Bonds & Bullion Battered As Big-Tech Takes Off To Start The New Year

While Apple’s $3 trillion market cap made the big headlines, it was bonds that really should have even as US Manufacturing survey slipped to 12-month lows as COVID cases are exploding at record pace…

AAPL now bigger than UK’s GDP…

TSLA was just silly too (adding almost 3 TWTRs today)…

This all led Nasdaq to outperform along with Small Caps (notably everything just drifted higher after Europe closed)…

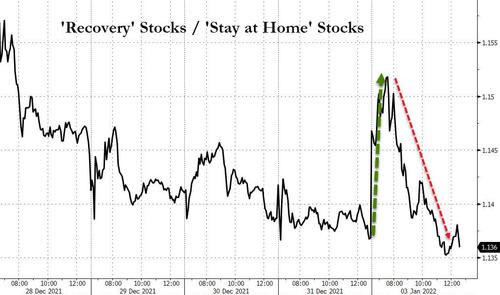

Interestingly, ‘recovery’ stocks started the day as the big winners but by the close it was ‘stay at home’ stocks that outperformed…

Source: Bloomberg

Bonds were a bloodbath today with the curve bear steepening dramatically (2Y +5bps, 30Y +12bps)…

Source: Bloomberg

The steepening of the curve took it back to the upper range of the last month’s range…

Source: Bloomberg

2Y Yield rose to 80bps – highest since March 2020…

Source: Bloomberg

10Y Yields jumped above 1,60% to pre-Omicron levels…

Source: Bloomberg

30Y Yields jumped back above 2.00% – a big surge above the Omicron level…

Source: Bloomberg

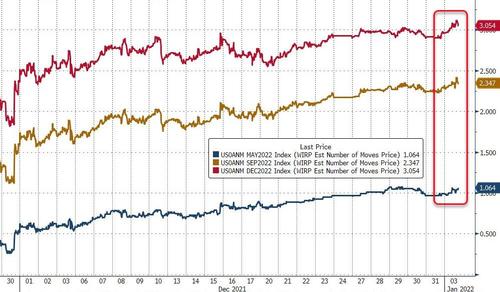

The short-end of the curve shifted hawkishly…

Source: Bloomberg

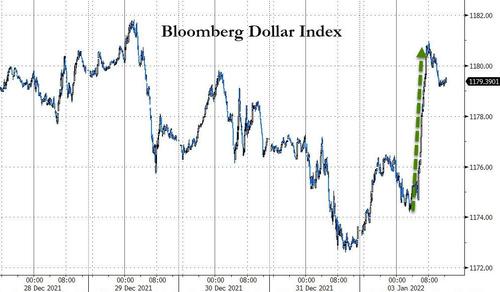

The dollar surged higher during the US day session…

Source: Bloomberg

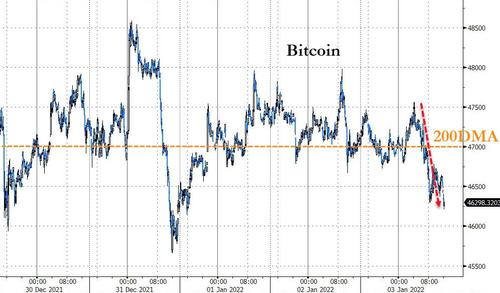

Bitcoin limped lower today also, falling back below its 200DMA…

Source: Bloomberg

Interestingly this is the second day that crypto has been puked during the US day session (On Friday, bigh tech fell with it, today, it reversed)…

Source: Bloomberg

Gold was blasted back below $1800 briefly before bouncing back…

Oil managed gains on the day after diving below $75 briefly…

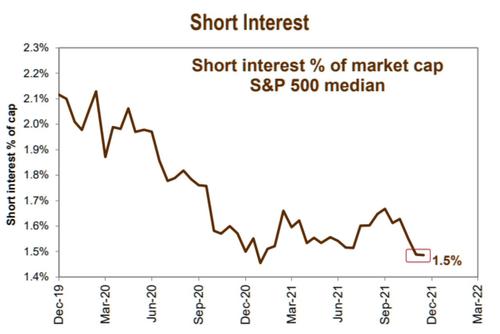

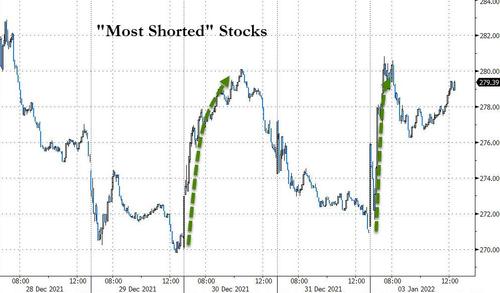

Finally, it appears there are still some shorts left to bury…

And squeezed they were today…

But when will the squeezers run out of ammo?

Oh, and ignore this…

We did it Joe! We shut down the virus! https://t.co/WS9HB3cPQQ

— ELIJAH 🇺🇸🇦🇺 (@ElijahSchaffer) January 3, 2022

Tyler Durden

Mon, 01/03/2022 – 16:00

via ZeroHedge News https://ift.tt/3qNPJJN Tyler Durden