The Great Rotation…

Via AdventuresInCapitalism.com,

In a few short hours, we’re headed back into the trenches. No sleep for us weary hedgies. They’ve re-set the performance clock at zero and we’ve got to fight our way forward, showing why we’re worth those incentive fees.

Before heading off for battle, I figured a 2022 roadmap would be helpful.

Here’s mine.

I’ve been critical of the Ponzi Sector for quite some time and was early. It looked to be rolling over in late 2019, then COVID hit. Fiscal and Monetary both went into ludicrous mode, and we had the mother of all blow-off tops. Excluding a few securities, the Ponzis peaked during the spring of 2021. Since then, they’ve started to leak, slowly at first, then the leak accelerated into a flood as the year progressed. There will be some spectacular rallies along the way, but most of these securities will spend the year melting away. I’m not breaking new ground with this prediction. As it becomes consensus and capital shuts off to the sector, the Ponzis will go into free-fall. My bold prediction for 2022 is that we’re about to have the mother of all sector rotations. On one hand, the Tiger-40 will get sold off—on the other hand, the “old economy” is about to absolutely roar.

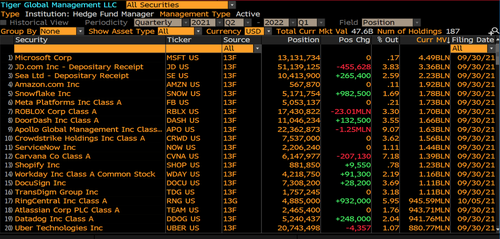

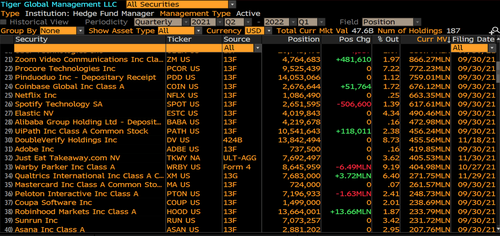

What’s the Tiger-40? It’s the top 40 holdings of Tiger Global Management LLC (as shown by Bloomberg). Let me start by saying that I have the utmost respect for Tiger and the performance record they’ve produced over multiple decades. They’re smart capital allocators—for all I know, they’ve dumped most of these names by now. However, as far as I’m concerned, the Tiger-40 is a list of the most over-owned hedge fund hotels I can think of. All the wise guys are max long, often with leverage—this is because most of the large PMs all know each other. They share the same notes. They copy each other and they copy what’s been working. Put simply, if they didn’t own the Tiger-40 over the past few years, they’d have long ago been redeemed. You had to own it—so they all own it in size.

While there are some Ponzis tossed in here, the majority of this list can be summarized as top quality large-cap tech. Everyone knows these are good businesses, which is why most of them trade at unfathomable valuations. For the past few years, anyone who questioned the valuations, missed out—those that closed their eyes, got inflows. As a result, complacency has set in. Aggressively valued, transitioned into silly, but it kept working, so no one cared. The Tiger-40 were labelled as “compounders,” or companies that you could buy and forget about because the value would eventually catch up to the share price. I think inflation is about to awaken all these PMs from their slumber. In a deflationary world, you can pay almost any price for future growth. When inflation rages to the point that the Fed is forced to act, all you want is current cash flow, not 2050’s cash flow discounted back.

Value investing just doesn’t seem to be performing…

Despite a brief surge last winter, value investors in “old economy” names have suffered for a decade. Low interest rates have brought on an endless oversupply of everything. Inflation is about to solve that issue. Replacement costs are about to explode. Financing costs will ramp. Return thresholds will suddenly have a threshold. Government spending will push the demand side, as will repeated rounds of stimmys. I think the impending economic returns for the “old economy” will stun people. In fact, the past year has seen surprising strength in reported corporate numbers—the issue is that investors haven’t really cared. I think they’re about to.

One of my favorite books about investing is Marc Faber’s Tomorrow’s Gold. While it’s dated, the concepts, in terms of how to find the next great bull market, are just as important today as they were two decades ago. Marc uses the analogy of a large bowl of water that shifts on top of a pivot. The water is never flat, it splashes from one side to another. The water represents money, and the money moves from one sector to another—often violently when people have lopsided positioning.

But Kuppy, don’t you realize that if large-cap tech collapses, the market collapses and the Fed steps back in? Who said anything about the market collapsing? Imagine the Tiger-40 declining by half and the market ending the year unchanged. The “old economy” can fill in the gap. Why can’t oil companies trade at a few times PV-10? If people think oil is going to a few hundred, why shouldn’t they trade at massive premiums? What about financials? What if people suddenly expect a yield curve? What if banks can earn an actual yield on deposits? Look at industrials. What is a factory worth if a new one costs five-times as much and takes 10 years to permit? We’re re-shoring all sorts of production, where’s it going to be produced? We need between 5 and 10 million single-family homes to catch up with underproduction over the past decade. There’s massive supply chain issues—these will need capital spending; roads, pipelines, infrastructure, electrical grids, ports, airports, and public transport. All of this will absorb stunning amounts of commodities and lead to fat margins throughout the process. Much of it will be paid for by the government printing money—which means it will be sloppy and dysfunctional. Can you feel the gross margin expansion? Politicians are now demanding that we have a transition into a “green” economy. Whatever that means, they’ll fund it all. Where will the basic materials, the commodities, the components come from? This is going to all be wasteful government spending—don’t you think the margins will be excessive? If they even go through with a tiny piece of what they’re talking about globally, the whole periodic table will go positively mental. What’s a copper mine worth when it takes a decade to build a new one? What about a cobalt mine? All these boring, old, dirty businesses are about to have a decade of excess profits. The governments of the world intend to print the money and spend it—inflation be damned.

In this sort of environment, do you think anyone wants to own a SAAS stock at 30-times revenue that’s roughly breaking even—but growing revenue at 20% a year? Who’s going to subsidize this growth? The cost of capital is about to explode because inflation is about to explode. Interest rates are going to lag, but they’re also going to surprise to the upside. Look at the Tiger-40 and think about where it will trade in the coming environment. How much downside is there if a SAAS stock is valued at 10 times next year’s after-tax, after options, earnings instead of the make-believe-accounting they use currently. I remember buying software in 2002 at a discount to that value. It can return there. I remember them valuing un-built copper mines at 20 times projected profits in 2007. It can return there. We’re about to have one of the largest sector rotations that anyone has ever witnessed. It will start slowly, then accelerate. One week, out of the blue, the spread between the “old economy” and the Tiger-40 will blow out by 2000 basis points. That’s my prediction. Copious leverage and crowded positioning will create an epic move. Here’s my other prediction—the overall market will sort of shrug its shoulders. The money will just slosh from one side to the other.

* * *

If you enjoyed this post, subscribe for more at http://www.adventuresincapitalism.com

Tyler Durden

Mon, 01/03/2022 – 15:15

via ZeroHedge News https://ift.tt/3zlZtyI Tyler Durden