Ray Dalio On The Changing World Order: “Entirely Possible Neither Side Will Accept Losing The 2024 Election”

Authored by Ray Dalio via LinkedIn.com,

At the risk of boring you by repeating myself, now at this beginning of the new year and with the publication of my book Principles for Dealing with the Changing World Order, I want to concisely convey the most important thoughts I have about the paradigm we are now in, which is a result of how the world order appears to be changing. To be clear, while I express concerns and risks, I believe that we collectively have the power to manage our challenges well if we are smart and considerate with each other. Also, please know that I am not sure that any expectations I have are right. I’m just passing along my thinking for you to take or leave as you like.

MY CONCLUSIONS UP-FRONT

The world order is changing in important ways that have happened many times before in history, though not in our lifetimes. How the world order is changing has created the paradigm that we are in. By “paradigm,” I mean the environment that we are in. Paradigms typically last about 10 years, with occasional big corrections within them. They are driven by a persistent set of conditions that takes those conditions in a swing from one extreme to an opposite extreme. Because of this, each paradigm is more likely to be opposite than similar to the one before it. For example, the Roaring ’20s were followed by the depressionary 1930s, and the inflationary 1970s were followed by the disinflationary 1980s. The assets and liabilities that you would most like to have, and those that you would most like to avoid, change with the paradigm that exists at the time. For example, in the Roaring ’20s you’d want to own stocks and avoid bonds, while in the depressionary 1930s it would be the opposite; in the inflationary 1970s you’d want to own hard assets like gold and avoid bonds, while in the disinflationary 1980s you’d want to own financial assets and avoid hard assets.

For reasons explained in this report, I believe the current paradigm is a classic one that is characterized by the leading empire (the US) 1) spending a lot more money than it is earning and printing and taxing a lot, 2) having large wealth, values, and political gaps that are leading to significant internal conflict, and 3) being in decline relative to an emerging great power (China). The last time we saw this confluence of events was in the 1930-45 period, though the 1970-80 period was also analogous financially. In this piece, I will explain my reasoning and show charts that display these things happening. (For a much more comprehensive description, read Principles for Dealing with the Changing World Order.)

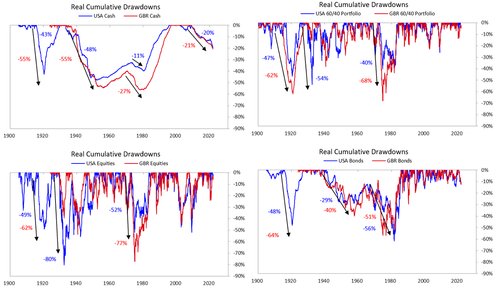

What should one do in this new paradigm? This paradigm is leading to a big shift in wealth and power. Naturally, as a global macroeconomic investor, the economic and market behaviors in this paradigm are top of mind. I think one should consider minimizing one’s ownership of cash and bonds in dollars, euros, and yen (and/or borrow in these) and putting funds into a highly diversified portfolio of assets, including stocks and inflation-hedge assets, especially in countries with healthy finances and well-educated and civil populations that have internal order. These things are especially important in this paradigm. In brief, I think one’s assets and liabilities should be well-balanced with minimum exposures to dollar, euro, and yen currency and debt assets. During this time, I also think it will pay to be short cash (i.e., borrow cash). Of course there will be corrections during the several years in the paradigm—for example, in central bank tightenings. But I don’t see any sustained period in which the government will likely allow cash returns to be better than the returns of a well-diversified, non-cash portfolio (e.g., All Weather) geared to the level of risk you’re comfortable with because that would cause terrible problems. These circumstances also have big geopolitical implications, which I will touch on here.

Now I will show you the reasoning behind my conclusions. Please do not just believe my conclusions because I don’t want you to blindly follow me. I urge you to challenge my reasoning and see how it goes. I hope the picture comes through clearly in the charts and text that follow.

