possible that cryptocurrencies could reap extraordinary returns — even if the opposite is also true, Peterffy said.

“I think it can go to zero, and I think it can go to a million dollars,” he said in an interview. “I have no idea.”

Well, unlike Peterffy, we had an idea back in 2015 and so far that idea has returned over 200x in 4 years.

But what is more important, is that the Hungarian’s tentative approach highlights the shifting attitude toward crypto by investors who once scorned or were wary of digital tokens but realized, especially in 2021, that they can’t bear to miss out on the potential for massive gains that have made millions of ordinary forward thinkers extremely rich.

One such example of slow money adoption is Bridgewater’s Ray Dalio, whoe recently revealed he was holding at least some Bitcoin and Ethereum in his portfolio only months after questioning crypto’s utility as a store of wealth. The Bridgewater Associates founder views the investments as an alternative money in a world where “cash is trash’’ and inflation erodes buying power. Paul Tudor Jones disclosed he’s invested as a hedge against inflation, and almost half the family offices Goldman Sachs Group does business with were interested in adding digital currencies to their portfolios.

What is remarkable, is that for once the world’s richest are far behind the adoption curve, with even retail investors way ahead of them. Consider that while the SEC has yet to approve a token-based ETF, tens of millions of Americans are already investing and trading crypto, a process which made Coinbase founder, Brian Armstrong, worth some $10 billion. Elsewhere, an NFT from Beeple sold for $69.3 million at Christie’s. Tom Brady released NFTs tied to his legendary career, while Katy Perry, Grimes and the agency behind K-Pop sensation BTS all sought to profit from the burgeoning industry. El Salvador’s President Nayib Bukele even made Bitcoin legal tender in his country.

And, as Bloomberg notes, the crypto marketing juggernaut will keep going in 2022 — Staples Center in Los Angeles is now Crypto.com Arena, while FTX and Singapore’s Crypto.com are running ads during the Super Bowl — even if prices don’t necessarily climb to the moon.

Still, that doesn’t mean that prices will continue their stratospheric ascent. Billionaire Michael Novogratz, who runs Galaxy Digital, said last month that prices could go “sideways to down” in the near-term. There was a lot of “froth” in the markets in 2021, Novogratz told Bloomberg, as retail investors piled into NFTs and pursued unusual crypto investments. The New York-based digital evangelist also predicted Bitcoin won’t fall below a floor of about $42,000. It closed the year at about $46,300.

“So much money is pouring into this space it would make no sense if crypto prices would go much below that,” Novogratz stated.

Even if prices did drop, they would promptly find buyers – after all if only 21 million people bought (and held) just one bitcoin, there would be no more freely floating. Jesse Powell, chief executive officer of crypto exchange Kraken, acknowledges prices could fall, but said on Bloomberg TV on Dec. 14 that any move below $40,000 is a “buying opportunity.” Then again, one should take his forecasts with a ton of salt: in August, he predicted prices would reach $100,000 a coin in 2021; they peaked just below $70K. Ark Investment Management’s Cathie Wood, meanwhile, still expects Bitcoin to reach $500,000, and said last month that it isn’t necessarily due for a correction.

That said, not every billionaire is a believer. Citadel’s Ken Griffin recently described the rush to embrace cryptocurrencies as a “jihadist call” against the U.S. dollar. But Griffin said his own firm would trade crypto if there were more regulation. JPMorgan’s Jamie Dimon called Bitcoin “worthless” in October, but that came even as the New York-based banking giant was bulking up hiring to help its clients trade digital currencies. Of course, anyone who listened to Dimon who threatened to fire any JPM employees caught trading bitcoin, would have lost on the best investment opportunity of the 21st century… similarly to anyone who still pays for a Financial Times subscription. With its non-stop negative coverage of bitcoin over the past decade, the British (or is that Japanese) newspaper has singlehandedly been responsible for the greatest personal finance value destruction in modern history.

Tyler Durden

Sun, 01/02/2022 – 18:25

via ZeroHedge News https://ift.tt/3sWEO3f Tyler Durden