January Lures With Gains. Tricky Part Comes After

By Jan-Patrick Barnert, Bloomberg Markets Live reporter and commentator

The consensus narrative for stocks this year seems to be clear: Watch inflation and central banks’ reaction to it amid slowing global economic growth. But that means a lot of moving parts and when the seasonal strength in January ebbs, the path to further gains this year might not be so easy.

European equities gained on the first trading day of the year and showed a slight tilt toward cyclical value stocks, with autos being Monday’s best-performing group. However, some defensives such as food and beverages and utilities also showed up in the upper half of the sector leaderboard in a sign that aggressive positioning isn’t the way to start this year.

“Tightening monetary policy and decelerating growth supports our large-cap, defensive quality bias,” Morgan Stanley U.S. equity strategists led by Michael Wilson writes.

Their defensive stance is based on leading indicators that point to decelerating purchasing manager indexes in coming months, they wrote

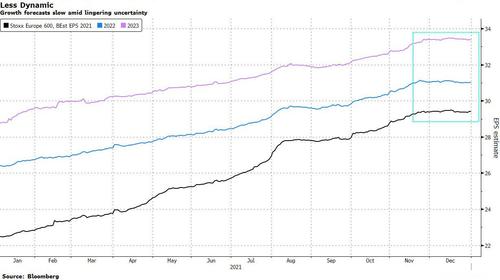

Company fundamentals also might have seen a large part of the joy already. “Europe’s 2022 earnings-growth story is hitting a bump as omicron spikes across the region and unresolved pandemic-related issues linger into the new year,” Bloomberg Intelligence analyst Tim Craighead writes.

Estimates for growth in European earnings per share this year have ebbed to just 6%, below the S&P 500 Index’s 8%, weighed down by supply-chain issues and cost inflation challenges, Craighead says.

Goldman Sachs strategists led by David Kostin recommend focusing on stocks with high growth and high margins and avoid firms with major exposure to wage inflation.

Yet despite the uncertainty from monetary policy, growth and the virus’s path, bullish sentiment has prevailed recently, with two minor corrections of about 6% being bought up quickly and mirroring a phase of market calmness last seen in 2013/2014.

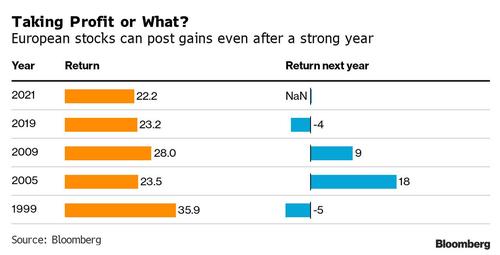

And while 2021 was a strong year, the Stoxx Europe 600 Index’s history doesn’t scream sell either. Since inception in 1998, the European benchmark saw five years of gains of more than 20%, including 2021. Following such gains, the index advanced twice and fell twice in the year after, with the gains outpacing the losses.

Tyler Durden

Tue, 01/04/2022 – 11:00

via ZeroHedge News https://ift.tt/3t15hfQ Tyler Durden