THE FOLLOWING ARE THE THREE BIGGEST ISSUES THAT I WANT TO FOCUS ON

1) Big Debt and Debt Monetizations, Particularly in the World’s Leading Reserve Currency

2) Internal Conflicts over Wealth and Values Gaps

3) External Conflicts, Most Importantly the Rise of a Great Power (China) to Challenge the Existing Great Power (the US)

The confluence of these three issues is shaping the type of paradigm we are in. While I can’t cover them in depth in this brief report, I can hit the most important aspects of them, particularly of the debt/money/investment issue because that’s an area I have devoted my life to. All three issues transpire in cycles driven by cause/effect relationships that are logical and can be understood. It is important to understand how these cycles work and where we are in them.

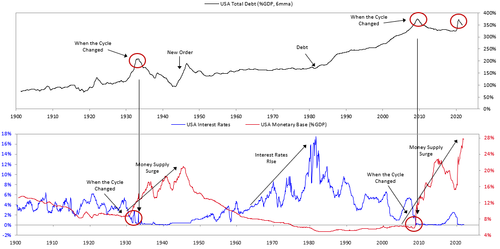

1) BIG DEBT AND DEBT MONETIZATIONS

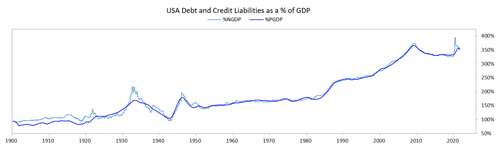

The three major reserve currency empires—the United States, Europe, and to a lesser extent Japan—are in poor financial shape. The top chart shows for the US how debt levels (black line) are high today and were high in the 1929-33 and 2008 periods. In both cases, interest rates hit 0% (blue line), and the printing of money and buying of financial assets began in a big way (red line). More recently, the COVID-triggered downturn and the political move to the left has led to a massive increase in debt creation and debt monetization in the US (and other countries). There is no doubt that this will continue even after COVID disappears, as large deficits that have to be monetized will exist. This makes everyone financially rich (i.e., they have a lot of money) and devalues money, which takes away much of this newfound wealth.

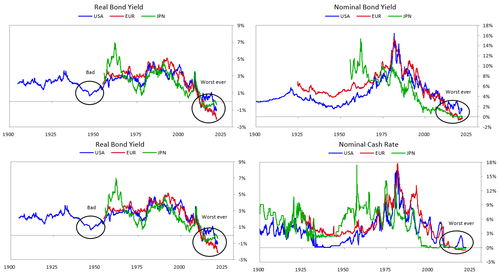

THIS PRINTING OF MONEY AND BUYING OF DEBT ASSETS HAS DRIVEN INTEREST RATES SO LOW THAT CASH AND BONDS ARE STUPID TO OWN

You aren’t getting an interest rate—why would you keep your money there? You are guaranteed to get lousy rates, particularly on cash. The charts below show that you are basically going to get the worst interest rates ever in both inflation-adjusted and nominal terms.

Think about the deal. The charts below show the number of years it takes for the money one invests in bonds and cash to be returned before one starts making a profit. The one on the top left is in dollars and the one on the top right is in inflation-adjusted dollars. As shown, the amounts of time are between 50 years and never. This creates more incentive to sell and borrow this debt than to buy more. At the same time, a lot more debt will be produced and will have to be sold. There won’t be enough demand to buy it, especially since global investors are already overweight in it. The way this is dealt with is that the Fed prints a lot more money and buys a lot of debt.

REMEMBER THAT ONE PERSON’S DEBTS ARE ANOTHER PERSON’S ASSETS, AND IMAGINE WHAT WOULD HAPPEN IF THE ASSET HOLDERS SOLD BECAUSE THE DEBT ASSETS WERE UNATTRACTIVE (WHICH THEY ARE)

That would lead to either a big increase in interest rates or a huge increase in the printing of money to buy the debt to artificially hold interest rates down. The chart below shows the amount of debt assets relative to GDP, which means that a lot can be sold if the holders lose their taste for it.

THE AMOUNT OF FINANCIAL ASSETS RELATIVE TO REAL ASSETS IS DANGEROUSLY HIGH, WHICH COULD LEAD TO A “BANK RUN”-TYPE MOVE FROM FINANCIAL ASSETS TO REAL ASSETS

I am not saying this will happen, but I am saying that there is a much higher probability of this happening than is reflected in market pricing. Think about it. There is only one purpose of investment assets, and that is to sell them to get cash to buy the real goods and services that one wants. Throughout history, whenever there were far more claims on real assets than there were real assets, a crisis eventually occurred when many holders of these financial assets went to sell them and discovered that there were far too many of them. That led to a “run on the bank”-type dynamic. Right now, there are vastly more financial assets than there are real assets, so if there was a move to convert them into real assets, that would lead to a “run on the bank”-type dynamic, which central banks would certainly respond to by printing a lot of money to allow people to get the money, but it would be of much less value.

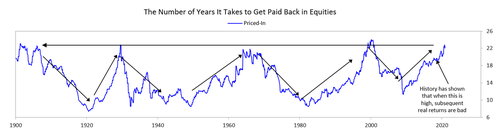

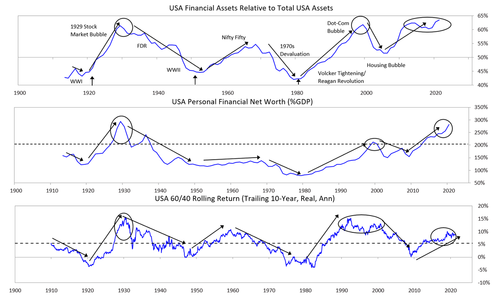

Making financial asset prices go up by creating a lot of money and debt makes people financially richer, but it doesn’t make them actually richer. It also leads to periods of bad real returns. This is shown in the following charts [3]. The top chart shows financial asset values as a percentage of all assets, the second chart shows financial net worth relative to GDP, and the third chart shows rolling returns of the 60/40 stock/bond portfolio since 1910.

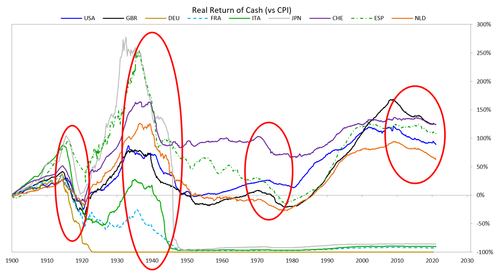

PERIODS LIKE THESE PRODUCE TERRIBLE RETURNS FOR HOLDING CASH

In my opinion, the four periods circled in the chart below are the analogous periods to today, each of which produced analogous paradigms to what we’re experiencing.

PERIODS LIKE THESE EVENTUALLY PRODUCE BAD REAL RETURNS FOR STOCKS AND BONDS

2) INTERNAL CONFLICTS OVER WEALTH AND VALUES GAPS

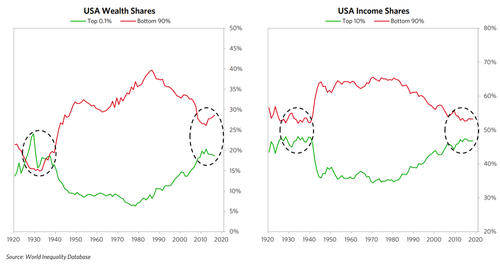

In the US (and a number of other countries), wealth and income gaps are the largest since the 1930s.

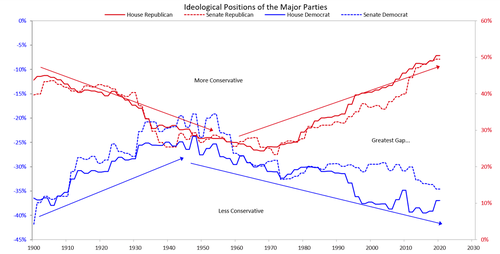

AND THE POLITICAL GAPS ARE THE GREATEST EVER

This chart shows that the US Republican Party (red lines) is more right-leaning and the US Democratic Party (blue lines) is more left-leaning than at any time since 1900, so the gap between them is enormous. There is great internal conflict going on in the United States now, which makes it a risky place. For example, it is entirely possible that neither side will accept losing the 2024 election. Such political clashes hurt productivity and create an inhospitable environment, which hurts capital flows.

GOVERNMENT SPENDING WILL INCREASE A LOT. TAX RATES WILL RISE A LOT, BUT NOT ENOUGH TO COVER THE SPENDING. SO WEALTH WILL BE REDISTRIBUTED THROUGH BOTH TAXES AND DEBT MONETIZATIONS.

3) EXTERNAL CONFLICTS DUE TO THE RISES AND DECLINES OF GREAT POWERS

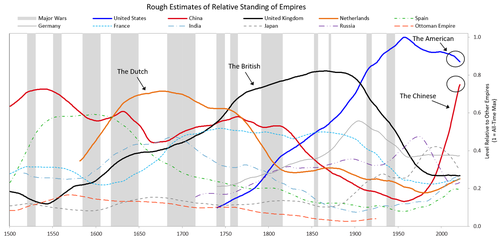

The chart below shows indices of the strengths and weaknesses of the leading world powers since 1500. Note the Dutch, British, American, and Chinese cycles. The Dutch guilder was the world’s reserve currency when the Dutch Empire was on top, the British pound was the world’s reserve currency when the British Empire was on top, and the US dollar is the dominant reserve currency now that the US is on top. Note how things are changing. These cycles are transpiring for archetypical reasons.

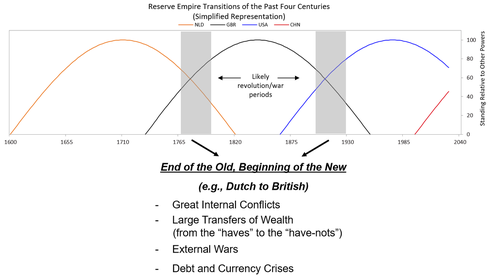

This chart is a simplified version of what you just saw for these four empires. The gray shaded areas are the periods of great internal and external conflicts and restructurings via depression, revolution, and war (typically lasting 10-25 years). They are followed by more extended periods of peace and prosperity in which order is brought about by the existence of a dominant power that no country wants to fight because it’s too strong, leading people to work harmoniously together.

THE ARCHETYPICAL BIG CYCLE

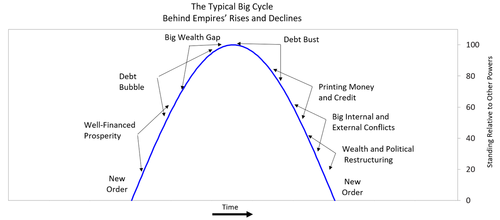

I will begin taking you through the typical cycle at the point that the new order is created. After revolutions and wars a new order—i.e., a new system run by new leaders—is created. For example, the last world order to be created came after WWII, in 1945. At that point in the cycle there is a dominant power, and nobody wants to fight the dominant power, so this part of the cycle is typically peaceful and, if managed well, prosperous. It is economically rewarding, which leads people to borrow and bet on it continuing, leading to over-indebtedness. Because economic opportunities are naturally distributed unevenly, large wealth gaps develop. Also, with time, competitors emerge and grow in power. Over-indebtedness and declining competitiveness eventually lead to financial problems at the same time as there are large wealth and political gaps. This produces more internal conflict and people demanding more money, which leads governments to create more debt and print a lot more money, which weakens the currency and raises inflation. As the dominant power weakens and other powers get strong enough to challenge it, there are greater internal and external conflicts that lead to revolutionary changes in who has what wealth and power. That ends the old order and leads to the next new order. That is now happening.

As explained in my conclusions up-front, I believe that important wealth and power shifts are underway, creating a new paradigm in which 1) it is undesirable to hold dollar-, euro-, and yen-denominated credit assets, especially short-term debt assets, because they will have significantly negative real returns, and 2) it is desirable to hold a well-diversified portfolio of currencies, countries, and asset classes.

What I’ve given you above is an inadequately brief overview of that which is covered comprehensively in my book Principles for Dealing with the Changing World Order. If you are interested in this subject, I urge you to read it.

In the coming days, I’ll be sharing another update on what I’ll be watching for in 2022.

Tyler Durden

Tue, 01/04/2022 – 17:25

via ZeroHedge News https://ift.tt/3eOx5f8 Tyler Durden